USA100 Weekly Special Report based on 1.00 Lot Calculation:

USA100:

- USA100 represents the Nasdaq 100, which includes 100 of the largest and most innovative non-financial companies listed on the Nasdaq exchange. It features global tech and AI leaders such as Apple, Google, Tesla, Nvidia, Meta, Microsoft, Amazon, and others. In essence, USA100 reflects the strength and evolution of the modern digital economy in the United States.

US Q3 EARNINGS SEASON (OCTOBER 14 - NOVEMBER 15, 2025):

- US Q3 EARNINGS SEASON BEGINS IN OCTOBER: The Q3 earnings season began with the banking sector in mid-October 2025. Companies such as Apple, Alphabet (Google), Meta (Facebook), AMD, Netflix, Tesla, and Microsoft are also expected to report their Q3 earnings results.

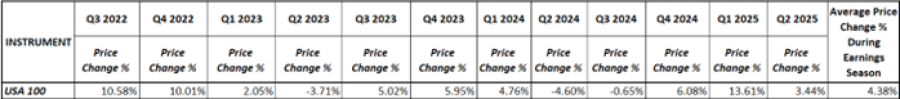

- STATISTICS (LAST 12 QUARTERS): USA100 PRICE ROSE ON AVERAGE 4.38% DURING THE QUARTERLY SEASON SINCE A.I. BOOM BEGAN IN Q3 2022.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

COMPANY EVENTS (OCTOBER 2025):

- NETFLIX: Q3 EARNINGS REPORT (OCTOBER 21, AFTERMARKET).

- TESLA: Q3 EARNINGS REPORT (OCTOBER 22, AFTERMARKET).

- INTEL: Q3 EARNINGS REPORT (OCTOBER 23, AFTERMARKET).

- NVIDIA: NVIDIA GTC A.I. EVENT (WASHINGTON, D.C., USA) (OCTOBER 27 – 29).

- ALPHABET (GOOGLE): Q3 EARNINGS REPORT (OCTOBER 29, AFTERMARKET).

- META (FACEBOOK): Q3 EARNINGS REPORT (OCTOBER 29, AFTERMARKET).

- MICROSOFT: Q3 EARNINGS REPORT (OCTOBER 29, AFTERMARKET).

- APPLE: Q3 EARNINGS REPORT (OCTOBER 30, AFTERMARKET).

US FEDERAL RESERVE:

- NEXT FEDERAL RESERVE MEETING AND INTEREST RATE DECISION: October 29. Interest rates are expected to be further cut to 4.00%. The US Federal Reserve is expected to finish the year 2025 by cutting the rates to 3.75% on December 10.

- BREAKING (SEPTEMBER 17): US FEDERAL RESERVE CUT INTEREST RATE TO 4.25% FROM 4.50%, ITS FIRST INTEREST RATE CUT SINCE DECEMBER 2024. The Federal Reserve policymakers said they expect to see 2 more rate cuts by the end of 2025, to slash current rates to 3.75%.

TECHNICAL ANALYSIS:

- DAILY MOVING AVERAGES: USA100 has remained above the 20-, 50-, and 100-day moving averages, pointing to a positive trend. However, USA100 could also change its trend if prices fall below the 20-, 50-, and 100-day moving averages.

- UPTREND IN 2025: USA100 has remained in an uptrend, as depicted by the uptrend channel on the daily graph below. However, there remains a risk of a potential breakout below the orange uptrend line if market conditions change.

- PRICE ACTION: USA100 PRICE HAS RISEN AROUND 19% SINCE THE START OF 2025. However, it could also decline.

GRAPH (Daily): May 2025 – October 2025

Please note that past performance does not guarantee future results

#USA100, October 21, 2025.

Current Price: 25,250

|

USA100 |

Weekly |

|

Trend direction |

|

|

27,000 |

|

|

26,500 |

|

|

26,000 |

|

|

24,500 |

|

|

24,400 |

|

|

24,300 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

USA100 |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

17,500 |

12,500 |

7,500 |

-7,500 |

-8,500 |

-9,500 |

|

Profit or loss in €² |

15,054 |

10,753 |

6,452 |

-6,452 |

-7,312 |

-8,172 |

|

Profit or loss in £² |

13,077 |

9,340 |

5,604 |

-5,604 |

-6,352 |

-7,099 |

|

Profit or loss in C$² |

24,605 |

17,575 |

10,545 |

-10,545 |

-11,951 |

-13,357 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 9:57 (GMT+1) 21/10/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit