SILVER weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: RUSSIA-UKRAINE CONFLICT

- EVENT (FRIDAY, OCTOBER 17 AT 18:00 GMT+1): US PRESIDENT TRUMP TO MEET UKRAINIAN PRESIDENT ZELENSKY. According to Reuters, analysts believe the meeting will be mostly related to Trump’s decision whether to supply Ukraine with long-range weapon Tomahawk missiles. Tomahawk missiles have a range of 2,500 km (1,550 miles), putting Moscow in the range of Ukraine's arsenal, were Kyiv to be granted them.

CHINA AND USA TRADE: POSSIBLE NEW TRADE CONFLICT?

- BREAKING (OCTOBER 10): US PRESIDENT TRUMP THREATENS NEW TARIFFS ON CHINA. Rising geo-political tensions increase safe-haven demand for silver. US President Trump threatened additional 100% tariffs on China, totaling to 130% on a post on his platform Truth Social. The tariffs are set to start on November 1.

USA: GOVERNMENT SHUTDOWN ENTERED ITS 17TH DAY (October 17, 2025)

- BREAKING (WEDNESDAY, OCTOBER 1 AT 05:00 AM GMT+1): US GOVERNMENT SHUTDOWN BEGAN WITH NO DEAL IN SIGHT. According to Reuters, U.S. President Donald Trump and his Democratic opponents made no progress in ending the government shutdown. Without passage of funding legislation, parts of the government have remained closed since Wednesday (October 1).

EVENTS

- FRIDAY, OCTOBER 24 AT 13:30 GMT+1: US INFLATION (CPI) (SEPTEMBER). Despite the ongoing US government shutdown, latest reports have said that US inflation data could be still released, with the office workers expected to work harder to get the data out. Headline inflation is expected to see a rise in September to 3.1% from the previous 2.9%. Core Inflation is expected to remain unchanged at 3.1%. This would be the last inflation report before Fed’s interest rate decision on October 29.

US FEDERAL RESERVE:

- BREAKING (SEPTEMBER 17): US FEDERAL RESERVE CUT INTEREST RATE TO 4.25% FROM 4.50%, ITS FIRST INTEREST RATE CUT SINCE DECEMBER 2024. The Federal Reserve policymakers said they expect to see 2 more rate cuts by the end of 2025, to slash current rates to 3.75%.

- NEXT FEDERAL RESERVE MEETING AND INTEREST RATE DECISION: October 29. Interest rates are expected to be further cut to 4.00%.

- DECEMBER 10: US Federal Reserve is expected to finish the 2025 year by cutting the rates to 3.75% on December 10.

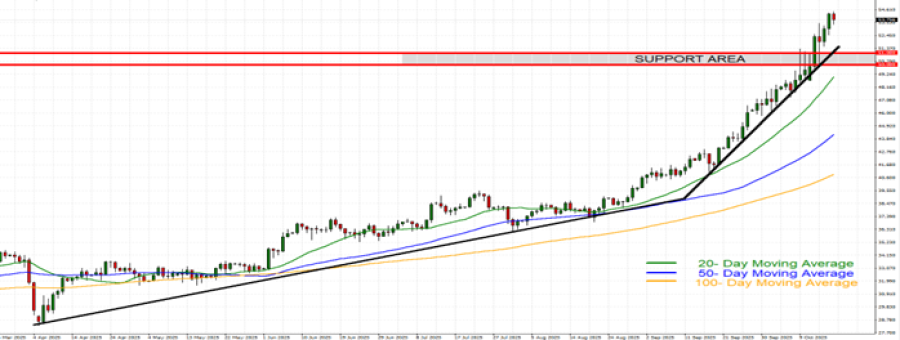

TECHNICAL ANALYSIS:

- SUPPORT AREA: $51 - $50. After hitting a fresh all-time high ($54.454), silver prices have remained above the area defined by $51 - $50, which has now become its next psychological support.

- UPTREND SINCE APRIL 2025: After the March-April price pullback, silver prices have since been trading in uptrend, as depicted by the daily chart below and the solid black uptrend line on the same chart. Since the beginning of 2025, silver prices have risen by around 87%.

- ANALYSTS’ OPINION: CITIGROUP forecasts $55; UBS forecasts $55; BANK OF AMERICA forecasts $65. ANZ forecasts $57.5.

GRAPH (Daily): March 2025 – October 2025

Please note that past performance does not guarantee future results

Silver, October 17, 2025.

Current Price: 53.70

|

Silver |

Weekly |

|

Trend direction |

|

|

60.00 |

|

|

58.00 |

|

|

56.00 |

|

|

51.50 |

|

|

51.00 |

|

|

50.50 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

63,000 |

43,000 |

23,000 |

-22,000 |

-27,000 |

-32,000 |

|

Profit or loss in €2 |

53,840 |

36,748 |

19,656 |

-18,801 |

-23,074 |

-27,347 |

|

Profit or loss in £2 |

46,972 |

32,060 |

17,149 |

-16,403 |

-20,131 |

-23,859 |

|

Profit or loss in C$2 |

88,565 |

60,449 |

32,333 |

-30,928 |

-37,957 |

-44,986 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 9:15 (GMT+1) 17/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.