GBP/USD Weekly Special Report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

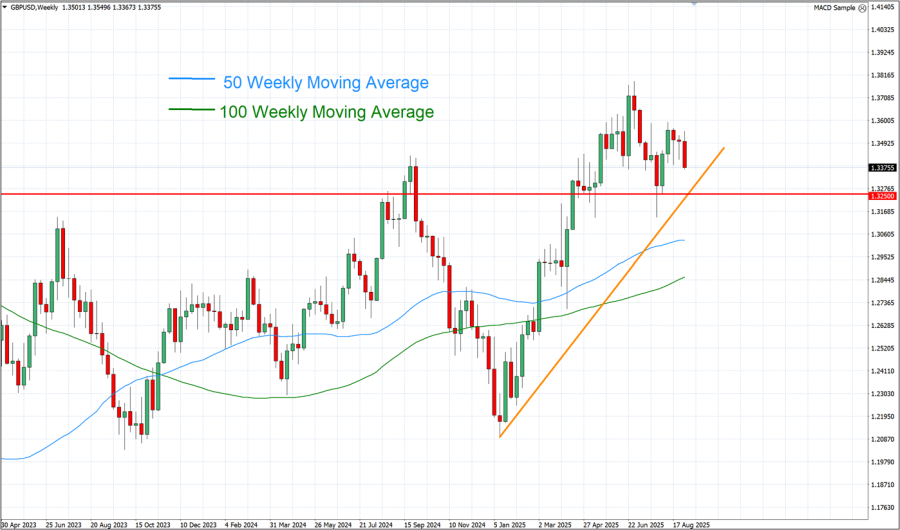

- CURRENT UPTREND (SINCE JANUARY 2025): The orange trend line, describing the uptrend, is depicted on the chart below. GBP/USD currency pair has tested a level of 1.22 in February, and since then it has been moving above this uptrend line. However, there remains a risk of a potential breakout below this level if market conditions change.

- 50-, AND 100-WEEKLY MOVING AVERAGE POINT TO UPTREND: GBP/USD currency pair has recently traded above the 50-, and 100-Weekly Moving Average, pointing to an ongoing uptrend. However, this trend can also change if prices fall below the 50-, and 100-Weekly Moving Average.

- LONG-TERM SUPPORT AREA AT THE PSYCHOLOGICAL MARK OF 1.325: GBP/USD currency pair have recently tested levels of 1.325, which has been tested 4 since April 2025.

GRAPH (Weekly): April 2023 – September 2025

Please note that past performance does not guarantee future results

EVENTS:

- WEDNESDAY, SEPTEMBER 3 AT 9:30 GMT+1: SERVICES PURCHASING MANAGERS INDEX (PMI). The services sector makes up over 70% of the U.K. economy, making this release a key driver for sterling. A stronger-than-expected reading would signal robust business activity and resilient domestic demand, providing support for GBP and potentially pushing GBP/USD higher against the dollar.

- FRIDAY, SEPTEMBER 5 AT 13:30 GMT+1: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (AUGUST). The US labor market data remains one of the most important indicators, used by the US Fed, that could potentially predict if and when there could be new interest rate cuts. The US unemployment rate remained above 4%, last coming in at 4.2% for July.

CENTRAL BANKS: US FEDERAL RESERVE

- WEDNESDAY, SEPTEMBER 17 AT 19:00 GMT+1: US FEDERAL RESERVE INTEREST RATE DECISION. After some weaker-than-expected employment market data in July and downward revisions to June figures and Fed Chair Jerome Powell speech at the Jackson Hole Economic Symposium, markets have increased their expectations for an interest rate cut in September, expected to be followed by another in December. The benchmark interest rate currently stands at 4.5%, and according to market expectations, it is expected to decline to 4% by the end of 2025. This could put negative pressure on the US dollar and, in turn, support the GBP/USD price.

GBPUSD, September 2,2025.

Current Price: 1.3380

|

GBP/USD |

Weekly |

|

Trend direction |

|

|

1.3700 |

|

|

1.3600 |

|

|

1.3500 |

|

|

1.3270 |

|

|

1.3210 |

|

|

1.3160 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

GBP/USD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

3,200 |

2,200 |

1,200 |

-1,100 |

-1,700 |

-2,200 |

|

Profit or loss in €² |

2,746 |

1,888 |

1,030 |

-944 |

-1,459 |

-1,888 |

|

Profit or loss in £² |

2,389 |

1,643 |

896 |

-821 |

-1,269 |

-1,643 |

|

Profit or loss in C$² |

4,499 |

3,093 |

1,687 |

-1,546 |

-2,390 |

-3,093 |

- 1.00 lot is equivalent of 100.000 units

- Calculations for exchange rate used as of 13:00 (GMT+1) 2/9/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.