Wheat Weekly Special Report based on 1.00 Lot Calculation:

GLOBAL WHEAT MARKET SHARE:

- LARGEST WHEAT PRODUCERS (OF TOTAL PRODUCTION EXPECTED IN 2024/2025: 793.24 MILLION TONES): China at 17%, the European Union at ~17%, India at ~14%, Russia at ~12%, USA at ~6%, and Ukraine at ~3%.

- LARGEST WHEAT EXPORTERS OF A TOTAL 212.31 MILLION TONS (2024/2025): Russia at 22.62%, the European Union at 14.13%, Canada at 12.25%, Australia at 11.78%, the USA at 10.58%, and Ukraine at 7.54%.

- RUSSIA + UKRAINE SHARE at ~30%: Russia and Ukraine account for nearly one-third of total global exports.

IMPACT OF THE RUSSIA-UKRAINE WAR:

The Russia-Ukraine war has significantly disrupted the global wheat market, as both countries together account for over 30% of global wheat exports. Key effects include:

- SUPPLY DISRUPTIONS: Ukraine’s wheat production and exports declined due to damaged infrastructure, blocked ports, and trade restrictions, while Russia’s export taxes and quotas further tightened global supply.

RECENT NEWS:

- NEWS (JUNE 1): UKRAINE HITS RUSSIAN AIRBASES WITH MASSIVE DRONE STRIKE. Ukraine launched “Operation Spider’s Web,” using 117 drones to target five Russian airbases, damaging or destroying up to 20 warplanes, including strategic bombers.

- NEWS (JUNE 4): US PRESIDENT TRUMP TALKED TO PRESIDENT PUTIN; PUTIN SAID HE WOULD RESPOND TO RECENT UKRAINE ATTACKS. Russian President Vladimir Putin told U.S. President Donald Trump that he would have to respond to Ukrainian drone attacks on Russia's nuclear-capable bomber fleet.

- BREAKING (JUNE 6): RUSSIA STRIKES KYIV WITH MASSIVE AIR ATTACK. Russia launched over 400 drones and 45 missiles, hitting Kyiv’s metro lines, power infrastructure, and industrial sites. Six people were killed and around 80 were injured. Most drones were intercepted, but several key systems were damaged.

- BREAKING (JUNE 7): US EXPECTS FURTHER RUSSIAN STRIKES AFTER DRONE ATTACK. Washington believes Russia’s recent missile barrage was only the beginning of a broader retaliation against Ukraine’s June 1 drone strike on its airbases.

- RECENT RUSSIA-UKRAINE TALKS OFFER NO DEAL: Russia and Ukrainian representatives met twice, on May 16 and June 2. However, they were unable to agree on a ceasefire, with the war actually getting worse. As the fighting continues and even increases, it is expected that the global wheat supply will stay limited, since the war keeps affecting farming and exports in this important region.

TECHNICAL ANALYSIS:

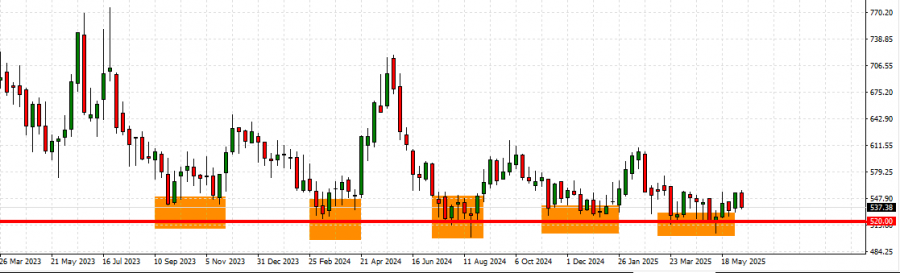

- STRONG SUPPORT AT $520: Since September 2023, Wheat has been predominantly trading above the mark of $520. Wheat has tested the area around $520 five times since September 2023, and every time it would recover to levels toward 600 or above. However, there remains a risk of a potential breakout below this level if market conditions change. (Source: Fortrade Meta Trader 4 Platform).

- 4–YEAR AVERAGE DAILY PRICE (JUNE 9, 2021 – JUNE 9, 2025): $695.26. The Wheat’s average price in the period between June 9, 2021, and June 9, 2025, which includes the Russia-Ukraine war, has been around $695. (Data Source: Meta Trader 4)

- WHEAT PRICES HIT AN ALL-TIME HIGH OF $1356.50 (MARCH 2022). Wheat was trading last near $540, and if a full recovery to 2022’s all-time high occurs, this could provide an upside of around 151%. Although prices could fall, too.

GRAPH (Weekly): March 2023 – June 2025

Please note that past performance does not guarantee future results.

WHEAT, June 10, 2025

Current Price: 537

|

Wheat |

Weekly |

|

Trend direction |

|

|

600 |

|

|

580 |

|

|

560 |

|

|

518 |

|

|

510 |

|

|

505 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

WHEAT |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

6,300 |

4,300 |

2,300 |

-1,900 |

-2,700 |

-3,200 |

|

Profit or loss in €2 |

5,522 |

3,769 |

2,016 |

-1,665 |

-2,367 |

-2,805 |

|

Profit or loss in £2 |

4,672 |

3,189 |

1,706 |

-1,409 |

-2,002 |

-2,373 |

|

Profit or loss in C$2 |

8,632 |

5,892 |

3,152 |

-2,603 |

-3,700 |

-4,385 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 09:45 (GMT+1) 10/06/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.