GOLD weekly special report based on 1.00 Lot Calculation:

USA: WILL THERE BE A GOVERNMENT SHUTDOWN?

- BREAKING (WEDNESDAY, OCTOBER 1 AT 05:00 AM GMT+1): US GOVERNMENT SHUTDOWN BEGAN WITH NO DEAL IN SIGHT. According to Reuters, U.S. President Donald Trump and his Democratic opponents made no progress in ending the government shutdown. Without passage of funding legislation, parts of the government have remained closed since Wednesday (October 1).

EVENTS:

- WEDNESDAY, OCTOBER 8 AT 19:00 GMT+1: US FEDERAL RESERVE (FOMC) LAST MEETING MINUTES. The US Fed held its last interest rate policy meeting on September 17, deciding to cut rates to 4.25%. The transcripts, however, from that meeting are announced three weeks after the meeting, on October 8. At the last meeting, the Fed decided to cut rates and projected it would cut two more times by the end of 2025. Similar messages are expected to be carried by the last meeting transcripts on Wednesday (October 8), which could put negative pressure on the US dollar, while positive support could be provided to gold prices.

- THURSDAY, OCTOBER 9 AT 13:30 GMT+1: US FEDERAL RESERVE (FED) CHAIR JEROME POWELL SPEAKS. Federal Reserve Chair Jerome Powell will deliver opening remarks at a banking conference in Washington, D.C. Comments on the Fed policy could be expected to be made, too, which could increase volatility in Gold prices.

US FEDERAL RESERVE:

- BREAKING (SEPTEMBER 17): US FEDERAL RESERVE CUT INTEREST RATE TO 4.25% FROM 4.50%, ITS FIRST INTEREST RATE CUT SINCE DECEMBER 2024. The Federal Reserve policymakers said they expect to see 2 more rate cuts by the end of 2025, to slash current rates to 3.75%.

- NEXT FEDERAL RESERVE MEETING AND INTEREST RATE DECISION: October 29. Interest rates are expected to be further cut to 4.00%.

- DECEMBER 10: The US Federal Reserve is expected to finish the year 2025 by cutting the rates to 3.75% on December 10.

TECHNICAL ANALYSIS:

- SUPPORT: $3,850 - $3,800. After hitting fresh all-time highs ($3,949.39), gold prices have recently traded above the level of $3,850, which has now become its next psychological support down to $3,800.

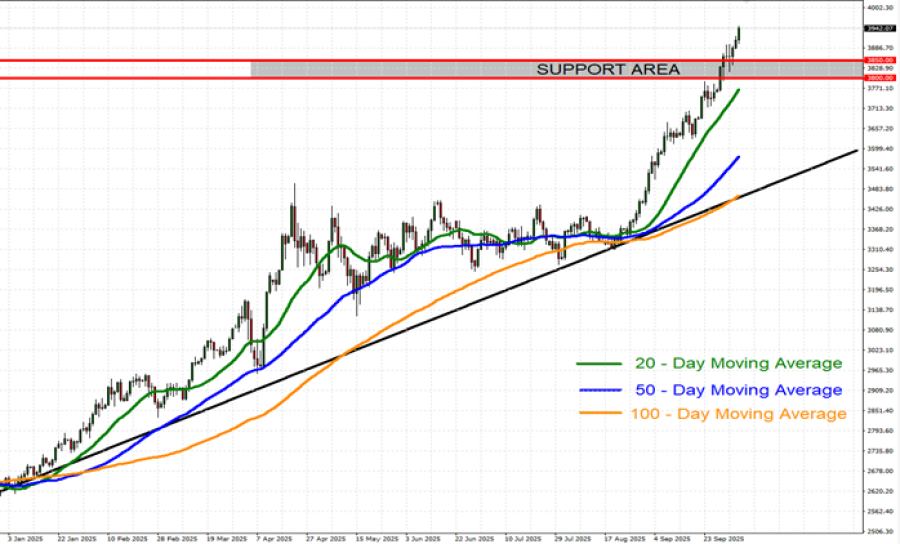

- UPTREND SINCE JANUARY 2025: Gold prices have been trading in an uptrend, as depicted by the daily chart below and the solid black uptrend line on the same chart. Since the beginning of January 2025, Gold prices have risen by around 50%. However, a shift in direction remains possible.

- ANALYSTS’ OPINION: Deutsche Bank forecasts $4,000; Goldman Sachs forecasts $4,000, but under certain circumstances, Goldman Sachs forecasts $5,000; Bank of America forecasts $4,000; J.P. Morgan forecasts $4,000; UBS forecasts $4,200; CITIGROUP forecasts $4,000;

GRAPH (Daily): January 2025 – October 2025

Please note that past performance does not guarantee future results

GOLD, October 6, 2025.

Current Price: 3,935

|

GOLD |

Weekly |

|

Trend direction |

|

|

4,500 |

|

|

4,200 |

|

|

4,030 |

|

|

3,850 |

|

|

3,825 |

|

|

3,800 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

56,500 |

26,500 |

9,500 |

-8,500 |

-11,000 |

-13,500 |

|

Profit or loss in €2 |

48,439 |

22,719 |

8,145 |

-7,287 |

-9,431 |

-11,574 |

|

Profit or loss in £2 |

42,057 |

19,726 |

7,072 |

-6,327 |

-8,188 |

-10,049 |

|

Profit or loss in C$2 |

78,837 |

36,977 |

13,256 |

-11,860 |

-15,349 |

-18,837 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 10:30 (GMT+1) 06/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.