SPECIAL REPORT: US Stocks, Commodities, US Dollar

DATE OF REPORT: September 19, 2023

EVENT DATE: September 20, 2023

EVENT: US Federal Reserve Interest Rate Decision (19:00 GMT+1). Press Conference (19:30 GMT+1)

FEDERAL RESERVE INTEREST RATE (CURRENT): 5.50%. EXPECTED (SEPTEMBER 20): 5.50%.

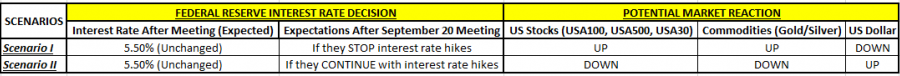

TABLE I: FEDERAL RESERVE INTEREST RATE DECISION AND ITS POTENTIAL IMPACT ON THE MARKETS

Data Source: WWW.CMEGROUP.COM

- SCENARIO I (UNCHANGED at 5.50% and STOP Interest Rate Hikes Afterwards) (Probability Rate= 69%**)

According to the CME FedWatch Tool*, the Fed is given a 69% probability rate that it will not continue raising interest rates after the September 20 meeting. The market participants might see greater chances for the prices of US Stocks and Commodities to rise, while the US dollar could go down.

- SCENARIO II (UNCHANGED and CONTINUE Interest Rate Hikes Afterwards) (Probability Rate= 31%**)

According to the same tool, the Fed is given a 31% probability rate that it will keep raising interest rates after the September 20 meeting. In this case, considering the recent banking crisis, the market participants could see greater chances for the prices of US Stocks and Commodities to fall, while the US dollar may go up.

* https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

**At time of writing and subject to frequent change due to market activity