GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS:

- MIDDLE-EAST TENSION: Rising geopolitical tensions increase the demand for safe-haven instruments such as Gold. Iran’s Supreme Leader Ali Khamenei rejected holding negotiations with the United States over a nuclear deal. US President Donald Trump warned that "there are two ways Iran can be handled: militarily, or you make a deal".

- TRADE WAR: Trade wars increase global insecurity, increasing demand for safe-haven instruments such as Gold. US President Trump has declared that he will implement tariffs on various countries that, according to him, have treated the US unfairly in trade.

US PRESIDENT DONALD TRUMP AND GOLD DURING TRUMP’S FIRST PRESIDENCY

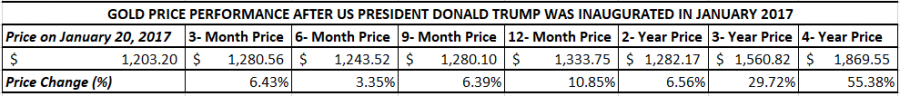

- STATISTICS: GOLD ROSE 10.85% DURING TRUMP’S FIRST YEAR OF PRESIDENCY (JANUARY 20, 2017 – JANUARY 20, 2018). In addition, Gold rose 55.38% during the entire first presidential term of Donald Trump (January 20, 2017 – January 20, 2021).

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

US FEDERAL RESERVE HAS BEGUN YET ANOTHER INTEREST RATE CUT CYCLE:

- FEDERAL RESERVE INTEREST RATE AT 4.5%. The US Federal Reserve decided to cut its benchmark interest rate by 0.50% points in September, 0.25% points in November, and 0.25% in December. The bank expects to cut rates two more times in 2025 to slash its benchmark rate to 4% by the end of 2025. The bank expects rates to fall to 3.40% in 2026 and further down to 3.10% in 2027.

- NEXT FED INTEREST RATE DECISION: March 19, 2025 at 18:00 GMT. Markets have recently raised their expectations for three interest rate cuts in 2025, which could eventually bring rates down to 3.75% from the current 4.5% (Source: CMEGROUP.COM).

OTHER EVENTS:

- MONDAY, MARCH 17, AT 12:30 GMT: US RETAIL SALES (FEBRUARY): A lower-than-expected reading could be taken as positive for Gold, because it could motivate the FED to lower interest rates more aggressively in order to stimulate the economy. Retail sales measure the change in the total value of sales at the retail level. The figure for the previous month was -0.9%.

ANALYSTS’ OPINION:

- GOLDMAN SACHS RAISED GOLD PRICE TARGE TO $3,100, WITH AN UPPER BOUNDARY AT $3,300.

- UBS RAISED GOLD PRICE TARGET TO $3,200.

- MORGAN STANLEY SET A BULL-CASE GOLD PRICE TARGET AT $3,400.

Source: Reuters, Bloomberg, CNBC

GOLD, March 14, 2025

Current Price: 2992

|

GOLD |

Weekly |

|

Trend direction |

|

|

3200 |

|

|

3100 |

|

|

3050 |

|

|

2945 |

|

|

2930 |

|

|

2915 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

20,800 |

10,800 |

5,800 |

-4,700 |

-6,200 |

-7,700 |

|

Profit or loss in €2 |

19,169 |

9,953 |

5,345 |

-4,331 |

-5,714 |

-7,096 |

|

Profit or loss in £2 |

16,089 |

8,354 |

4,486 |

-3,635 |

-4,796 |

-5,956 |

|

Profit or loss in C$2 |

29,982 |

15,567 |

8,360 |

-6,775 |

-8,937 |

-11,099 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 10:00 (GMT) 14/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.