Crude Oil weekly special report based on 1.00 Lot Calculation:

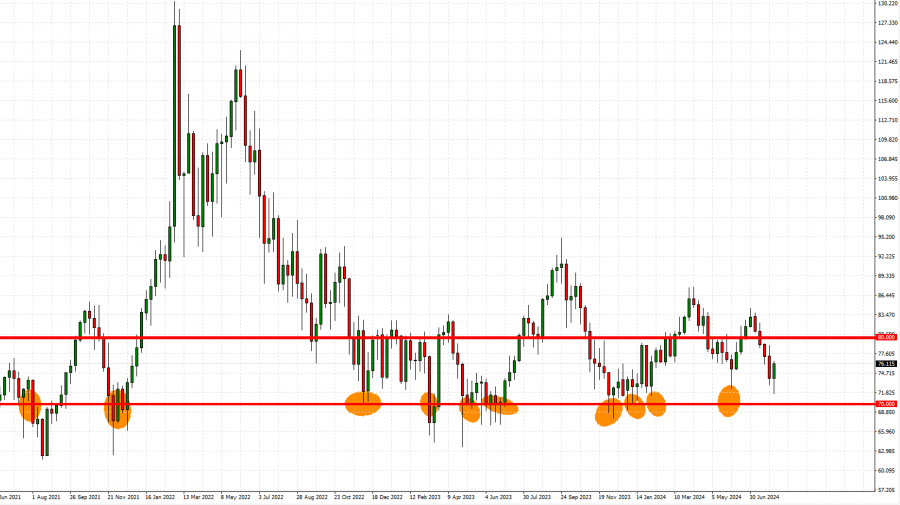

TECHNICAL ANALYSIS:

- CRUDE OIL PRICES TESTED THEIR LOWEST LEVELS IN 6 MONTHS ($71.775).

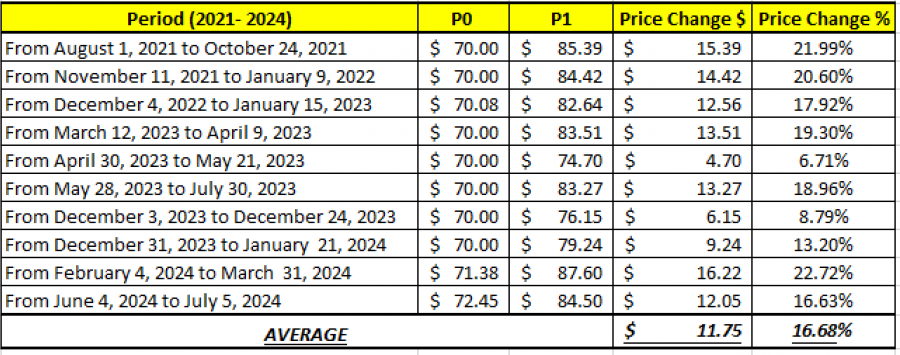

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $70 (OR NEAR) 10 TIMES SINCE 2021. This is the 11th time that the Crude Oil prices are testing levels near the mark of $70.

GRAPH (Daily): July 2021 – August 2024

- 2021- 2024 STATISTICS: CRUDE OIL TENDS TO RECOVER BY AROUND 16% AFTER TESTING THE MARK OF $70 OR NEAR IT.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

GEOPOLITICS:

- ISRAEL EXPECT TO BE ATTACKED BY IRAN AND THEIR PROXIES AS IRAN’S SUPREME LEADER (AYATOLLAH ALI KHAMENEI) ORDERED ATTACK ON ISRAEL. Iran’s supreme leader, Ayatollah Ali Khamenei, has issued an order for Iran to strike Israel directly, in retaliation for the killing in Tehran of Hamas’s leader, Ismail Haniyeh. Ismail Khamenei gave the order at an emergency meeting of Iran’s Supreme National Security Council, shortly after Iran announced that Ismail Haniyeh had been killed, said the three Iranian officials, including two members of the Revolutionary Guards. Rising Middle East tensions tends to have positive impact on oil prices as the region is rich in oil and fears over potential oil supply disruptions usually support oil prices positively.

EVENTS:

- MONDAY (AUGUST 12) AT 13:00 GMT+1: OPEC OIL MONTHLY REPORT. In its last report, OPEC kept its global demand growth unchanged for 2024 at 2.25 million barrels a day. Total global demand is estimated to stay at 104.5 million barrels a day in 2024.

- TUESDAY (AUGUST 13) AT 09:00 GMT+1: INTERNATIONAL ENERGY AGENCY (IEA) REPORT. According to the agency, for 2024 as a whole, global oil supply growth is forecast to average 770 kb/d, which will boost oil supply to a record 103 million barrels a day.

- TUESDAY (AUGUST 13) AT 21:30 GMT+1: US WEEKLY OIL INVENTORIES DATA (AMERICAN PETROLEIUM INSTITUTE). Analysts expect to see a decrease in the US oil inventories for the past week due to the ongoing travel season in the US. If the inventories fall, the supply gets lower, which in turn could support positively the oil prices.

- WEDNESDAY (AUGUST 14) AT 15:30 GMT+1: US WEEKLY OIL INVENTORIES DATA (US GOVERNMENT). Analysts expect to see a decrease in the US oil inventories for the past week due to the ongoing travel season in the US. If the inventories fall, the supply gets lower, which in turn could support positively the oil prices.

Crude Oil, August 9, 2024

Current Price: 75.90

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

88.00 |

|

|

84.00 |

|

|

80.00 |

|

|

72.00 |

|

|

71.00 |

|

|

70.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

12,100 |

8,100 |

4,100 |

-3,900 |

-4,900 |

-5,900 |

|

Profit or loss in €2 |

11,077 |

7,415 |

3,753 |

-3,570 |

-4,486 |

-5,401 |

|

Profit or loss in £2 |

9,477 |

6,344 |

3,211 |

-3,055 |

-3,838 |

-4,621 |

|

Profit or loss in C$2 |

16,615 |

11,122 |

5,630 |

-5,355 |

-6,728 |

-8,101 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 09:00 (GMT+1) 09/08/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit.