Fundamental analysis

03 September, 2021

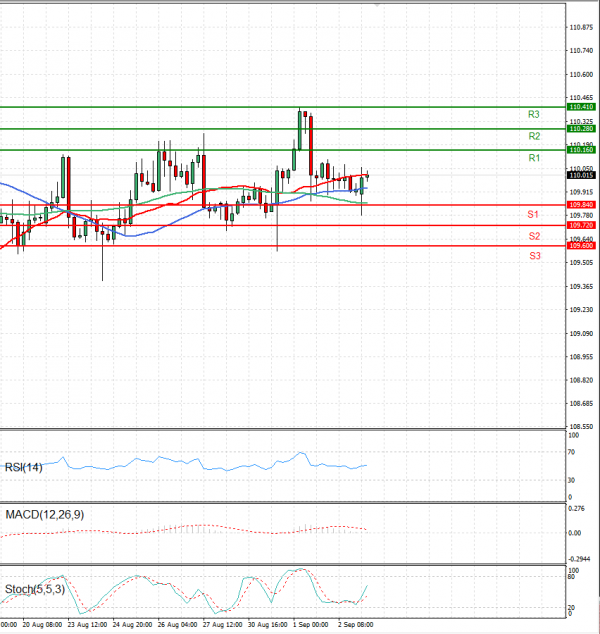

During Asian trading, the Japanese yen continues to trade in a narrow range of oscillations against the dollar. Yesterday, the ADP hinted that the report from the American labor market on Friday could be much worse. In the USA, only 374.000 jobs were added in the private sector, which is much lower than expected. At around 08:30, the US dollar is exchanged for 110 yen, which represents a weakening of the Japanese currency by 0,06% since the beginning of trading last night. At 2:30 p.m. a regular NFP report from the U.S. labor market for August will be released. The unemployment rate is expected to slip from 5.4% to 5.2% and expectations for the number of newly created jobs stand at 750,000.