Natural Gas weekly special report based On 1 Lot Calculation:

FUNDAMENTAL FACTORS:

- GEOPOLITICAL TENSIONS: Fears are rising as the current tensions in the Middle-East could affect liquefied natural gas shipments (LNG) to Europe. Qatar is a major supplier of LNG to the EU and the third largest LNG exporter in the world after the US and Australia.

EVENT: US gas producers like EQT and Chesapeake Energy are cutting production. US output is ~4% lower in March than in February. For most producers the current price is far below their break even price.

PRICE ACTION:

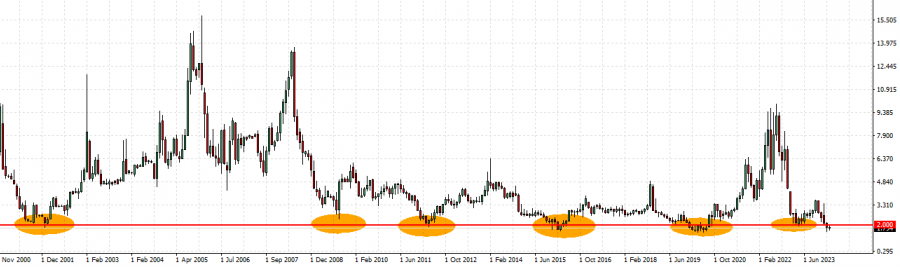

- Natural Gas has undergone a downward correction of around ~82% since August 23, 2022. Natural gas traded last around $1.77, near the lowest since 2020 and below the strong support at $2. If a full recovery followed, that could imply an upside of around ~457%. However, the price could decline further.

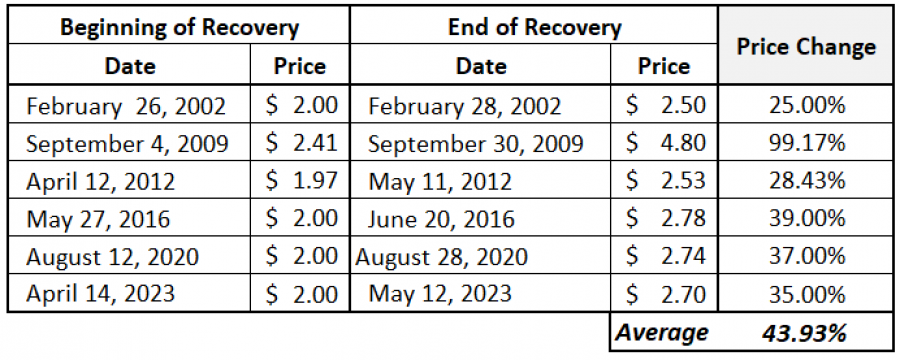

Since 2000 the price fell near or below $2 six times and within a month recovered on average 43.93%.

Source: MT4

Please note that past performance does not guarantee future results.

Source: MT4

Please note that past performance does not guarantee future results.

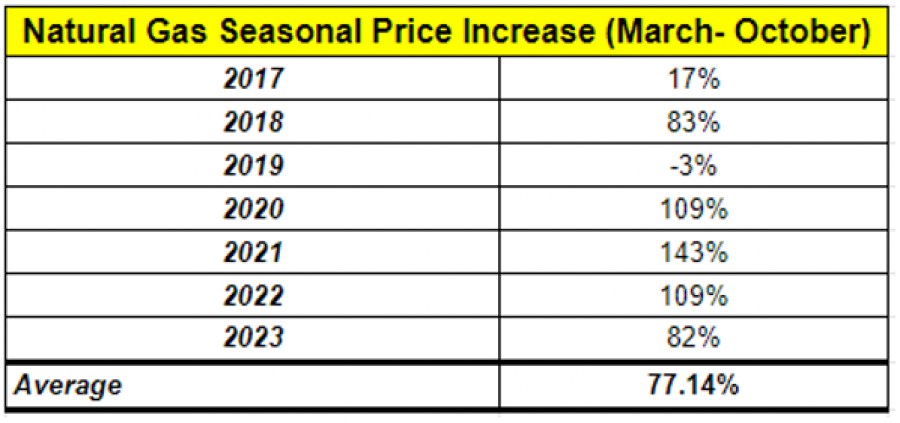

NATURAL GAS SEASONAL PRICE INCREASE (March -October)

The period between March and October marks an increased natural gas buying as countries across the world are refilling their storages for the next season, being accompanied by higher demand during summer months due to air conditioning. Last summer, for example, the US consumed the largest amount of electricity in their history.

|

Source: MT4 |

|

NATURAL GAS, March 27, 2024

Current Price:1.77

|

NATURAL GAS |

Weekly |

|

Trend direction |

|

|

4.000 |

|

|

3.000 |

|

|

2.100 |

|

|

1.550 |

|

|

1.450 |

|

|

1.350 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

22,300.00 |

12,300.00 |

3,300.00 |

-2,200.00 |

-3,200.00 |

-4,200.00 |

|

Profit or loss in €² |

20,590.04 |

11,356.84 |

3,046.96 |

-2,031.30 |

-2,954.62 |

-3,877.94 |

|

Profit or loss in £² |

17,664.42 |

9,743.15 |

2,614.02 |

-1,742.68 |

-2,534.80 |

-3,326.93 |

|

Profit or loss in C$² |

30,324.66 |

16,726.16 |

4,487.51 |

-2,991.67 |

-4,351.52 |

-5,711.37 |

1. 1 lot is equivalent of 10,000 units

2. Calculations for exchange rate used as of 09:30 (GMT+1) 27/03/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

· You may wish to consider closing your position in profit, even if it is lower than suggested one

· Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more details