PAYPAL (#PAYPAL) weekly special report based on 1 Lot Calculation:

PAYPAL: THE COMPANY

- PAYPAL is a global digital payments company that allows individuals and businesses to send and receive money online. It provides tools for online checkout, peer-to-peer payments, and merchant services. PayPal is available in over 200 markets and supports 25+ currencies, and has 430+ million active accounts.

- PAYPAL stock is part of the Nasdaq 100 (USA100) and the S&P 500 (USA500).

PAYPAL: EVENTS

- EVENT (TUESDAY, OCTOBER 28, PREMARKET): Q3 EARNINGS REPORT: PayPal is expected to print a revenue of $8.234 billion, which is around 5% higher than the same quarter for the previous year and an Earnings Per Share (EPS) of $1.21, which is 1.68% higher than the same quarter last year. A net income of $1.164 billion is also expected. (Source: Bloomberg)

- PAYPAL TENDS TO BEAT EXPECTATIONS: In the past 8 quarters, PayPal has beat expectations for Revenue (6 out of 8 times), for Earnings Per Share (EPS) (5 out of 8 times) and for Net Income (7 out of 8 times).

PAYPAL: NEWS

- PAYPAL PARTNERS WITH GOOGLE TO CREATE AI POWERED SOLUTIONS ACROSS PLATFORMS. Google has signed a multiyear agreement with PayPal that will embed PayPal’s payment infrastructure across key Google services like (Google Ads, Google Play and Google Cloud). Both companies will collaborate on creating AI “agentic commerce” – automated systems that conduct transactions on behalf of the user.

- PAYPAL INVESTS IN EXPANDING AFRICAN AND MIDDLE EASTERN MARKETS. PayPal has announced new investments worth $100 million throughout Africa and the Middle East. The investments will focus on acquisitions, funding new ventures and technology deployments and solutions that will help entrepreneurs scale faster and unlock new opportunities for growth.

PAYPAL: TECHNICAL ANALYSIS AND PRICE ACTION

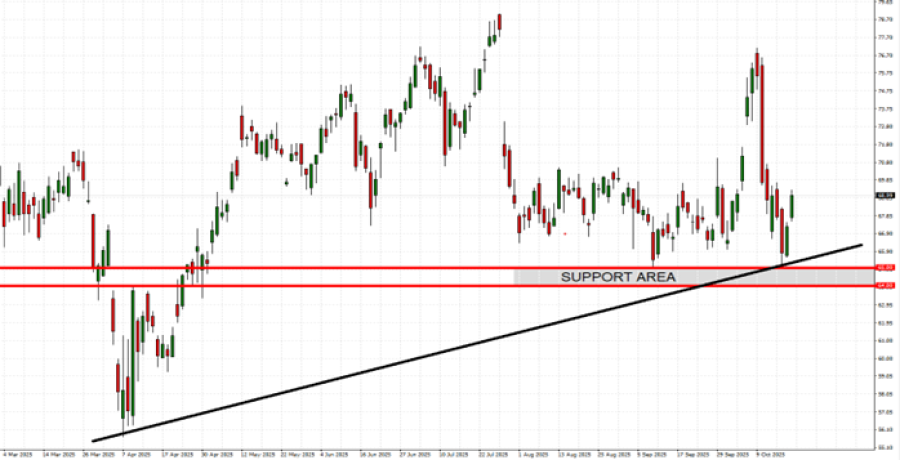

- UPTREND CHANNEL SINCE EARLY APRIL 2025: As depicted by the daily chart below, the PayPal stock price has kept above the mid – term black uptrend line, confirming its mid-term trend is up. The trend has been in place since early April 2025.

- SUPPORT: $65 - $64. The daily chart below also shows us that the PayPal stock has maintained a strong support area between $65 and $64 since April 2025.

- THE STOCK HIT AN ALL-TIME HIGH OF $309.50 (February 16, 2021). PayPal was last trading around $69, and if a full recovery follows to recent all-time highs, the stock price could see an upside of around 350%. However, the price could decline further.

- ANALYSTS’ OPINIONS: Morgan Stanley forecasts $75; Deutsche Bank forecasts $75; Mizuho forecasts $84; Canaccord Genuity forecasts $96; JPMorgan forecasts $85;

GRAPH (Daily): March 2025 – October 2025

Please note that past performance does not guarantee future results

#PAYPAL, October 21, 2025.

Current Price: 69

|

PAYPAL |

Weekly |

|

Trend direction |

|

|

96 |

|

|

85 |

|

|

76 |

|

|

64 |

|

|

62 |

|

|

60 |

Example of calculation based on weekly trend direction for 1 Lot1

|

PAYPAL |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

27,000 |

16,000 |

7,000 |

-5,000 |

-7,000 |

-9,000 |

|

Profit or loss in €2 |

23,260 |

13,784 |

6,030 |

-4,307 |

-6,030 |

-7,753 |

|

Profit or loss in £2 |

20,191 |

11,965 |

5,235 |

-3,739 |

-5,235 |

-6,730 |

|

Profit or loss in C$2 |

37,942 |

22,484 |

9,837 |

-7,026 |

-9,837 |

-12,647 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 13:20 (GMT+1) 21/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.