Silver Weekly Special Report based on 1.00 Lot Calculation:

- EVENT (FEDERAL RESERVE INTEREST RATE DECISION - MARCH 20, 2024): The United States Federal Reserve will be deciding on interest rates on March 20th, 2024. The Fed has kept interest rates at 5.5% since July 2023 and markets are expecting rates to remain unchanged at the March meeting. The markets expect the first cut will take place in June, and expect a sort of confirmation by the Fed. Markets will be focused on Fed Chairman Powell’s speech after the meeting for indications and guidance as to when interest rate cuts could be expected.

- Silver prices went up amid increasing prospects that major central banks will soon start cutting interest rates. Both the Fed and the ECB are expected to start loosening monetary policy in June while the Bank of England will likely deliver its first rate cut in August.

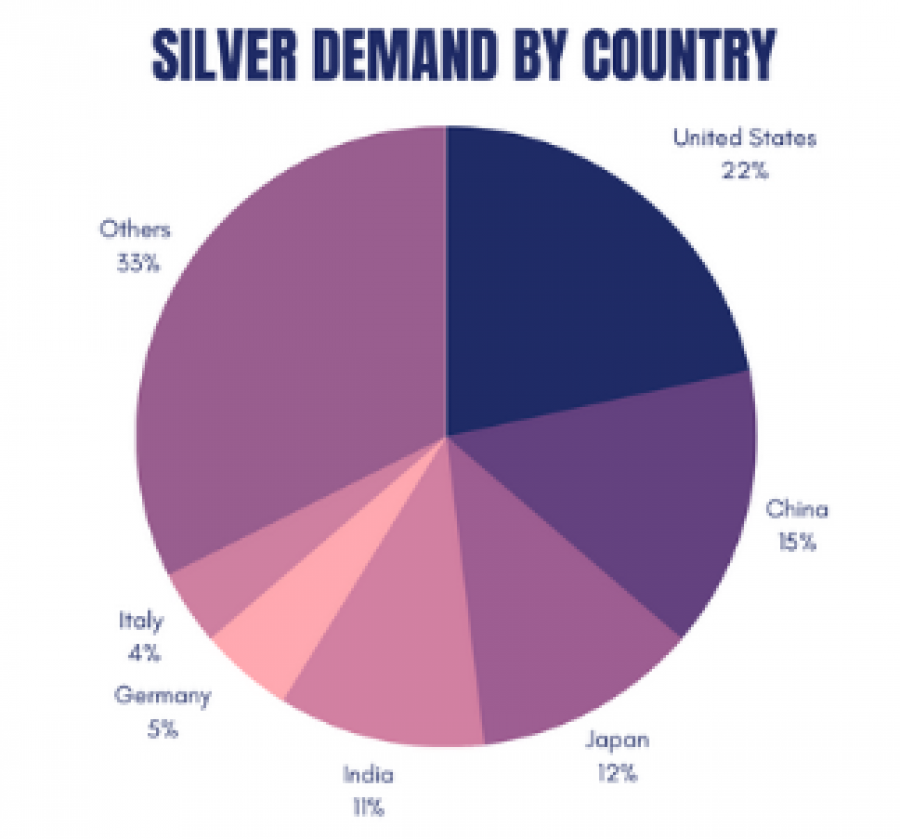

- Silver demand: The United States remains the most important market with 22% of the global demand for silver, while China represents 15% of the global demand for silver. China's economy can potentially grow by about 5%. While other recent indicators, such as much stronger-than-expected trade figures, have suggested improvement in some parts of the economy, the price of silver to an extent depends on how well the Chinese economy is performing.

Source: Bloomberg

Silver, March 14, 2024

Current Price: 24.90

|

SILVER |

Weekly |

|

Trend direction |

|

|

30.00 |

|

|

29.00 |

|

|

26.00 |

|

|

23.90 |

|

|

23.20 |

|

|

22.80 |

Example of calculation based on trend direction for 1.00 Lot*

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

51,000.00 |

41,000.00 |

11,000.00 |

-10,000.00 |

-17,000.00 |

-21,000.00 |

|

Profit or loss in €2 |

46,668.25 |

37,517.61 |

10,065.70 |

-9,150.64 |

-15,556.08 |

-19,216.34 |

|

Profit or loss in £2 |

39,865.40 |

32,048.65 |

8,598.42 |

-7,816.74 |

-13,288.47 |

-16,415.16 |

|

Profit or loss in C$2 |

68,746.22 |

55,266.57 |

14,827.62 |

-13,479.65 |

-22,915.41 |

-28,307.27 |

1. 1.00 lot is equivalent of 10.000 units

2. Calculations for exchange rate used as of 14:00 (GMT) 14/03/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager

regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail