Tesla (#TSLA) weekly special report based on 1 Lot Calculation:

TESLA: THE COMPANY

- Tesla produces several Electric Vehicles (EVs), including the Model 3, Model X, Model Y, Model S, and, since recently, the Cybertruck. Tesla also delivers the Semi-Truck.

- STOCK INDEX PARTICIPATION: Tesla stock is part of both the NASDAQ 100 (USA100) index and the S&P 500 (USA500) index.

- MARKET SHARE: Tesla is still the largest seller of pure battery-powered Electric Vehicles (EVs) in the world and an absolute leader in the US (taking up around 50% market share).

TESLA: EVENTS AND FINANCIALS

- BREAKING (WEDNESDAY, JULY 2): TESLA Q2 CAR DELIVERY CAME IN AT 384,122. In the second quarter of 2025, Tesla delivered approximately 384,122 vehicles. The number was up around 14% from Q1’s 336,681.

- EVENT (EXPECTED: WEDNESDAY, JULY 23, AFTERMARKET): Q2 EARNINGS REPORT. Tesla is expected to print $22.955 billion dollars in revenue, a growth of 19% from the previous quarter and $1.595 billion dollars in net income, a growth of 219% from the previous quarter. If Tesla manages to beat expectations it could create positive pressure for the its stock price.

TESLA: ROBOTAXI

- BREAKING (JUNE 22): TESLA ROBOTAXI SERVICES IN AUSTIN, TEXAS BEGAN JUNE 22, CHARGING A FLAT FEE OF $4.20. CEO Musk said a Tesla robotaxi service will start with about 10 vehicles in Austin, and rapidly expand to thousands of vehicles should the launch go well with no incidents.

- ROBOTAXI CAR: TESLA STARTS WITH “MODEL Y”. To start, Tesla has said its robotaxis will be Model Y vehicles equipped with a forthcoming version of FSD, or full self-driving, known as FSD Unsupervised.

TESLA: PRICE ACTION AND ANALYS OPINION

- WEDBUSH DAN IVES forecasts $500, FUBON SECURITIES forecasts $470, MORGAN STANELY forecasts $410, CANTOR FITZGERALD forecasts $355 and DEUTSCHE BANK forecasts $345.

- TESLA’S STOCK PRICE HIT A NEW ALL-TIME HIGH IN LATE 2024: $487.99. The current stock price is around $302, and if the price moves to its recent all-time high levels, this would be a price change of around 62%. However, the price could decline as well.

TECHNICAL ANALYSIS:

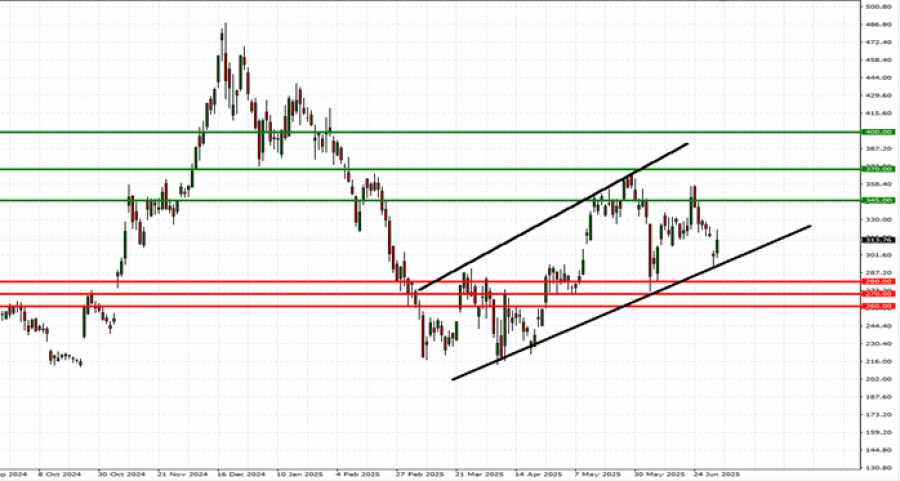

- UPTREND CHANNEL SINCE EARLY MARCH 2025: As depicted by the daily chart below, the Tesla stock price has kept trading within the mid-term black - lined uptrend channel, confirming its mid-term trend is up. The channel has been in place since early March 2025.

GRAPH (Daily): October 2024 – July 2025

Please note that past performance does not guarantee future results

#TSLA, July 2, 2025

Current Price: 310

|

Tesla |

Weekly |

|

Trend direction |

|

|

400 |

|

|

370 |

|

|

345 |

|

|

280 |

|

|

270 |

|

|

260 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Tesla |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

90,000 |

60,000 |

35,000 |

-30,000 |

-40,000 |

-50,000 |

|

Profit or loss in €2 |

76,475 |

50,984 |

29,740 |

-25,492 |

-33,989 |

-42,486 |

|

Profit or loss in £2 |

66,047 |

44,031 |

25,685 |

-22,016 |

-29,354 |

-36,693 |

|

Profit or loss in C$2 |

122,785 |

81,857 |

47,750 |

-40,928 |

-54,571 |

-68,214 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 14:15 (GMT+1) 02/07/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.