INTEL (#INTEL) weekly special report based on 1.00 Lot Calculation:

INTEL: THE COMPANY

- INTEL: Intel's business involves designing and manufacturing semiconductor products, including central processing units (CPUs) like the Intel Core processor line. Their focus has recently shifted to AI integration, heavily investing in AI–powered solutions, developing products, and collaborating on AI infrastructure to enhance business operations.

- FOUNDATION: 1968. Intel remains one of the oldest tech brands in the USA, which has been among the top names for years in the USA.

- INTEL STOCK IS IN THE S&P 500 INDEX (USA500) AND THE NASDAQ 100 INDEX (USA100).

INTEL: COMPUTER PROCESSING UNITS (CPU) MARKET SHARE IS STILL THE HIGHEST

- DEFINITION: A computer processing unit, or CPU, is the "brain" of a computer, responsible for executing instructions and performing calculations.

- MARKET SHARE (CPU): 76%. According to data in Q1 2025, Intel holds around 76% market share, while AMD follows with 24.4%.

INTEL: RECENT ANNOUNCEMENTS AND DEVELOPMENTS

- BREAKING: INTEL IN TALKS FOR A POTENTIAL PARTNERSHIP WITH AMD; AMD HAS JUST ANNOUNCED A MULTIBILLION-DOLLAR DEAL WITH OPENAI. The ecosystem created by this collaboration could support Intel’s operations, as AMD will be producing AI chips for OpenAI. The deal pushed AMD’s stock up by more than 30% (October 6, 2025). In addition, if Intel enters into a partnership with AMD, its stock price could be positively impacted, as this move could open a whole new market for the recently troubled company.

- BREAKING (SEPTEMBER 25): INTEL IN TALKS WITH TAIWAN SEMICONDUCTOR TO FORM A JOINT VENTURE. According to the SeekingAlpha, Intel and Taiwan Semiconductor Manufacturing have reached a preliminary agreement to form a joint venture to operate some of Intel's foundry facilities. TSMC would take a 20% stake in the new company, according to the report, which cited two people familiar with the situation. Intel, along with other unnamed U.S. semiconductor companies, would hold the majority of shares in the Joint Venture.

- BREAKING (SEPTEMBER 24): INTEL APPROACHED APPLE AS WORK IS STILL IN PROGRESS. According to the SeekingAlpha, Intel has allegedly approached Apple to consider investing in Intel.

- BREAKING (SEPTEMBER 18): NVIDIA BOUGHT A STAKE IN INTEL INVESTING $5 BILLION. The stake will make Nvidia one of Intel's largest shareholders, giving it roughly 4% of the company after new shares are issued. This new pact includes a plan for the two companies to jointly develop PC and data center chips.

- BREAKING (AUGUST 22): TRUMP- LED U.S. GOVERNMENT TOOK 10% STAKE IN INTEL. According to the BBC, Intel said in a statement that the US government would make a $8.9 billion investment in Intel common stock.

- BREAKING (AUGUST 18): JAPAN’S SOFTBANK INVESTED $2 BILLION IN INTEL. This would be equivalent to roughly 2% of Intel’s company shares.

INTEL: FINANCIALS

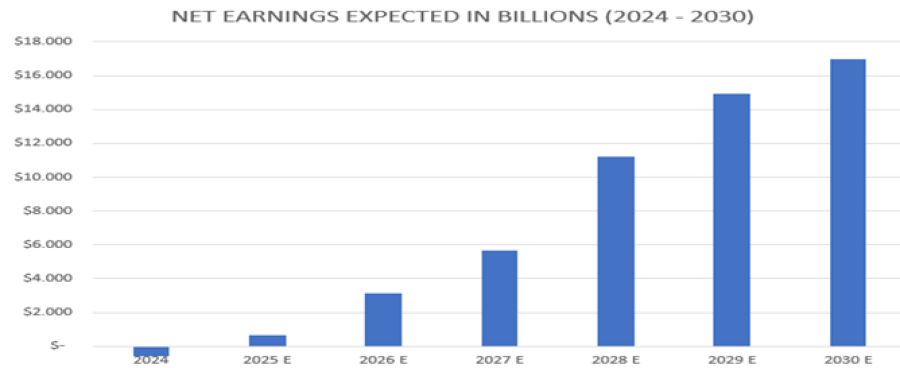

- 2025 EARNINGS: Intel is expected to print 213% growth in net earnings in 2025, from negative $566 million to positive $643 million. According to Bloomberg, Intel’s net earnings are expected to grow to up to $17 billion in 2030.

- NET EARNINGS (2024 – 2030): INTEL’S NET EARNINGS ARE EXPECTED TO RISE BY 138.19% ON AVERAGE ANNUALLY BY 2030. Net Earnings are expected to grow from negative $566 million in 2024 to $17 billion in 2030.

*- E stands for expected

Data Source: Bloomberg Terminal

#INTEL, October 6, 2025.

Current Price: 37

|

INTEL |

Weekly |

|

Trend direction |

|

|

60 |

|

|

51 |

|

|

45 |

|

|

30 |

|

|

26 |

|

|

24 |

Example of calculation based on weekly trend direction for 1 Lot1

|

INTEL |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

23,000 |

14,000 |

8,000 |

-7,000 |

-9,000 |

-11,000 |

|

Profit or loss in €2 |

19,681 |

11,980 |

6,846 |

-5,990 |

-7,701 |

-9,413 |

|

Profit or loss in £2 |

17,117 |

10,419 |

5,954 |

-5,210 |

-6,698 |

-8,187 |

|

Profit or loss in C$2 |

32,107 |

19,543 |

11,168 |

-9,772 |

-12,563 |

-15,355 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 13:00 (GMT+1) 06/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.