EUR/USD Weekly Special Report based on 1.00 Lot Calculation:

GEOPOLITICS: TRADE PROGRESS:

- WEDNESDAY - THURSDAY, JULY 2- JULY 3: E.U. – U.S. TRADE TALKS CONTINUE. According to Reuters, European Trade Commissioner Maros Sefcovic would seek meetings with U.S. Trade Representative Jamieson Greer and Commerce Secretary Howard Lutnick on Wednesday and Thursday. Sefcovic said the EU had received the first drafts of proposals from the United States for an eventual agreement.

EVENTS:

- TUESDAY, JULY 1, AT 14:30 GMT+1: US FEDERAL RESERVE CHAIR JEROME POWELL AND CHRISTINE LAGARD WILL SPEAK IN SINTRA (PORTUGAL) AT ECB (European Central Bank) FORUM. On Tuesday (July 1), Mr. Powell will join Bank of Japan Governor Ueda, Bank of England Governor Bailey and ECB President Lagarde on a policy panel.

- THURSDAY, JULY 3, AT 13:30 GMT+1: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (JUNE). If the NFP figures come in lower than the expected, or the unemployment rate beats expectations, the U.S. dollar could weaken, putting upward pressure on EUR/USD.

TECHNICAL ANALYSIS:

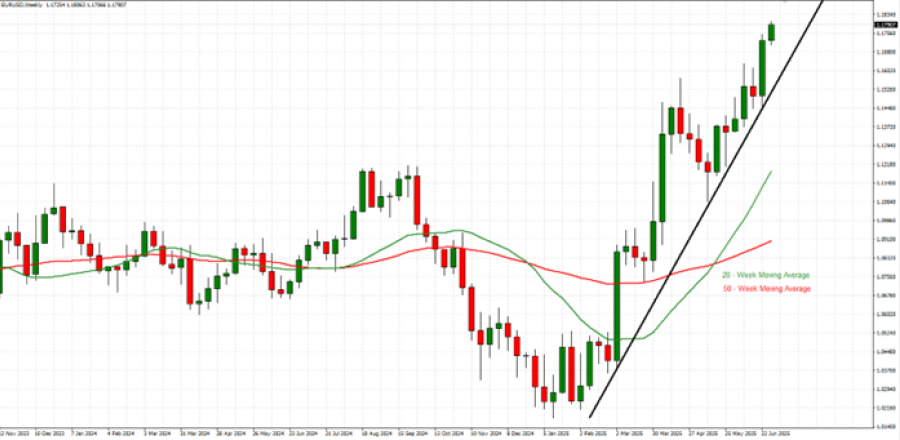

- LONGER-TERM TREND LINE: The black trend line depicted by the chart below shows that EUR/USD prices have maintained their uptrend in general since January 2025.

- WEEKLY MOVING AVERAGES POINT TO UPTREND: EUR/USD has recently traded above the 20- and 50-week moving Averages, pointing to an ongoing uptrend. However, EUR/USD can change its trend if prices fall below the 20- and 50-week Moving Averages.

- RESISTANCE AND SUPPORT LEVELS: The EUR/USD has remained in a longer-term uptrend, looking at Resistance 1 of $1.1900, Resistance 2 of $1.2000, and Resistance 3 of $1.2350 to the upside. On the downside, EUR/USD looks at Support 1 of $1.1670, then towards Support 2 of $1.1630, and Support 3 of $1.1600.

- EUR/USD IS TRADING AT HIGHEST LEVEL SINCE SEPTEMBER 2021: EUR/USD is trading at its highest level since September 2021, extending its recent upward trend and gaining traction in the market. However, there remains a risk of a potential breakout below this level if market conditions change.

GRAPH (Weekly): November 2023 – June 2025

Please note that past performance does not guarantee future results

EURUSD, July 1, 2025

Current Price: 1.1780

|

EUR/USD |

Weekly |

|

Trend direction |

|

|

1.2350 |

|

|

1.2000 |

|

|

1.1900 |

|

|

1.1670 |

|

|

1.1630 |

|

|

1.1600 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

EUR/USD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

5,700 |

2,200 |

1,200 |

-1,100 |

-1,500 |

-1,800 |

|

Profit or loss in €² |

4,839 |

1,868 |

1,019 |

-934 |

-1,273 |

-1,528 |

|

Profit or loss in £² |

4,141 |

1,598 |

872 |

-799 |

-1,090 |

-1,308 |

|

Profit or loss in C$² |

7,751 |

2,991 |

1,632 |

-1,496 |

-2,040 |

-2,448 |

- 1.00 lot is equivalent of 100.000 units

- Calculations for exchange rate used as of 08:00 (GMT+1) 01/07/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.