Nvidia (#NVDA) Weekly Special Report based on 1 Lot Calculation:

The Company -

- NVIDIA develops and produces three-dimensional graphics processors and other related software. Additionally, the company also produces graphics processing units, which is a critical component when developing artificial intelligence and self-driving autonomous vehicles.

- NVIDIA’S LATEST PRODUCT PIPELINE FOR THE AI CHIP SECTOR: Nvidia’s CEO said the company now plans to release a new family of AI chips every year, accelerating its prior release schedule of roughly every two years. The current pipeline includes the Blackwell chip, set for release in 2024; The Blackwell Ultra, set for 2025; The Rubin chip, set for 2026 and the Rubin Ultra, set for 2027.

EVENT:

- NVIDIA 10:1 STOCK SPLIT COMPLETED (JUNE 10, 2024): Nvidia recently completed a 10:1 stock split, in which each shareholder received 10 shares per existing share held. Since conducting the stock split, the stock is trading around 8.3% higher.

ANALYSIS:

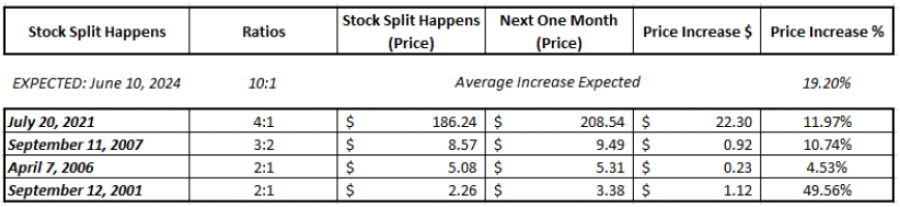

- NVIDIA’S MOST RECENT POST-STOCK SPLIT PERFORMANCE WAS STRONG (July 20, 2021): THE STOCK ROSE ~86% IN THE FIRST FOUR MONTHS AFTER THE STOCK SPLIT IN 2021 (July 2020- November 2021 from $186.24 to $346). (Data Source: Meta Trader 4 Platform).

*Please note that past performance does not guarantee future results

- NVIDIA STOCK SPLIT HISTORY

Data Source: Yahoo.Finance

*Please note that past performance does not guarantee future results

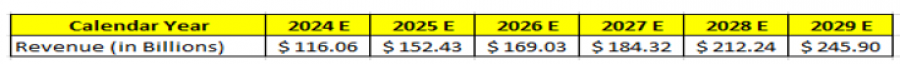

- NVIDIA IS EXPECTED TO CONTINUE ITS SUBSTANTIAL GROWTH MOMENTUM –

Source: Bloomberg

OTHER NEWS –

- NVIDIA BECOMES THE LARGEST COMPANY IN THE WORLD, NOW WORTH AROUND $3.34 TRILLION: Nvidia has overtaken Apple and Microsoft in terms of market capitalization, making it the most valuable company in the world. The company has increased its market value by almost 200% since the beginning of 2024.

- ACCORDING TO RECENT REPORTS, NVIDIA MAY BECOME PART OF THE DOW JONES 30 AFTER ITS STOCK SPLIT: According to recent reports, Nvidia could replace Intel on the Dow Jones index after its stock split. If this materializes, Nvidia would join a very small group of companies that share that title. The companies include Amazon, Apple, Cisco, Honeywell and Microsoft.

Price Action –

- ANALYSTS OPINIONS: Wells Fargo: $155, Rosenblatt Securities: $200, Barclays: $145,

- STOCK PRICE POTENTIAL: NVIDIA was last trading at $130, with Rosenblatt Securities targeting $200 indicating a potential upside of ~54% should these forecasts materialize. However, the price could also decline further.

Nvidia, June 21, 2024

Current Price: 130.00

|

NVIDIA |

Weekly |

|

Trend direction |

|

|

200.00 |

|

|

170.00 |

|

|

150.00 |

|

|

115.00 |

|

|

110.00 |

|

|

105.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Profit or loss in $ |

70,000.00 |

40,000.00 |

20,000.00 |

-15,000.00 |

-20,000.00 |

-25,000.00 |

|

Profit or loss in €² |

65,466.45 |

37,409.40 |

18,704.70 |

-14,028.52 |

-18,704.70 |

-23,380.87 |

|

Profit or loss in £² |

55,304.71 |

31,602.69 |

15,801.35 |

-11,851.01 |

-15,801.35 |

-19,751.68 |

|

Profit or loss in C$² |

95,816.35 |

54,752.20 |

27,376.10 |

-20,532.08 |

-27,376.10 |

-34,220.13 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 09:55 (GMT+1) 21/06/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail