USD/CAD weekly special report based on 1 Lot Calculation:

CANADA:

- WEDNESDAY, AUGUST 9 AT 13:30 GMT+1: CANADA EMPLOYMENT CHANGE AND UNEMPLOYMENT RATE (JULY). Canada’s has risen to 6.4% in June, which is the highest rate since February 2022. Meanwhile, the Bank of Canada cut its benchmark interest rate twice to slash it down to 4.5% from the previous 5.00%. Falling interest rates tend to help the economic activity and the labor market, therefore the markets could expect positive labor market figures in Canada soon. This could, in turn, support the Canadian dollar.

USA:

- THURSDAY, AUGUST 8 AT 13:30 GMT+1: US INITIAL JOBLESS CLAIMS: The US will report its weekly initial jobless claims. Jobless claims have been rising, indicating a slowing job market.

- WEDNESDAY, AUGUST 14 AT 13:30 GMT+1: US INFLATION (CPI) (JYLY). The US inflation continued falling, marking a decline from 3.5% to the current 3.0% since April. If inflation continues falling, this could encourage the US Fed to start cutting its benchmark interest soon, which in return could put the US dollar under negative pressure.

TECHNICAL REVIEW:

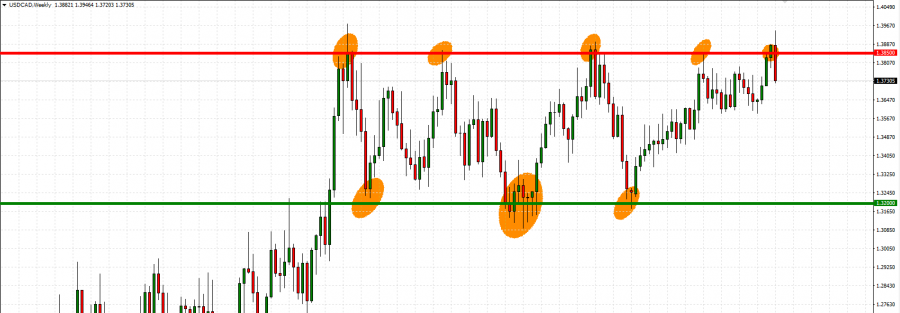

- TECHNICAL ANALYSIS: THE USD/CAD IS TRADING NEAR THE TOP OF ITS SIDEWAYS CHANNEL (BETWEEN 1.3200 AND 1.3850). The channel has been in place since September 2022, whereby the USD/CAD has tested the upper boundary of 1.38500 four times. On the downside, the USD/CAD has tested the lower boundary three times over the same period. The USD/CAD could be expected to soon undergo a downward correction after recently testing its upper boundary of 1.38500 again.

GRAPH: Weekly (April 2021 – August 2024)

Please note that past performance does not guarantee future results.

USD/CAD, August 8, 2024

Current Price: 1.3740

|

USD/CAD |

Weekly |

|

Trend direction |

|

|

1.4000 |

|

|

1.3950 |

|

|

1.3870 |

|

|

1.3600 |

|

|

1.3400 |

|

|

1.3200 |

Example of calculation based on weekly trend direction for 1 Lot1

|

USD/CAD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

-1,959 |

-1,595 |

-939 |

954 |

2,410 |

3,866 |

|

Profit or loss in €2 |

-1,791 |

-1,458 |

-859 |

872 |

2,203 |

3,535 |

|

Profit or loss in £2 |

-1,542 |

-1,255 |

-740 |

751 |

1,898 |

3,044 |

|

Profit or loss in C$2 |

-2,690 |

-2,190 |

-1,290 |

1,310 |

3,310 |

5,310 |

1. 1.00 lot is equivalent of 100,000 units

2. Calculations for exchange rate used as of 09:00 (GMT+1) 08/08/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.