GER 40 Weekly Special Report based on 1.00 Lot Calculation:

GER 40:

- The GER40 represents the DAX 40 in Germany, which includes companies such as Adidas, Bayer, Mercedes-Benz, Deutsche Bank, Siemens, BMW, E.ON, etc. In essence, GER40 includes the most valuable and advanced companies in Germany, the largest economy in Europe.

TECHNICAL ANALYSIS:

-

-

-

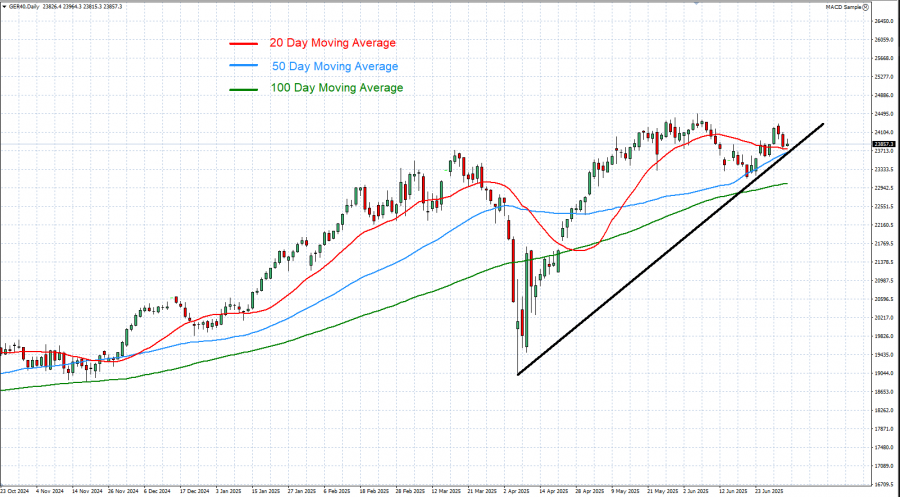

- LONGER-TERM TREND LINE: The black trend line depicted by the chart below shows that GER40 prices have maintained their uptrend in general since April 2025. However, there remains a risk of a potential breakout below this level if market conditions change.

- GER40 REMAINS ABOVE 20-, 50- DAY, AND 100-DAY MOVING AVERAGES: The daily graph below shows that GER40 has remained above three, technically, crucial moving averages, indicating ongoing uptrend. Although, the trend could change if prices fall below the 20-, 50- and 100- Day Moving Averages.

- THE GER40 HIT AN ALL-TIME HIGH OF 24,497 (JUNE 5, 2025).

-

-

GRAPH (Daily): November 2024 – July 2025

Please note that past performance does not guarantee future results

GEOPOLITICS: TRADE PROGRESS AND OPTIMISM

- EVENT (WEDNESDAY-THURSDAY, JULY 2 - JULY 3): U.S. - E.U. TRADE TALKS TO CONTINUE ON WEDNESDAY AND THURSDAY. European Trade Commissioner Maros Sefcovic will meet with U.S. Trade Representative Jamieson Greer and Commerce Secretary Howard Lutnick on Wednesday and Thursday. Sefcovic said the EU had received the first drafts of proposals from the United States for an eventual agreement.

- PROGRESS IN THE U.S.–E.U. TRADE TALKS could boost investor sentiment across European markets, potentially supporting the GER40 as expectations rise for improved transatlantic trade relations.

- EVENT (JUNE 26, 2025): TRUMP ANNOUNCES NEW TRADE DEAL WITH CHINA: President Trump announced that the U.S. signed a new trade agreement with China, calling it “a great deal for both countries” during a press briefing at the White House. Trump said the deal covers key areas including agriculture, manufacturing, and digital trade, and aims to reduce tariffs gradually over the coming months.

- GERMAN EXPORTERS BENEFIT. Key GER40-listed multinationals such as Volkswagen, Siemens, and BASF are expected to benefit from increased global demand and fewer supply chain disruptions, especially in Asia.

CENTRAL BANKS:

- EVENT (THURSDAY, JULY 24 AT 13:15 GMT+1): EUROPEAN CENTRAL BANK (ECB) INTEREST RATE DECISION. The ECB cut its benchmark interest rate in June from 2.40% to the current 2.15%, and investors expect the ECB could continue with their rate-cutting cycle on. If the ECB does decide on an interest rate cut, this could push the GER40 higher, as borrowing costs for businesses could become lower and therefore allow for the economy to grow and expand.

STATISTICS: THE GER40 HIT AN ALL-TIME HIGH OF 24,497 (JUNE 5, 2025): GER40 HAS RISEN AROUND 33% SINCE THE ECB STARTED CUTTING INTEREST RATES IN JUNE 2024. HOWEVER, THE PRICE COULD DECLINE.

GER40, July 2, 2025

Current Price: 23,870

|

GER40 |

Weekly |

|

Trend direction |

|

|

25,500 |

|

|

25,000 |

|

|

24,500 |

|

|

23,300 |

|

|

23,100 |

|

|

22,900 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

GER40 |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

19,163 |

13,285 |

7,406 |

-6,701 |

-9,052 |

-11,404 |

|

Profit or loss in €² |

16,300 |

11,300 |

6,300 |

-5,700 |

-7,700 |

-9,700 |

|

Profit or loss in £² |

14,026 |

9,724 |

5,421 |

-4,905 |

-6,626 |

-8,347 |

|

Profit or loss in C$² |

26,146 |

18,126 |

10,106 |

-9,143 |

-12,351 |

-15,559 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 13:00 (GMT+1) 2/7/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.