Fundamental analysis

03 September, 2021

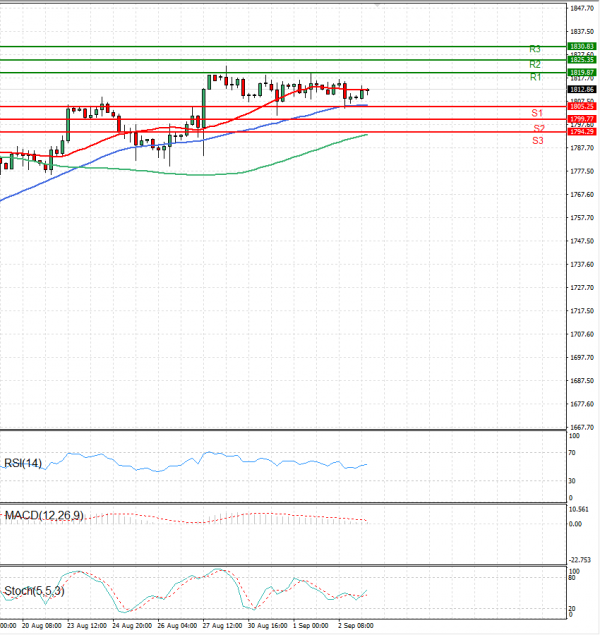

During Asian trade, the price of gold rose slightly. Caution is still present ahead the publication of the NFP report from the American labor market this afternoon. The day before yesterday, ADP hinted that it could fail considerably compared to the previous month, which should support the price of the precious metal. ADP showed that the number of newly created jobs in the private sector in the US is only 374,000, which is much lower than expected. If this trend is confirmed today, investors expect that the FED could refrain from gradual tapering worth 120 billion dollars a month, which would be an incentive for the price of gold. At around 08:15, the price of gold is trading at 1814 dollars per fine ounce, which represents a price increase of 0.11%. At 2:30 p.m. a regular NFP report from the U.S. labor market for August will be released.