SILVER weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS

- EVENT (TUESDAY, FEBRUARY 17): US–IRAN INDIRECT NUCLEAR TALKS (ROUND 2) TO CONTINUE IN GENEVA, MEDIATED BY OMAN. This follows the first round of indirect talks held in Oman on February 6. According to Reuters, Iran and the U.S. are seeking a deal that could deliver economic benefits for both sides. The U.S. delegation, led by envoys Steve Witkoff and Jared Kushner, will meet Iranian officials in Geneva. Tehran reiterated that 0% uranium enrichment is not acceptable and its ballistic missile program is not up for negotiation.

- EVENT (FEBRUARY 17-18): RUSSIA-UKRAINE TALKS WILL CONTINUE IN GENEVA (SWITZERLAND) AND WILL BE MEDIATED BY THE USA. The previous talks of the trilateral working groups in Abu Dhabi, capital of the UAE, on January 23-24 and February 4-5, did not bring any breakthrough solutions. The main sticking point is the long-term fate of territory in eastern Ukraine, large parts of which Russia has occupied. Moscow is demanding that Kyiv pull its troops out of swaths of the Donbas, including heavily fortified cities that sit atop vast natural resources, as a condition of any deal.

EVENTS

- WEDNESDAY, FEBRUARY 18 AT 19:00 GMT: FEDERAL RESERVE (FOMC) MEETING MINUTES. Investors will closely analyze the Fed’s latest meeting minutes for clues on future rate cuts. Any discussion showing concern about growth or the labor market could reinforce expectations of further easing, which could support silver prices.

- FRIDAY, FEBRUARY 20 AT 13:30 GMT: U.S. GROSS DOMESTIC PRODUCT (GDP) (Q4). U.S. GDP is expected at 2.8%, following 4.4% in the previous quarter. A weaker than expected reading would signal slowing economic momentum and strengthen expectations for Fed rate cuts, a backdrop that typically supports silver prices.

SILVER MARKET: HIGHER DEMAND AMID SUPPLY SHORTAGES LEADS TO A WIDENING DEFICIT

- MARKET DEFICIT: SILVER MARKET REMAINS IN DEFICIT SINCE AT LEAST 2016. The silver market faced a deficit of around 300 million ounces in 2025, according to recent reports from The Silver Institute. While the market has been in deficit since 2016, the gap has grown significantly since 2022.

- SUPPLY CONSTRAINTS: SILVER PRODUCTION REMAINS AROUND 800 MILLION OUNCES PER YEAR. Annual production has held near 800 million ounces, remaining largely unchanged since 2016. There is no clear indication that output will be meaningfully higher in 2026 or the following years.

- DEMAND REMAINS STRONG: SOLAR PANELS, ELECTRIC VEHICLES, AND A.I. INFRASTRUCTURE. Silver demand is expected to increase during 2026 and beyond due to rising demand from solar production, electric vehicles, and rapidly expanding A.I. data center infrastructure.

PRICE ACTION

- SILVER PRICE HIT A NEW ALL-TIME HIGH ON JANUARY 29, 2026 ($121.499). Silver currently trades around $77, and if it fully recovers to its previous all-time high, it could see an upside of around $44. However, the price could also decline.

TECHNICAL ANALYSIS

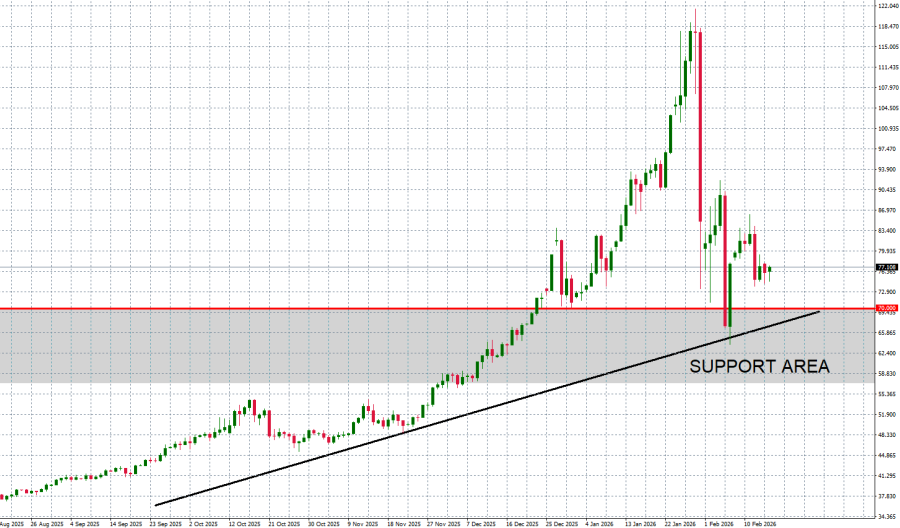

- LONG-TERM TREND IS UP. The overall trend of silver is up (black trendline), with the trend accelerating since November of 2025. Silver rose around 146% in 2025.

- SUPPORT AREA: $70. After the most recent downward price correction in early February, silver prices tested the $70 support zone, which has so far held and triggered a rebound.

- ANALYSTS’ OPINION: Citigroup forecasts $150.

GRAPH (Daily): August 2025 – February 2026

Please note that past performance does not guarantee future results

SILVER, February 16, 2026

Current Price: 77

|

SILVER |

Weekly |

|

Trend direction |

|

|

150 |

|

|

120 |

|

|

90 |

|

|

67 |

|

|

65 |

|

|

63 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

730,000 |

430,000 |

130,000 |

-100,000 |

-120,000 |

-140,000 |

|

Profit or loss in €2 |

615,164 |

362,357 |

109,550 |

-84,269 |

-101,123 |

-117,977 |

|

Profit or loss in £2 |

534,787 |

315,011 |

95,236 |

-73,258 |

-87,910 |

-102,562 |

|

Profit or loss in C$2 |

994,043 |

585,532 |

177,021 |

-136,170 |

-163,404 |

-190,638 |

1. 1.00 lot is equivalent of 10,000 units

2. Calculations for exchange rate used as of 11:00 (GMT) 16/02/2026

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.