GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: RUSSIA – USA/UKRAINE CONFLICT

- EVENT (FRIDAY, AUGUST 8): US PRESIDENT TRUMP CONFIRMED WANTS A CEASFIRE DEAL BETWEEN RUSSIA AND UKRAINE BY AUGUST 8; OTHERWISE, THE USA WILL IMPOSE NEW SANCTIONS ON RUSSIA AND SECONDARY TARIFFS ON COUNTRIES THAT TRADE WITH RUSSIA. U.S. President Donald Trump has made clear that he wants a deal to end Russia’s war in Ukraine by August 8. Trump has threatened sanctions on both Russia and buyers of its exports unless progress is made. Trump reiterated that, without a deal, his administration would impose 100% secondary tariffs on countries continuing to buy Russian exports.

- BREAKING (FRIDAY, AUGUST 1): US PRESIDENT TRUMP DEPLOYS NUCLEAR SUBMARINES. Us President Trump said the US Military positioned two nuclear submarines “in the appropriate regions” in response to “highly provocative” comments by Russia’s Dmitry Medvedev. Medvedev has recently threatened the US in response to Trump’s ultimatums to Moscow to agree to a ceasefire in Ukraine or face tough sanctions.

EVENTS:

- THURSDAY, AUGUST 7 AT 13:30 GMT+1: US INITIAL JOBLESS CLAIMS. A higher than expected reading could prove positive for gold, because it will increase the odds of an interest rate cut by the FED. This data measures the number of individuals who filed for unemployement insurance for the first time during the past week. The data for the previous week stood at 218.000 which was higher than the week before (217.000)

- TUESDAY, AUGUST 12 AT 13:30 GMT+1: US INFLATION (CPI) (JULY). A lower than expected reading should be positive for Gold, because it could point to the FED cutting interest rates sooner and more aggresively. This index measures the change in the price of goods and services from the perspective of the consumer. The data for the previous month (June) came in at 2.7%.

- FRIDAY, AUGUST 15 AT 13:30 GMT+1: US RETAIL SALES (JULY). A lower than expected reading could prove positive for the price of Gold, because it could motivate the FED to cut interest rates to stimulate economic activity. This data measures the change in the total value of sales at the retail level. The number for the previous month (June) stood at 3.92%.

TECHNICAL ANALYSIS:

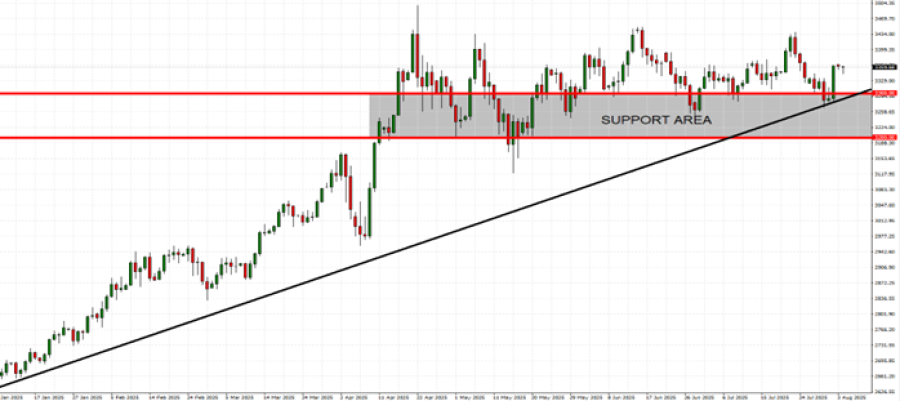

- SUPPORT AREA BETWEEN $3,300 AND $3,200: Gold prices have seen near-term support at $3,300, and an extended support level at $3,200, meaning the area between $3,300 and $3,200 altogether acts as a near-term support area. Gold prices have tested the area between $3,300 and $3,200 seven times since April 2025.

- LONG – TERM UPTREND: Gold has steadily kept above its long term black trendline, indicating that Gold is in an uptrend since at least January 2025. The prices could also move in the opposite direction if the price goes below the long – term trendline.

- GOLD HIT A NEW ALL-TIME HIGH OF $3,499.76 (April 22, 2025): Gold has traded around $3,358, and if a full recovery takes place, the price of Gold could rise around $140. Although the price could decline as well.

GRAPH (Daily): January 2025 – August 2025

Please note that past performance does not guarantee future results

GOLD, AUGUST 04, 2025.

Current Price: 3,358

|

GOLD |

Weekly |

|

Trend direction |

|

|

3,500 |

|

|

3,450 |

|

|

3,425 |

|

|

3,300 |

|

|

3,280 |

|

|

3,260 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

14,200 |

9,200 |

6,700 |

-5,800 |

-7,800 |

-9,800 |

|

Profit or loss in €2 |

12,273 |

7,952 |

5,791 |

-5,013 |

-6,742 |

-8,470 |

|

Profit or loss in £2 |

10,683 |

6,921 |

5,040 |

-4,363 |

-5,868 |

-7,373 |

|

Profit or loss in C$2 |

19,566 |

12,676 |

9,232 |

-7,992 |

-10,747 |

-13,503 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 09:00 (GMT+1) 04/08/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.