GOLD weekly special report based on 1.00 Lot Calculation:

EVENTS:

- TUESDAY, DECEMBER 23 AT 13:15 GMT: US ADP EMPLOYMENT CHANGE WEEKLY. A weaker than expected ADP employment reading would point to a softer U.S. labor market, reinforcing expectations for further Fed rate cuts, conditions that typically support silver prices. Recent data already show rising unemployment at 4.6%, the highest level since November 2021, alongside moderating inflation, with CPI at 2.7%.

- TUESDAY, DECEMBER 23 AT 13:30 GMT: US GROSS DOMESTIC PRODUCT (GDP) (Q3) (first reading). US GDP (Q3) preliminary data will be released on Tuesday. The second-quarter figure showed growth of 3.8%, a notable improvement from the first-quarter contraction of –0.5%. If the Q3 data comes in below expectations, gold prices could see some upside support.

- TUESDAY, DECEMBER 23 AT 15:00 GMT: US CB CONSUMER CONFIDENCE (DECEMBER). Investors eagerly await the December data, bearing in mind that the November release disappointed, coming in at 88.7 (vs. 93.5 expected). November marked the lowest reading since April 2025. If the December data comes in below expectations, gold prices could see some upside support.

US FEDERAL RESERVE:

- BREAKING (WEDNESDAY, DECEMBER 10): US FEDERAL RESERVE CUT THEIR INTEREST RATE TO 3.75% FROM THE PREVIOUS 4.00%. This is their third consecutive rate cut, following those on September 17 and October 29, 2025. It marks the lowest rate since September 2022.

- EARLIER:

OCTOBER 29, 2025: US FEDERAL RESERVE CUT INTEREST RATE TO 4.00% FROM 4.25%.

SEPTEMBER 17, 2025: US FEDERAL RESERVE CUT INTEREST RATE TO 4.25% FROM 4.00%.

GOLD PRICE ACTION: LAST TWO TIMES TIME (SEPTEMBER AND OCTOBER): Following the last two interest rate cuts (September and October 2025) by the FED, gold rose on average 10.79% after one month.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

PRICE ACTION

- GOLD PRICE HIT A NEW ALL-TIME HIGH ON DECEMBER 22, 2025 ($4,420.05). Since the beginning of 2025, the gold price has been rising solidly, hitting a fresh all-time high in December ($4,420.05), marking an increase of around 69%. However, the price could also decline.

- ANALYSTS’ OPINION: Bank of America forecasts $5,000; Societe Generale forecasts $5,000; Goldman Sachs forecasts $4,900; J.P. Morgan forecasts $5,055; HSBC forecasts $5,000.

TECHNICAL ANALYSIS AND ANALYSTS’ OPINION:

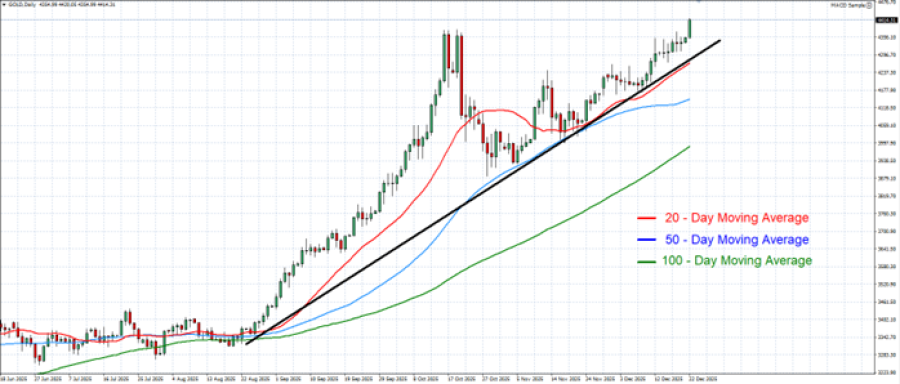

- GOLD TRADING ABOVE MOVING AVERAGES (MA). Gold has kept steady above its 20 -, 50 -, and 100-day moving averages, pointing to an uptrend. However, it could also decline.

- MID-TERM TREND IS UP. The overall trend of gold is up since the beginning of the year with the trend accelerating since mid – August of 2025.

GRAPH (Daily): June 2025 – December 2025

Please note that past performance does not guarantee future results

GOLD, December 22, 2025.

Current Price: 4,404

|

GOLD |

Weekly |

|

Trend direction |

|

|

4,700 |

|

|

4,600 |

|

|

4,500 |

|

|

4,310 |

|

|

4,275 |

|

|

4,250 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

29,600 |

19,600 |

9,600 |

-9,400 |

-12,900 |

-15,400 |

|

Profit or loss in €2 |

25,232 |

16,707 |

8,183 |

-8,013 |

-10,996 |

-13,127 |

|

Profit or loss in £2 |

22,037 |

14,592 |

7,147 |

-6,998 |

-9,604 |

-11,465 |

|

Profit or loss in C$2 |

40,754 |

26,986 |

13,218 |

-12,942 |

-17,761 |

-21,203 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 10:00 (GMT) 22/12/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.