GOLD weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS AND ANALYSTS’ OPINION:

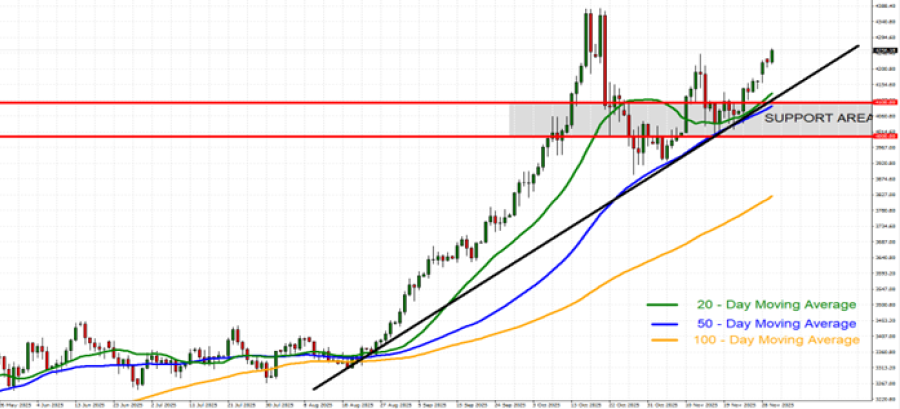

- GOLD TRADING ABOVE MOVING AVERAGES. Gold has kept steady above its 20 -, 50 -, and 100-Day moving averages, pointing to an uptrend.

- TECHNICAL SUPPORT: $4,100 - 4,000. Over the past month, after the most recent decline in gold prices, gold prices has tried to maintain near-term support between $4,100 and $4,000, an area that has been tested several times since late October 2025.

- GOLD PRICE HIT A NEW ALL-TIME HIGH ON OCTOBER 20, 2025 ($4,381.34). Since the beginning of 2025, the gold price has been rising solidly, hitting a fresh all-time high in October ($4,381.34), marking an increase of around 67%. However, the price could also decline.

- ANALYSTS’ OPINION: Bank of America forecasts $5,000; Societe Generale forecasts $5,000; Standard Chartered forecasts $4,500; Goldman Sachs forecasts $4,900; J.P. Morgan forecasts $5,055; Morgan Stanley forecasts $4,400; HSBC forecasts $5,000; Deutsche Bank forecasts $4,450.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

EVENTS:

- TUESDAY, DECEMBER 2 AT 01:00 GMT: FED CHAIR JEROME POWELL SPEAKS. Any dovish remarks from Powell, especially hints of additional interest rate cuts, would likely boost investor confidence and support gold prices.

- THURSDAY, DECEMBER 4 AT 13:30 GMT: US WEEKLY INITIAL JOBLESS CLAIMS. A higher-than-expected jobless claims figure would indicate softening labor conditions, raising expectations for additional Fed rate cuts, which tend to support gold prices.

GEOPOLITICS: RUSSIA – UKRAINE

- EVENT (THIS WEEK: DECEMBER 1 - DECEMBER 6): US - RUSSIA PEACE TALKS TO CONTINUE AS U.S. SPECIAL ENVOY STEVE WITKOFF WILL TRAVEL TO RUSSIA ON MONDAY (DECEMBER 1). President Trump said that Special Envoy Steve Witkoff will visit Russia and will likely meet with Russian President Vladimir Putin in Moscow. The president added that his son-in-law, Jared Kushner, may also join.

LAST TIME MR. WITKOFF WAS IN RUSSIA TO MEET PRESIDENT PUTIN: AUGUST 6. After the visit, a summit between Putin and Trump was organized, which took place on August 15 in Alaska, USA. However, the efforts did not lead to specifically positive results as no deal was reached.

US FEDERAL RESERVE:

- NEXT MEETING: DECEMBER 10 AT 19:00 GMT. The US Federal Reserve is expected to finish the year 2025 by cutting the rates to 3.75% on December 10.

- BREAKING (OCTOBER 29): US FEDERAL RESERVE CUT INTEREST RATE TO 4.00% FROM 4.25%. The Fed cut rates again in October after the one earlier in September. In total, this year, rates have fallen from 4.50% to the current 4.00%.

GOLD, December 01, 2025.

Current Price: 4,250

|

GOLD |

Weekly |

|

Trend direction |

|

|

4,700 |

|

|

4,500 |

|

|

4,350 |

|

|

4,160 |

|

|

4,130 |

|

|

4,100 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

45,000 |

25,000 |

10,000 |

-9,000 |

-12,000 |

-15,000 |

|

Profit or loss in €2 |

38,714 |

21,508 |

8,603 |

-7,743 |

-10,324 |

-12,905 |

|

Profit or loss in £2 |

34,037 |

18,909 |

7,564 |

-6,807 |

-9,076 |

-11,346 |

|

Profit or loss in C$2 |

62,923 |

34,957 |

13,983 |

-12,585 |

-16,779 |

-20,974 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 10:00 (GMT) 01/12/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.