Palladium weekly special report based on 1.00 Lot Calculation:

PALLADIUM USE AND MARKET SHARE:

- Palladium is mostly used in catalytic converters by the car industry to reduce harmful gas emissions, while tightening regulations are forcing automakers to put more Palladium into each vehicle, which in turn could keep the demand outlook positive. Palladium has also been used in fuel cells to generate power.

- MARKET SHARE (PRODUCERS): Russia is the largest producer, holding 43% of the market, while South Africa is the second largest with 33.00% of the market. Canada is third on the list with 9.5% of the global production.

- MARKET SHARE (CONSUMERS): China is the largest Palladium consumer with 31%, while Europe and North America (USA) hold 20% each. Japan stands at 11%.

GEOPOLITICS: UKRAINE – RUSSIA CONFLICT

- FRIDAY, OCTOBER 17 AT 18:00 GMT+1: U.S. PRESIDENT DONALD TRUMP MEETS UKRAINIAN PRESIDENT VOLODYMYR ZELENSKY. The White House meeting will focus on Ukraine’s request for advanced weaponry, including Tomahawk cruise missiles, amid rising tensions with Russia. Any escalation following this meeting could threaten Russian palladium exports — which account for around 40% of global supply — potentially tightening the market and supporting higher palladium prices.

GEOPOLITICS: CHINA – USA TRADE

- US PRESIDENT TRUMP AND CHINA PRESIDENT XI MEETING STILL ON TRACK TO TAKE PLACE (OCTOBER 31 – NOVEMBER 1): The meeting is expected to take place at the APEC (Asia-Pacific Economic Cooperation) Summit that will take place between October 31 and November 1 in South Korea. According to US Treasury Secretary Scot Bessent, the meeting between Trump and Xi is still expected to happen despite recent rise in trade tensions between the USA and China.

EVENTS:

- MONDAY, OCTOBER 20 AT 3:00 GMT+1: CHINA GROSS DOMESTIC PRODUCT (GDP) (Q3). A stronger-than-expected GDP reading would indicate solid economic growth and rising industrial output, which could boost demand for palladium used in automotive and manufacturing sectors. (PREVIOUS (Q2): +5.2%).

- MONDAY, OCTOBER 20 AT 3:00 GMT+1: CHINA INDUSTRIAL PRODUCTIION (SEPTEMBER). A stronger-than-expected industrial activity reading would indicate solid economic growth and rising industrial output, which could boost demand for palladium. (PREVIOUS (August): +5.2%)

- FRIDAY, OCTOBER 24 AT 13:30 GMT+1: US INFLATION (CPI) (SEPTEMBER). Despite the ongoing US government shutdown, latest reports have said that US inflation data could still be released, with the office workers expected to work harder to get the data out. In August, US inflation rose to 2.90%, up from July’s 2.70%. This would be the last inflation report before the Fed’s interest rate decision on October 29.

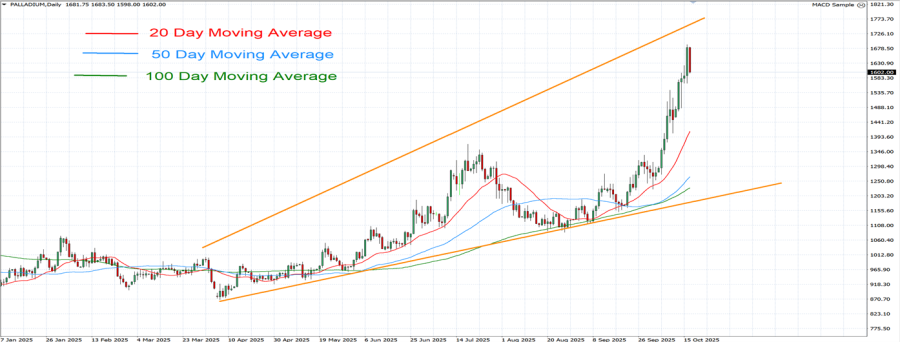

TECHNICAL ANALYSIS:

- UPTREND SINCE APRIL 2025: As shown in the daily chart below, palladium has been in a steady uptrend, supported by a rising uptrend channel since April 2025. However, the price could decline.

- PALLADIUM PRICE ABOVE 20-,50-, AND 100-DAILY MOVING AVERAGES: Palladium price has remained above its 20-, 50-, and 100-day moving averages, indicating a potential uptrend. The trend could reverse if Palladium price goes below these averages.

- PALLADIUM HIT AN ALL-TIME HIGH OF $3,409 (March 2022): Palladium price has traded around $1,600, and if a full recovery takes place, the price of palladium could see an upside of around 113%. Although the price could decline as well.

GRAPH (Daily): January 2025 – October 2025

Please note that past performance does not guarantee future results

Palladium, October 17, 2025.

Current Price: 1,600

|

PALLADIUM |

Weekly |

|

Trend direction |

|

|

2,000 |

|

|

1,850 |

|

|

1,700 |

|

|

1,520 |

|

|

1,460 |

|

|

1,400 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PALLADIUM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

40,000 |

25,000 |

10,000 |

-8,000 |

-14,000 |

-20,000 |

|

Profit or loss in €² |

34,186 |

21,366 |

8,547 |

-6,837 |

-11,965 |

-17,093 |

|

Profit or loss in £² |

29,818 |

18,636 |

7,454 |

-5,964 |

-10,436 |

-14,909 |

|

Profit or loss in C$² |

56,216 |

35,135 |

14,054 |

-11,243 |

-19,676 |

-28,108 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 9:45 (GMT+1) 17/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.