Crude Oil weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: MIDDLE EAST TENSIONS KEEP MARKETS NERVOUS

- ISRAEL- HAMAS WAR ESCALATES AS CEASFIRE NEGOTIATIONS BRING NO BREAKTHROUGH: Israel will push on with its offensive against Hamas, including into the southern Gaza city of Rafah, despite growing international pressure to stop, Prime Minister Benjamin Netanyahu said. Israel’s military intends to direct a significant portion of Rafah’s population of 1.4 million toward humanitarian islands in central Gaza ahead of Israel’s planned ground offensive.

- RED SEA, SUEZ CANAL WERE AVOIDED BY SHIPPING AND OIL TANKER COMPANIES. Middle East tensions, compounded by the ongoing Israeli ground offensive of the Gaza Strip, keep many oil investors nervous. Meanwhile, Yemen’s Houthis continue to pose a threat to the many ships transiting through the Red Sea. Some analyses show that around 9 million barrels a day of oil transits through the Red Sea. This is almost 10% of total global oil demand. Therefore, many investors fear the worst: oil delivery delays and higher oil prices thereafter. The Houthis have already claimed responsibility for many attacks on ships bound for Israel and have shown no signs of backing down.

GEOPOLITICS: RUSSIA- UKRAINE WAR

- RUSSIA- UKRAINE WAR: UKRAINE HAVE ATTACKED AT LEAST 12 RUSSIAN OIL REFINERIES WITH DRONES. According to analysts, Russia has capacity of 5.5 million barrels a day of oil refining. According to the latest reports, at least 10% of that capacity is now offline. It will take weeks before those facilities come back online, and with ongoing drone attacks, the oil prices could be expected to experience bigger upward pressure.

OPEC +:

- OPEC EXTENDED ITS CURRENT OIL PRODUCTION CUT POLICY INTO Q2 OF 2024, WHILE RUSSIA SAID WILL REDUCE PRODUCTION FROM CURRENT 9.5 TO 9.0 MILLION BARRELS A DAY. According to Bloomberg, Russia's Deputy Prime Minister Alexander Novak said that Moscow will reduce its output by 350,000 barrels a day (bpd) in April, by 400,000 bpd in May and then 471,000 bpd in June. Russia also agreed to further trim its export volumes — by 121,000 bpd in April and 71,000 bpd in May, compared to its average sales in the same months last year. Novak said late last month that Russian oil output stood at 9.5 million bpd. Their output is set to drop to almost 9 million bpd in June, if the reduction is implemented as planned.

- OPEC OIL MONTHLY REPORT (MARCH): A 1.8 MILLION BARRELS A DAY OF DEFICIT EXPECTED IN 2024. Oil price drop was mainly driven by selling pressure from speculators.

ANALYST EXPECTATIONS

- CITIGROUP: OIL COULD HIT $100 WITHIN THE NEXT 12- 18 MONTHS. According to CNBC, the catalysts for oil to hit $100 per barrel include higher geopolitical risks, deeper OPEC+ cuts and supply disruptions from key oil-producing regions. Major oil producer Iraq has been impacted by the conflict and any further escalation could hurt other major OPEC+ suppliers in the region.

- MORGAN STANLEY RAISED ITS OIL PRICE TARGET BY 10 DOLLARS FROM $80 TO $90. Morgan Stanley lowered its supply forecast for OPEC and Russia by 0.2-0.3 million barrels per day and sees a modest deficit in the second quarter, increasing to a larger deficit in the third quarter as demand ramps up.

TECHNICAL REVIEW:

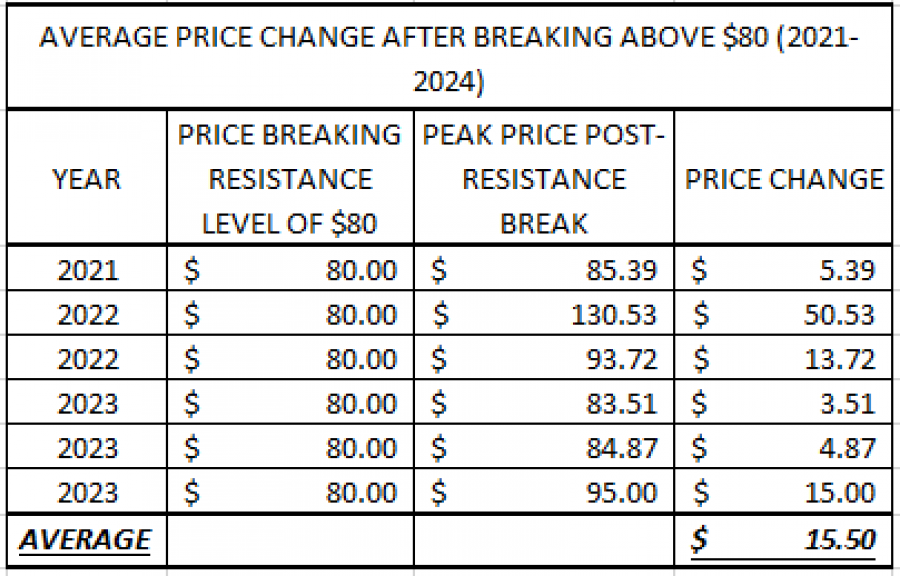

- CRUDE OIL ABOVE $80. The level of $80 has been considered strong resistance since 2021 and it would be rarely breached to the upside since 2021. In fact, since 2021, only 6 times the level of $80 has been breached to the upside. The table below shows that when the Crude Oil prices break above $80, they would continue rising by on average 15.50 dollars.

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results.

Crude Oil, March 20, 2024

Current Price: 81.80

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

100 |

|

|

93 |

|

|

87 |

|

|

77 |

|

|

76 |

|

|

75 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

18,200 |

11,200 |

5,200 |

-4,800 |

-5,800 |

-6,800 |

|

Profit or loss in €2 |

16,796 |

10,336 |

4,799 |

-4,430 |

-5,353 |

-6,275 |

|

Profit or loss in £2 |

14,341 |

8,825 |

4,097 |

-3,782 |

-4,570 |

-5,358 |

|

Profit or loss in C$2 |

24,758 |

15,236 |

7,074 |

-6,530 |

-7,890 |

-9,250 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 09:00 (GMT) 20/03/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail