USD/JPY Weekly Special Report based on 1.00 Lot Calculation:

TEHNICAL ANALYSIS:

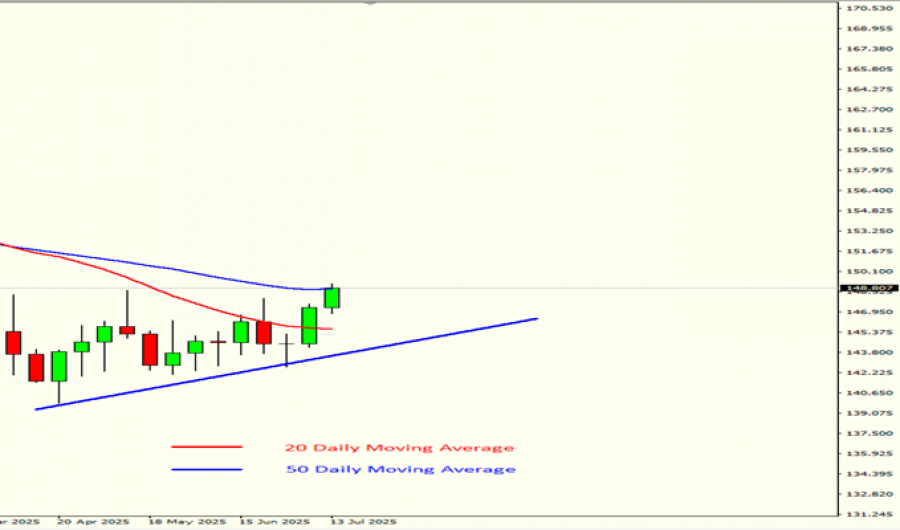

- DAILY MOVING AVERAGES POINT TO AN UPTREND: USDJPY have remained above the 20 - and 50-day moving averages, pointing to an ongoing uptrend. However, USDJPY can also change their trend if prices fall below the 20 - and 50 - day moving averages.

- MID–TERM UPTREND: As depicted by the daily chart below, the USDJPY has kept trading above the mid-term blue-lined uptrend line, confirming its mid-term trend is up. However, there remains a risk of a potential breakout below this level if market conditions change.

GRAPH (Daily): April 2025 – July 2025

Please note that past performance does not guarantee future results

GEOPOLITICS: U.S. – JAPAN TRADE NEGOTIATIONS

- US PRESIDENT DONALD TRUMP SAID WILL IMPOSE 25% TARIFFS ON ALL JAPANESE EXPORTS TO THE US IF NO DEAL IS REACHED BY AUGUST 1, 2025: U.S. President Donald Trump said they will impose 25% tariffs on all Japanese exports to the United States, which will take effect on August 1, if no deal is reached by then. This move exacerbates Japan's economic challenges, which, coupled with declining real wages and signs of weakening inflation, will likely force the Bank of Japan to abandon plans to raise interest rates this year.

EVENTS:

- EVENT (SUNDAY, JULY 20): ELECTIONS IN JAPAN: HOUSE OF COUNCILLORS (UPPER HOUSE OF PARLIAMENT). House of Councillors elections are scheduled to be held in Japan on 20 July 2025, with 124 of the 248 members of the upper house of the National Diet to be elected for a term of six years. Japan’s central bank may face political pressure to keep interest rates low for longer than it wants, as opposition parties favouring tax cuts and loose monetary policy are expected to gain influence after a July 20 election. Opinion surveys suggest Prime Minister Shigeru Ishiba’s coalition may lose its majority in the upper house of parliament. if opposition groups gain traction with their pressure on the BOJ to avoid rate hikes and for the government to cut the sales tax, that could boost bond yields and complicate the bank’s efforts to normalise monetary policy, which in turn could be negative for the Japanese Yen.

USDJPY, JULY 16, 2025.

Current Price: 148.80

|

USD/JPY |

Weekly |

|

Trend direction |

|

|

153.00 |

|

|

152.00 |

|

|

151.00 |

|

|

147.00 |

|

|

146.50 |

|

|

146.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

USD/JPY |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

2,822 |

2,150 |

1,478 |

-1,209 |

-1,545 |

-1,881 |

|

Profit or loss in €² |

2,427 |

1,849 |

1,271 |

-1,040 |

-1,329 |

-1,618 |

|

Profit or loss in £² |

2,107 |

1,605 |

1,104 |

-903 |

-1,154 |

-1,405 |

|

Profit or loss in C$² |

3,871 |

2,950 |

2,028 |

-1,659 |

-2,120 |

-2,581 |

- 1.00 lot is equivalent of 100.000 units

- Calculations for exchange rate used as of 09:50 (GMT+1) 16/07/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.