Gold Weekly Special Report based on 1.00 Lot Calculation:

GEOPOLITICS:

- MIDDLE EAST TENSIONS CONTINUE, WITH POSSIBILITY OF ESCALATION: According to the most recent reports, Israel will look to conduct operations in Rafah, suggesting that the final Hamas battalion could be there. Furthermore, US bases in the Middle East have been attacked for the first time in months. Increases in escalation could increase gold demand, as investors look to hedge the economic impacts of instability in the Middle East.

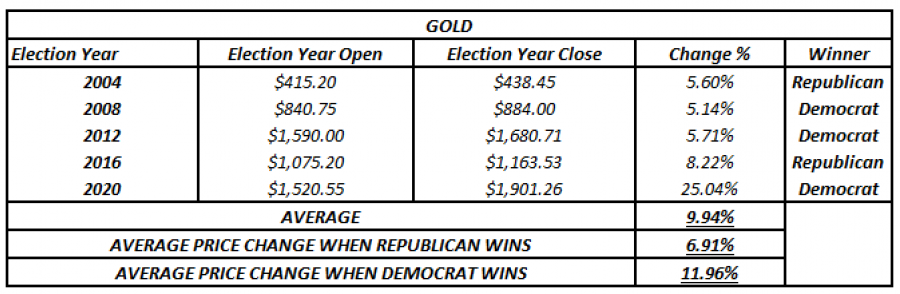

- ELECTION YEAR IN THE US: The United States Election Year has statistically been favorable for gold, rising on average 9.94%. According to the last five election cycles, gold prices have risen on average 9.94%, with the commodity rising 11.96% on average when Democrats win and 6.91% on average with a Republican victory.

Source: Bloomberg and MT4

Please note that past performance does not guarantee future results.

EVENTS:

- US Federal Reserve Interest Rate Decision (May 1st, 2024): The Federal Reserve Bank will meet on May 1st to set the Fed Funds rate target. According to the most recent estimates, analysts are expecting the Federal Reserve to hold interest rates at the current level of 5.50%. Jerome Powell will hold a press conference following the Interest Rate decision at 19:30 GMT to answer potential questions and clarify the Federal Reserve’s stance on interest rate policy.

ANALYST OPINION

- UBS: GOLD COULD REACH THE MARK OF $4000. UBS predicts that the price of gold may nearly double from now to 4,000 US dollars/ounce, and believes that it is not too late to participate in this round of gold rebound.

- CITIGROUP: GOLD COULD HIT $3000 WITHIN THE NEXT 12 TO 18 MONTHS. Gold could rise 50% if central banks sharply ramp up purchases of the yellow metal, a possible stagflation, or in case of a deep global recession. However, the price could also decline further. Central banks’ gold purchases have “accelerated to record levels” in recent years, as they seek to diversify reserves and reduce credit risk. China and Russian central banks are leading gold purchases, with India, Turkey, and Brazil, also increasing bullion buying.

- BANK OF AMERICA: TARGETS $3000. Bank of America still sees owning gold as one of its top trades for 2024. Central banks are buying at an unprecedented pace, purchasing more than 2,100 tons in the past two years, thus creating strong demand.

- GOLDMAN SACHS TARGETS $2700. The bank raised the forecast for gold from $2,300 to $2,700 per ounce by year’s end.

- JP MORGAN: GOLD COULD HIT $2,600 WITHIN THE NEXT 12 MONTHS: JP Morgan have put a price target on gold of $2,600, with the bank suggesting that gold prices could move higher on that back of expected Federal Reserve rate cuts. On the other hand, the price could also decline further. Additionally, geopolitical instability and strong central bank gold buying trends are also seen as catalysts for the commodity.

GOLD, April 23, 2024

Current Price:2300

|

GOLD |

Weekly |

|

Trend direction |

|

|

3000 |

|

|

2600 |

|

|

2350 |

|

|

2255 |

|

|

2230 |

|

|

2220 |

Example of calculation based on weekly trend direction for 1.00 Lot

|

Gold |

||||||

|

|

||||||

|

Profit or loss in $ |

70,000.00 |

30,000.00 |

5,000.00 |

-4,500.00 |

-7,000.00 |

-8,000.00 |

|

Profit or loss in €² |

65,546.14 |

28,091.20 |

4,681.87 |

-4,213.68 |

-6,554.61 |

-7,490.99 |

|

Profit or loss in £² |

56,535.05 |

24,229.31 |

4,038.22 |

-3,634.40 |

-5,653.50 |

-6,461.15 |

|

Profit or loss in C$² |

95,888.80 |

41,095.20 |

6,849.20 |

-6,164.28 |

-9,588.88 |

-10,958.72 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 09:45 (GMT+1) 23/04/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more details.