Fundamental analysis

27 May, 2022

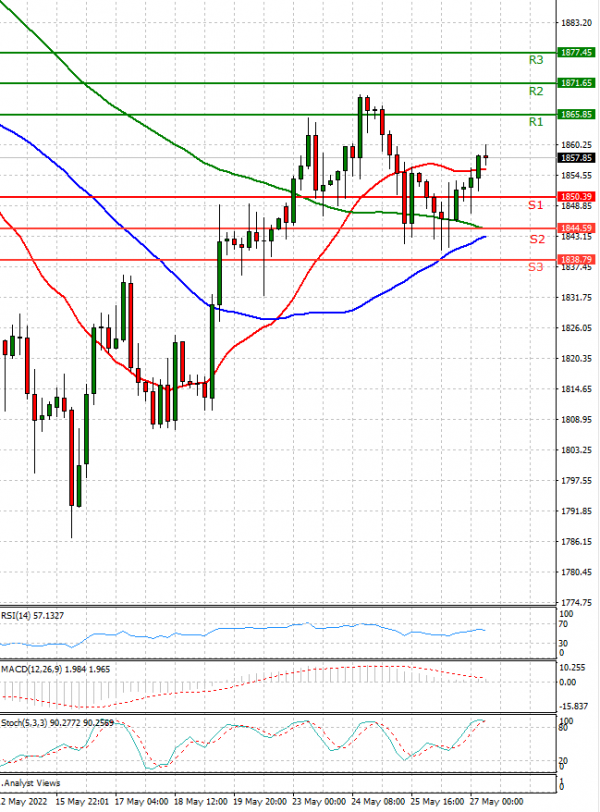

During most of European trade, the price of gold fell. The first reading of the US GDP for the first quarter, showed a gloomier picture of the state of the US economy. Also, the day before yesterday, the notes from the last meeting of the Fed showed a slightly milder hawkish tone. This helped the gold to continue its slight upward trend. Price inflation in the United States, the Eurozone, the United Kingdom and Canada, as well as Turkey and Brazil, indicates that it will remain a reality for a long time, which supports the price of the precious metal in the long run. From the point of view of technical analysis, gold was resold and a strong rebound from the 1800 level followed which continues. At around 13:20, the price of gold is trading at around 1858.5 dollars per fine ounce, which represents a price increase of 0.3% since the beginning of trading tonight. At 14:30, the personal consumption (inflation) index (PCE) will be published in the USA in April, which follows the Fed in conducting its monetary policy.