GOLD weekly special report based on 1.00 Lot Calculation:

GEOPILITICS: POSSIBLE NEW TRADE CONFLICT?

- BREAKING (OCTOBER 14): US – CHINA TRADE RELATIONS DETERIORATE AS PRISED TRUMP THREATENS ADDITIONAL 100% TARIFFS ON CHINA. After an initial de-escalation of rhetoric, US President Trump has once again accused the Chinese of intentionally avoiding purchases of American soybeans. Trump has threatened to end trade on cooking oil and other goods. China has responded by imposing sanctions on five American shipbuilders in South Korea, and announcing special import fees on US ships arriving in Chinese ports, starting on Tuesday (October 14). On October 10th US President Trump threatened to elevate tariffs on China by 100% to new 130% total.

GEOPOLITICS: UKRAINE- RUSSIA CONFLICT

- FRIDAY, OCTOBER 17: US president TRUMP TO MEET UKRANIAN PRESIDENT ZELENSKY. Analysts believe the meeting will be related to Trump’s decision whether or not to supply Ukraine with long-range Tomahawk missiles. If delivered it could put Moscow within striking distance of Ukraine’s arsenals potentially massively increasing geo-political tensions and safe – haven demand for Gold.

USA: GOVERNMENT SHUTDOWN ENTERED ITS 15TH DAY (October 15, 2025)

- BREAKING (WEDNESDAY, OCTOBER 1 AT 05:00 AM GMT+1): US GOVERNMENT SHUTDOWN BEGAN WITH NO DEAL IN SIGHT. According to Reuters, U.S. President Donald Trump and his Democratic opponents made no progress, even after eight attempts, in ending the government shutdown. Without passage of funding legislation, parts of the government have remained closed since Wednesday (October 1).

EVENTS:

- FRIDAY, OCTOBER 24 AT 13:30 GMT+1: US INFLATION (CPI) (SEPTEMBER). Despite the ongoing US government shutdown, latest reports have said that US inflation data could be still released, with the office workers expected to work harder to get the data out. In August, US inflation rose to 2.90%, up from July’s 2.70%. This would be the last inflation report before Fed’s interest rate decision on October 29.

US FEDERAL RESERVE:

- BREAKING (SEPTEMBER 17): US FEDERAL RESERVE CUT INTEREST RATE TO 4.25% FROM 4.50%, ITS FIRST INTEREST RATE CUT SINCE DECEMBER 2024. The Federal Reserve policymakers said they expect to see 2 more rate cuts by the end of 2025, to slash current rates to 3.75%.

- NEXT FEDERAL RESERVE MEETING AND INTEREST RATE DECISION: October 29. Interest rates could be further cut to 4.00%.

- DECEMBER 10: The US Federal Reserve is expected to finish the year 2025 by cutting the rates to 3.75% on December 10.

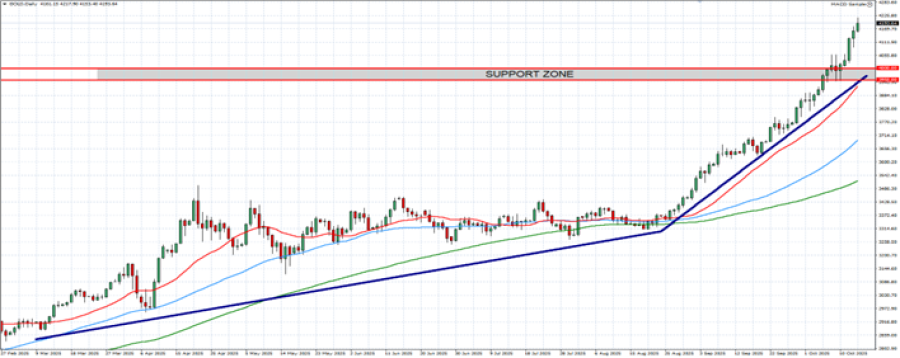

TECHNICAL ANALYSIS:

- SUPPORT: $4,000 - $3,950. After hitting fresh all-time highs ($4,217.90), gold prices have formed a psychological support level between $4000 and $3950. However, there remains a risk of a potential breakout below this level if market conditions change.

- ANALYSTS’ OPINION: Bank of America forecasts $5000; Societe Générale forecasts $5000; Standard Chartered forecasts $4,488; Goldman Sachs forecasts $4,900; J.P. Morgan forecasts $4,200 - $4,500; UBS forecasts $4,200; Julius Baer forecasts $4,500; TD Securities forecasts $4,400.

GRAPH (Daily): February 2025 – October 2025

Please note that past performance does not guarantee future results

GOLD, October 15, 2025.

Current Price: 4,190

|

GOLD |

Weekly |

|

Trend direction |

|

|

4,700 |

|

|

4,500 |

|

|

4,300 |

|

|

4,090 |

|

|

4,050 |

|

|

4,000 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

51,000 |

31,000 |

11,000 |

-10,000 |

-14,000 |

-19,000 |

|

Profit or loss in €2 |

43,835 |

26,645 |

9,455 |

-8,595 |

-12,033 |

-16,331 |

|

Profit or loss in £2 |

38,196 |

23,217 |

8,238 |

-7,489 |

-10,485 |

-14,230 |

|

Profit or loss in C$2 |

71,597 |

43,520 |

15,443 |

-14,039 |

-19,654 |

-26,674 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 08:00 (GMT+1) 15/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.