AI Basket Weekly Special Report based on 1.00 Lot Calculation:

ARTIFICIAL INTELLIGENCE INDUSTRY

- MARKET POTENTIAL: The global artificial intelligence (AI) market has shown remarkable growth and is expected to continue its upward trajectory in the coming years. As of 2023, the market was valued at approximately $196.63 billion and is projected to reach around $1,811.75 billion by 2030, representing a compound annual growth rate (CAGR) of 36.6% from 2024 to 2030.

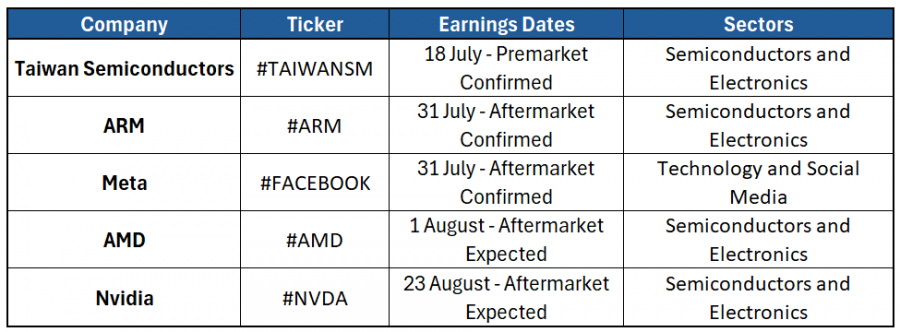

THE COMPANIES

Source: Bloomberg

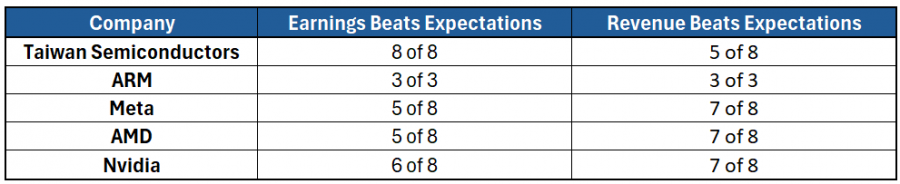

HISTORICAL PERFORMANCE (PAST QUARTERS): EARNINGS and REVENUE

Source: Bloomberg

- Taiwan Semiconductors: (61.2% market share in semiconductor fabrication, key supplier to Apple, Nvidia, AMD)

- ARM: (designs for ~30 billion chips, 99% of smartphones)

- META: (formerly Facebook, 60% share in social media advertising, AI for content moderation, personalized ads, and user experiences, AI research in machine learning, computer vision, NLP, exploring AI in AR/VR)

- AMD: (key player in semiconductors, significant in server/cloud computing, crucial for AI, expected 50% earnings growth, 14% revenue increase to $6.4 billion)

- NVIDIA: (87% AI processing market share, H100 GPU, 95% of machine learning graphics processors)

These companies are all deeply involved in AI, either through developing the hardware that powers AI computations, creating AI software and platforms, or integrating AI into their products and services. Their contributions are crucial in advancing the capabilities and applications of artificial intelligence across various industries.

STOCK PRICE REACTION: BASED ON FUNDAMENTAL ANALYSIS1

|

Downside potential |

Upside Potential |

|

-7% |

+20% |

|

Potential Profit/Loss on 1 lot of every stock in the basket2 |

|

|

-$85,120.00 |

$243,200.00 |

|

-€78,650.96 |

€224,717.02 |

|

-£66,462.10 |

£189,891.70 |

|

-C$116,094.74 |

C$331,699.26 |

Data Source on Stock Returns and Volatility: Bloomberg

TARGET LEVELS: SUPPORT AND RESISTANCE

|

Company |

Support |

Current Price (09/07/2024) |

Resistance |

|

Taiwan Semiconductors |

$175 |

188 |

$226 |

|

ARM |

$174 |

187 |

$224 |

|

Meta |

$495 |

532 |

$638 |

|

AMD |

$167 |

180 |

$216 |

|

Nvidia |

$120 |

129 |

$155 |

Note: Support and Resistance Levels have been calculated by using upside and downside potential figures.

Please note that past performance does not guarantee future performance.

1-Calculation Downside/Upside Potential: The sum of potential gains/losses if the stocks reach the given resistance/support levels, respectively.

2- Profit/Loss Calculation (**): Based on 1 lot (*) on each of the five stocks (5 lots). Range: based on the statistical analysis.

* TAIWANSM, ARM, NVIDIA, AMD and META, 1.00 lot is equivalent to 1000 units.

** Calculations for exchange rate used as of 10:15 (GMT+1) 09/07/2024.

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.