Copper Weekly Special Report based on 1 Lot Calculation:

TECHNICAL ANALYSIS:

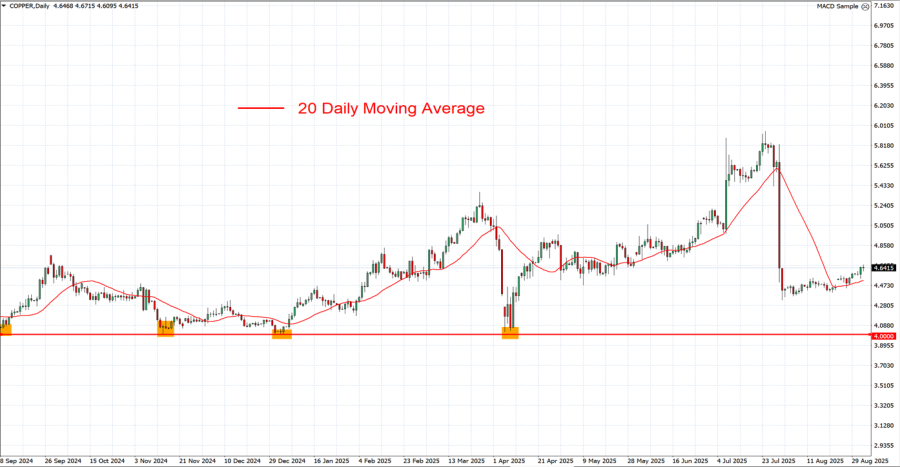

- COPPER PRICE ABOVE 20-DAILY MOVING AVERAGE: Copper price has kept above its 20 – day moving average, strongly pointing to an uptrend. The trend could reverse if Copper goes below this moving average.

- STRONG SUPPORT AT $4: Copper prices have tested the mark of $4 in total of 5 times since August 2024. This technical indicator indicates that the current downside potential remains limited, although if prices break below $4, then a negative trend could be observed.

- COPPER PRICE HIT AN ALL-TIME HIGH OF $5.9552 (July 24, 2025): The copper price currently trades around $4.64, and if a full recovery occurs, then copper prices could see an upside of around 28.35%. Although price could decline, too.

- COPPER PRICE HAS TESTED ITS LOWEST PRICE IN 3 AND A HALF MONTHS ($4.3302): After the most recent pullback of copper prices, losing more than 20% over two days, copper prices have tested their lowest levels in 3 and a half months ($4.3302).

GRAPH (Daily): September 2024 – September 2025

Please note that past performance does not guarantee future results

GEOPOLITICS: RUSSIA – UKRAINE PEACE TALKS IN JEOPARDY

- EVENT (SEPTEMBER 5): US PRESIDENT TRUMP EXPECTS OUTCOMES ON A POTENTIAL PUTIN-ZELENSKY MEETING THIS WEEK (ESTIMATED UNTIL SEPTEMBER 5). President Donald Trump said on August 22 he will give Russian President Vladimir Putin two weeks, further extending his deadline for potential consequences against Russia after urging the Russian leader to meet with his Ukrainian counterpart in hopes of ending the war. His latest comments come as the momentum around peace talks has stalled, with no sign that the bilateral meeting the White House has pushed is happening. Russian Foreign Minister Sergey Lavrov said earlier that there were no plans for a meeting between the two leaders.

- RUSSIA IS THE 4TH LARGEST REFINED COPPER EXPORTER IN THE WORLD. Russia is the 4th largest refined copper exporter in the world after Chile, Japan, and Australia. Russia’s refined copper is exported to China, Turkey, Italy, Egypt, and Germany.

TRADE: OPTIMISM PREVAILS

- BREAKING (AUGUST 11): US PRESIDENT TRUMP EXTENDED CHINA TARIFF TRUCE FOR ANOTHER 90 DAYS UNTIL MID-NOVEMBER. President Donald Trump signed an executive order delaying the reinstatement of higher U.S. tariffs on Chinese goods for an additional 90 days, moving the deadline to mid-November 2025.

US FEDERAL RESERVE AND OTHER EVENTS:

- FRIDAY, SEPTEMBER 5 AT 13:30 GMT+1: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (AUGUST). The US labor market data remains one of the most important indicators, used by the US Fed, that could potentially predict if and when there could be new interest rate cuts. The US unemployment rate remained above 4%, last coming in at 4.2% for July.

- WEDNESDAY, SEPTEMBER 17 AT 19:00 GMT+1: US FEDERAL RESERVE INTEREST RATE DECISION. After some weaker-than-expected employment market data in July and downward revisions to June figures, markets have increased their expectations for an interest rate cut in September, expected to be followed by another in December. The benchmark interest rate currently stands at 4.5%, and according to market expectations, it is expected to decline to 4% by the end of 2025.

COPPER, September 3, 2025.

Current Price: 4.64

|

COPPER |

Weekly |

|

Trend direction |

|

|

6.00 |

|

|

5.50 |

|

|

5.15 |

|

|

4.30 |

|

|

4.20 |

|

|

4.10 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

COPPER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

13,600 |

8,600 |

5,100 |

-3,400 |

-4,400 |

-5,400 |

|

Profit or loss in €² |

11,669 |

7,379 |

4,376 |

-2,917 |

-3,775 |

-4,633 |

|

Profit or loss in £² |

10,145 |

6,415 |

3,804 |

-2,536 |

-3,282 |

-4,028 |

|

Profit or loss in C$² |

18,766 |

11,867 |

7,037 |

-4,691 |

-6,071 |

-7,451 |

- 1.00 lot is equivalent of 10 000 units

- Calculations for exchange rate used as of 10:20 (GMT+1) 3/09/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit