BOEING (#BOEING) weekly special report based on 1 Lot Calculation:

BOEING

- THE COMPANY: The Boeing Co. is an aerospace company that manufactures commercial jetliners and defense, space, and security systems.

- MARKET SHARE (AIRCRAFT MANUFACTURING): Boeing is the second-largest company in the sector with around 40% of the market share. Airbus leads the way (56%), followed by Boeing (40%) and Others (4%).

BOEING: AIRCRAFT ORDERS SURGE TO $619 BILLION, WITH THE POTENTIAL TO REACH NEARLY $1 TRILLION

- RECENT BOEING AIRCRAFT ORDERS NEGOTIATED UNDER U.S. PRESIDENT TRUMP:

AIRCRAFTS: ~550.

DOLLAR MONEY WORTH: ~$330 billion.

SOUTH KOREA: COREAN AIR INTENDS TO PURCHASE 103 BOEING AIRCRAFTS. This could be part of the recent trade deal reached between the USA and South Korea.

JAPAN: US PRESIDENT DONALD TRUMP ANNOUNCED A TRADE DEAL WITH JAPAN. The deal calls for Japan to purchase 100 Boeing aircrafts and more defense purchases.

INDONESIA: US PRESIDENT DONALD TRUMP ANNOUNCED A TRADE DEAL WITH INDONESIA. Indonesia has agreed to purchase 50 Boeing jets.

UK: US PRESIDENT DONALD TRUMP ANNOUNCED A TRADE DEAL WITH THE UK. The deal calls for the UK to purchase 32 Boeing aircrafts.

U.A.E.: U.S.A. AND U.A.E. HAVE MADE A DEAL FOR 28 BOEING 787 AND 777X AIRCRAFT PURCHASES.

SAUDI ARABIA: SAUDI ARABIA ARE EXPECTED ORDER UP TO 30 BOEING 737 MAX JETS.

QATAR: QATARI AIRWAYS TO ACQUIRE UP TO 210 BOEING 787 DREAMLINER AND 777X AIRPLANES WORTH AROUND $100 BILLION.

- CHINA: BOEING IS IN TALKS WITH CHINA TO ORDER 500 AIRCRAFTS. The deal could be part of the broader agreement between the U.S. and China, whose truce was recently extended until mid-November 2025, keeping trade tensions low. The deal with China alone could be worth around $300 billion. Taken together, Boeing’s total order value could approach $1 trillion over the next few years, with more than 1,000 aircraft expected to be delivered.

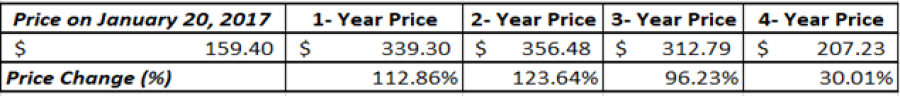

BOEING: HOW DOES THE STOCK PERFORM UNDER DONALD TRUMP AS PRESIDENT OF THE USA?

- HISTORICAL PERFORMANCE: THE STOCK PRICE ROSE 112.86% DURING THE FIRST YEAR OF TRUMP’S FIRST PRESIDENTIAL TERM (JANUARY 20, 2017 – JANUARY 20, 2018). Within the first two years, the Boeing stock price rose 123.64%.

Data Source: Bloomberg Terminal; Meta Trader 4 Platform;

Please note that past performance does not guarantee future results

- SECOND TERM OF U.S. PRESIDENT DONALD TRUMP (SINCE JANUARY 20, 2025): THE BOEING STOCK PRICE HAS RISEN AROUND 32% SO FAR SINCE DONALD TRUMP ASSUMED OFFICE IN HIS SECOND TERM (JANUARY 20, 2025 – AUGUST 26, 2025).

Data Source: Bloomberg Terminal; Meta Trader 4 Platform;

BOEING: PRICE ACTION

- THE STOCK PRICE HIT AN ALL-TIME HIGH OF $445.61 ON MARCH 1, 2019. Boeing was last trading around $226, and if a full recovery follows recent all-time highs, the stock price could see an upside of around 97%. However, the price could decline further.

#BOEING, August 26, 2025.

Current Price: 226

|

BOEING |

Weekly |

|

Trend direction |

|

|

280 |

|

|

260 |

|

|

242 |

|

|

211 |

|

|

205 |

|

|

200 |

Example of calculation based on weekly trend direction for 1 Lot1

|

BOEING |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

54,000 |

34,000 |

16,000 |

-15,000 |

-21,000 |

-26,000 |

|

Profit or loss in €2 |

46,458 |

29,252 |

13,765 |

-12,905 |

-18,067 |

-22,369 |

|

Profit or loss in £2 |

40,128 |

25,266 |

11,890 |

-11,147 |

-15,605 |

-19,321 |

|

Profit or loss in C$2 |

74,813 |

47,104 |

22,167 |

-20,781 |

-29,094 |

-36,021 |

- 1.00 lot is equivalent of 1 000 units

- Calculations for exchange rate used as of 9:00 (GMT+1) 26/8/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit