GOLD weekly special report based on 1.00 Lot Calculation:

JACKSON HOLE ECONOMIC SYMPOSIUM (2025):

- BREAKING (AUGUST 22, 2025): FED CHAIR JEROME POWELL SPOKE AT THE JACKSON HOLE ECONOMIC SYMPOSIUM. Mr. Powell signaled a potential interest rate cut in September by saying that rate cuts may be justified given rising concern about the job market. Federal Reserve Chair Jerome Powell said the central bank may cut the federal funds rate when its policy committee next meets in September.

- LAST TIME (AUGUST 23, 2024): FED CHAIR JEROME POWELL SPOKE AT THE JACKSON HOLE ECONOMIC SYMPOSIUM. Mr. Powell said that Inflation had significantly gone down, signaling Fed's interest rate cut cycle could begin soon. Eventually, after Jerome Powell speech in August (2024), Fed started its interest rate cut cycle on September 18, 2024, first lowering rates from then current 5.50% to 5.00%. By the end of 2024, interest rates fell to the current 4.5%.

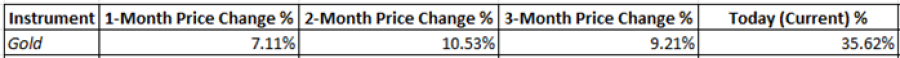

STATISTICS (2024): GOLD PRICE ROSE 7.11% ONE MONTH AFTER JEROME POWELL SPOKE AT THE JACKSON HOLE SYMPOSIUM (AUGUST 23, 2024). A month after that, gold prices traded up 7.11%, while two months after the speech, gold prices traded up 10.53%. In total, since Mr. Powell's speech last year at the Jackson Hole Symposium, gold prices have risen by around 35%.

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

US FEDERERAL RESERVE:

- WEDNESDAY, SEPTEMBER 17 AT 19:00 GMT+1: US FEDERAL RESERVE INTEREST RATE DECISION. After some weaker-than-expected employment market data in July and downward revisions to June figures and Fed Chair Jerome Powell speech at the Jackson Hole Economic Symposium, markets have increased their expectations for an interest rate cut in September. The benchmark interest rate currently stands at 4.5%, and according to market expectations, it is expected to decline to 4% by the end of 2025. This could put negative pressure on the US dollar and, in turn, support silver prices.

OTHER EVENTS:

- FRIDAY, SEPTEMBER 5 AT 13:30 GMT+1: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (AUGUST). The US labor market data remains one of the most important indicators, used by the US Fed, that could potentially predict if and when there could be new interest rate cuts. The US unemployment rate remained above 4%, last coming in at 4.2% for July.

ANALYST OPINION:

- GOLDMAN SACHS: THE BANK MAINTAINED GOLD PRICE TARGET AT $3,700 END-2025 AND $4,000 MID-2026.

TECHNICAL ANALYSIS AND PRICE ACTION:

- SUPPORT AREA BETWEEN $3,300 AND $3,200: Gold prices have seen near-term support at $3,300, and an extended support level at $3,200, meaning the area between $3,300 and $3,200 acts as a near-term support area. Gold prices have tested the area between $3,300 and $3,200 seven times since April 2025.

- LONG – TERM UPTREND: Gold price has steadily kept above its long term dark blue trendline, indicating that the price is in an uptrend since at least January 2025. The prices could also move in the opposite direction if the price falls below the long–term trendline.

- GOLD ABOVE ITS MOVING AVERAGES: Gold price has kept above its 100, 50 and 20 – day moving averages, strongly pointing to an uptrend. The trend could reverse if Gold goes below these averages.

- GOLD HIT A NEW ALL-TIME HIGH OF $3,499.76 (April 22, 2025): Gold has traded around $3,369, and if a full recovery takes place, the price of Gold could rise around $130. Although the price could also decline.

GRAPH (Daily): January 2025 – August 2025

Please note that past performance does not guarantee future results

GOLD, AUGUST 26, 2025.

Current Price: 3,369

|

GOLD |

Weekly |

|

Trend direction |

|

|

3,500 |

|

|

3,460 |

|

|

3,420 |

|

|

3,320 |

|

|

3,310 |

|

|

3,300 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

13,100 |

9,100 |

5,100 |

-4,900 |

-5,900 |

-6,900 |

|

Profit or loss in €2 |

11,251 |

7,816 |

4,380 |

-4,209 |

-5,067 |

-5,926 |

|

Profit or loss in £2 |

9,719 |

6,751 |

3,784 |

-3,635 |

-4,377 |

-5,119 |

|

Profit or loss in C$2 |

18,139 |

12,600 |

7,062 |

-6,785 |

-8,169 |

-9,554 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 11:00 (GMT+1) 26/08/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.