SILVER weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

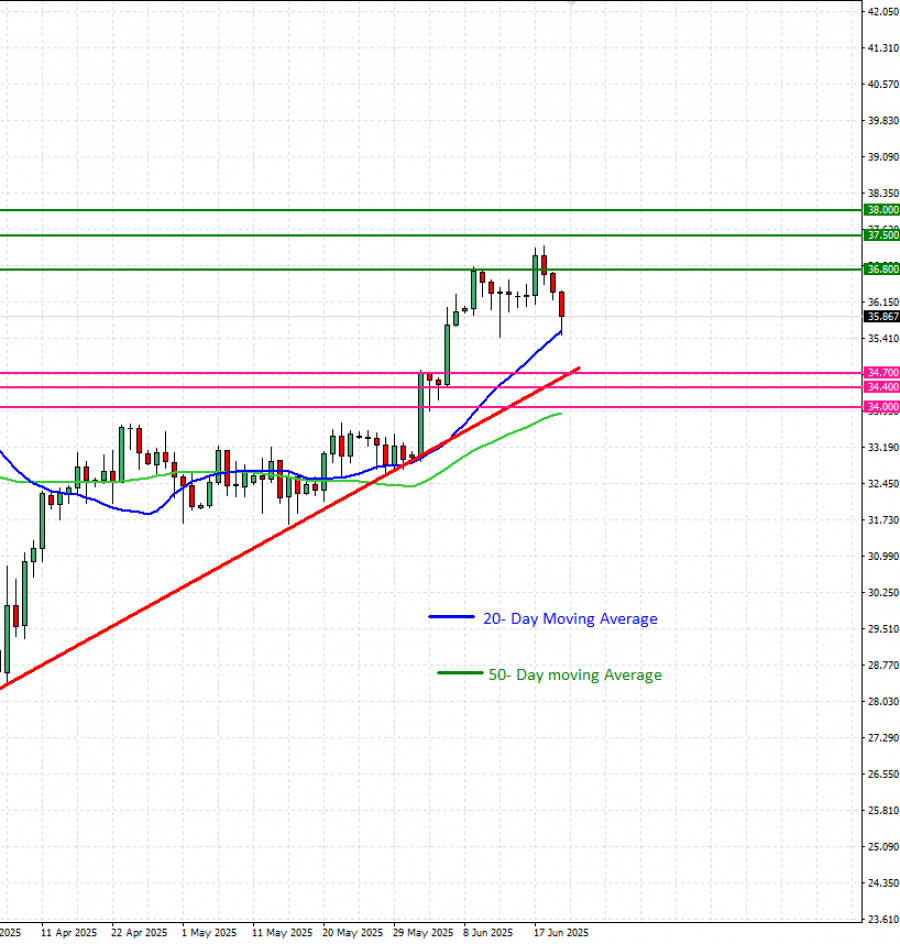

- DAILY MOVING AVERAGES POINT TO AN UPTREND: Silver prices have remained above the 20- and 50-day moving averages, pointing to an ongoing uptrend. However, silver prices can also change their trend if prices fall below the 20- and 50-day moving averages.

- MID-TERM UPTREND: As depicted by the daily chart below, the silver price has kept trading above the mid-term red-lined uptrend line, confirming its mid-term trend is up. However, there remains a risk of a potential breakout below this level if market conditions change

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, Silver trades around $36.60, and if a full recovery is made this could offer an upside potential of around 36%. However, the price could decline.

GRAPH (Daily): April 2025 – June 2025

Please note that past performance does not guarantee future results

NEWS:

- JUNE 25-26: POWELL TESTIMONY BEFORE CONGRESS: Fed Chair Jerome Powell signaled that rate cuts could come “sooner rather than later,” but stressed the need to monitor the inflationary effects of new tariffs. His cautious tone weakened the U.S. dollar, helping silver move higher as markets increased their expectations of Fed easing.

EVENTS:

- THURSDAY, JUNE 26 AT 13:30 GMT+1: GROSS DOMESTIC PRODUCT (GDP) (Q1) (third reading). A lower-than-expected result could be supportive for silver, because it would motivate the FED to conduct a more aggressive interest rate cut policy in order to stimulate the economy. This data measures the annualized change in the inflation-adjusted value of goods and services produced by the economy. According to the second reading published in May, the results for Q1 stood at -0.2% which is lower than the result for the previous quarter (2.4%).

- FRIDAY, JUNE 27, AT 13:30 GMT+1: US CORE PCE: This is the Fed’s preferred inflation measure. It is expected to rise from 2.5% to 2.6%. If the actual number comes in lower than the expected 2.6%, it could hurt the dollar as markets could expect rate cuts sooner. That would support silver.

ANALYSTS’ OPINION:

- UBS: The bank targets a price of $38.

- CITIGROUP: The bank targets a price of $40.

- J.P. MORGAN: The bank targets a price of $38.

Source: Reuters, Bloomberg, CNBC

SILVER, June 26, 2025

Current Price: 36.60

|

SILVER |

Weekly |

|

Trend direction |

|

|

39.00 |

|

|

38.30 |

|

|

37.60 |

|

|

35.70 |

|

|

35.40 |

|

|

35.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

24,000 |

17,000 |

10,000 |

-9,000 |

-12,000 |

-16,000 |

|

Profit or loss in €2 |

20,490 |

14,513 |

8,537 |

-7,684 |

-10,245 |

-13,660 |

|

Profit or loss in £2 |

17,473 |

12,377 |

7,280 |

-6,552 |

-8,737 |

-11,649 |

|

Profit or loss in C$2 |

32,867 |

23,280 |

13,694 |

-12,325 |

-16,433 |

-21,911 |

1. 1.00 lot is equivalent of 10,000 units

2. Calculations for exchange rate used as of 11:30 (GMT+1) 26/06/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.