Crude Oil weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

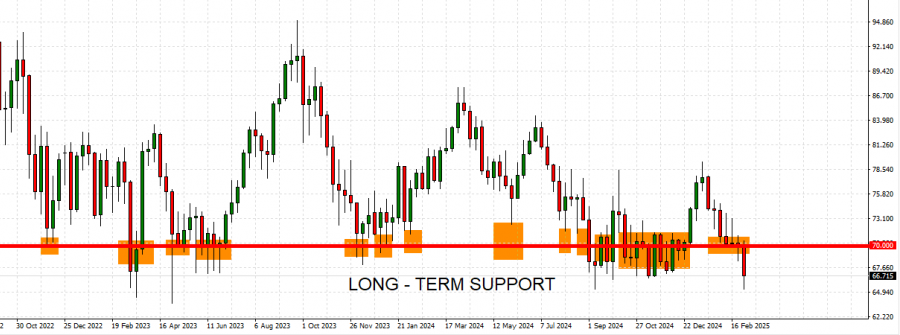

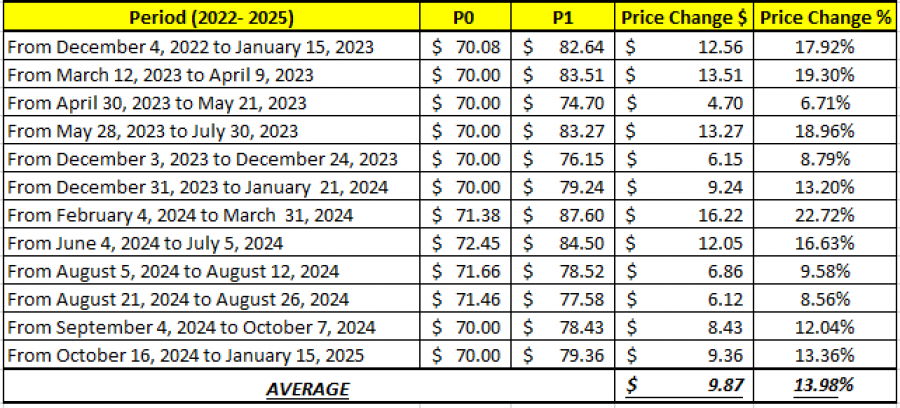

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $70 (NEAR OR BELOW) 12 TIMES SINCE OCTOBER 2022. This is the 13th time that Crude Oil prices are testing levels near or below the mark of $70. However, there is also a risk of further decline if market conditions change.

- CRUDE OIL HAS TESTED ITS LOWEST PRICE SINCE APRIL 2023: $65.205. Crude oil has earlier this week tested its lowest price in almost two years.

GRAPH (Weekly): October 2022 – March 2025

Please note that past performance does not guarantee future results

- 2022- 2025 STATISTICS: CRUDE OIL TENDS TO RECOVER BY AROUND 14% AFTER TESTING THE MARK OF $70 OR NEAR IT. However, there is also a risk of further decline if market conditions change.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

GEOPOLITICS:

- U.S.A. PUT “MAXIMUM PRESSURE” ON IRAN: U.S. President Donald Trump restored his "maximum pressure" campaign on Iran that includes efforts to drive its oil exports down to zero in order to stop Tehran from obtaining a nuclear weapon. REMINDER: President Trump is expected to impose new sanctions/measures on Iranian oil, to slash Iranian oil exports to minimum from current near 1.6 million barrels a day.

CHINA: THE LARGEST OIL IMPORTER AND THE SECOND LARGEST OIL CONSUMER IN THE WORLD

- CHINA NATIONAL PEOPLE’S CONGRESS MEETING (MARCH 5 – MARCH 11). China set its GDP (gross domestic product) growth target for 2025 at around 5%. China raised its budget deficit target to around 4% of GDP from 3% last year. The 4% deficit would mark the highest on record going back to 2010. (Source: CNBC).

- MORE STIMULUS ANNOUNCED: The government report outlined plans to issue 1.3 trillion yuan ($178.9 billion) in ultra-long-term special treasury bonds in 2025, 300 billion yuan more than last year. Another 500-billion-yuan ($69 billion) worth of special treasury bonds will be issued to support large state-owned commercial banks. The widened fiscal package also includes the issuance of 4.4 trillion yuan ($600 billion) of local government special-purpose bonds this year to help ease their financing strains (Source: CNBC).

EVENTS:

- FRIDAY, MARCH 7 at 13:30 GMT: US NONFARM PAYROLLS AND UNEMPLOYMENT RATE (FEBRUARY). US Unemployment rate is expected stay around 4.0%. The report will be closely watched as Fed interest rate decisions in 2025 will depend on the US employment market development. The US monetary policy directly affects the US economic activity, which in turn, affects the oil consumption in the US. The USA is still the largest consumer of oil and petroleum in the world, consuming more than 20 million barrels a day.

Crude Oil, March 6, 2025

Current Price: 66.10

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

75.00 |

|

|

72.00 |

|

|

69.00 |

|

|

64.00 |

|

|

63.50 |

|

|

63.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

8,900 |

5,900 |

2,900 |

-2,100 |

-2,600 |

-3,100 |

|

Profit or loss in €² |

8,250 |

5,469 |

2,688 |

-1,947 |

-2,410 |

-2,873 |

|

Profit or loss in £² |

6,904 |

4,577 |

2,250 |

-1,629 |

-2,017 |

-2,405 |

|

Profit or loss in C$² |

12,768 |

8,464 |

4,160 |

-3,013 |

-3,730 |

-4,447 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 10:00 (GMT) 06/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.