Palantir (#PALANTIR) weekly special report based on 1.00 Lot Calculation:

PALANTIR: THE COMPANY

- Palantir Technologies is a software company specializing in big data analytics and artificial intelligence (AI). It primarily offers artificial intelligence (API) platforms, Palantir Gotham and Palantir Foundry, to government agencies, defence sectors, and large enterprises for tasks like intelligence analysis, risk assessment, and operational decision-making.

- PALANTIR STOCK IS IN THE S&P 500 AND NASDAQ 100 INDEX (USA500, USA100). Palantir joined the S&P 500 index on September 23, 2024. Palantir joined the Nasdaq 100 index on December 23, 2024.

PALANTIR: A.I. PARTNER TO THE US ADMINISTRATION AND THE U.S. ARMY

- US GOVERNMENT IS PALANTIR’S LARGEST CLIENT: Palantir gets nearly 60% of its revenue from government agencies.

BREAKING (DECEMBER 17): U.S. CONGRESS PASSED THE LARGEST ANNUAL MILITARY SPENDING BILL EVER ($901 Billion). The U.S. government has spent billions of dollars on Palantir contracts over the past couple of years. Therefore, Palantir could expect new, expensive contracts to be signed in 2026, as the U.S. government is increasing its military budget for 2026.

BREAKING (DECEMBER 10): US NAVY AND PALANTIR ANNOUNCED AN INITIAL $448 MILLION CONTRACT. According to breakingdefence.com, Navy Secretary John Phelan AND Palantir chief Alex Karp jointly announced the new initiative, called ShipOS (Shipbuilding Operating System), which Phelan characterized as the most ambitious integration of artificial intelligence into naval construction, maintenance, and repair, and history.

BREAKING (AUGUST 1): PALANTIR GOT THE LARGEST CONTRACT EVER FROM THE US DEFENSE DEPARTMENT, WORTH UP TO 10 BILLION DOLLARS. According to CNBC, Palantir has inked a contract with the U.S. Army worth up to $10 billion to meet growing warfare demands for commercial software, data integration, analytics, and AI services over the next decade.

PREVIOUS LARGE CONTRACT (Maven Smart System): MODIFIED 1.3 BILLION DOLLARS FROM THE DEPARTMENT OF DEFENSE (PENTAGON) (CONCLUDED IN MAY 2025). According to www.ainvest.com, this partnership positions Palantir as a key player in the modernization of U.S. defense systems, providing recurring revenue streams for years to come.

PALANTIR: NEW CONTRACTS AND PARTNERSHIPS

- BREAKING (DECEMBER 4): PALANTIR TEAMED UP WITH NVIDIA AND CenterPoint ENERGY TO BUILD A.I. INFRASTRUCTURE. Palantir Technologies Inc. unveiled Chain Reaction, the operating system for American AI infrastructure. Chain Reaction’s founding partners include CenterPoint Energy and NVIDIA.

PALANTIR: TECHNICAL ANALYSIS AND PRICE ACTION

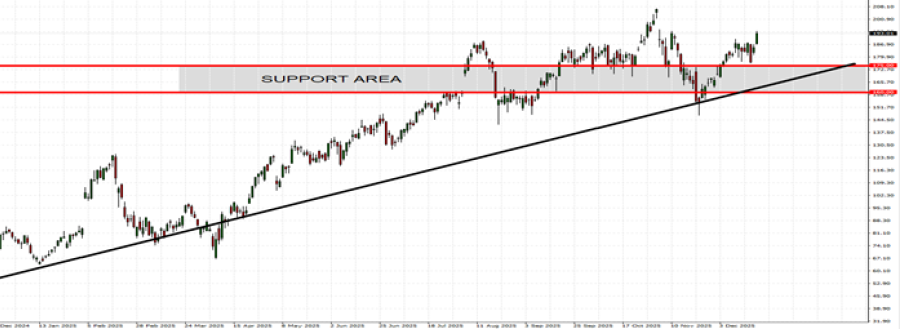

- STRONG SUPPORT ZONE AT $175-$160. Since August 2025, the price of Palantir has maintained a support area between $175-$160.

- PALANTIR STOCK PRICE HIT AN ALL-TIME HIGH OF $207.01 (November 3, 2025). The Palantir stock price has traded at around $176, and if it returns to its recent all time highs, there is a potential upside of around 7%. However, the price could decline.

- ANALYSTS' OPINIONS: CTBC Securities forecasts $235; Wedbush forecasts $230; Piper Sandler forecasts $225; Citi forecasts $210; Morgan Stanely forecasts $205. Deutsche Bank forecasts $200. UBS forecasts $205.

GRAPH (Daily): December 2024 – December 2025

Please note that past performance does not guarantee future results

#PALANTIR, December 22, 2025.

Current Price: 193

|

PALANTIR |

Weekly |

|

Trend direction |

|

|

230 |

|

|

220 |

|

|

210 |

|

|

177 |

|

|

175 |

|

|

173 |

Example of calculation based on weekly trend direction for 1 Lot1

|

PALANTIR |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

185,000 |

135,000 |

85,000 |

-80,000 |

-90,000 |

-105,000 |

|

Profit or loss in €2 |

157,511 |

114,941 |

72,370 |

-68,113 |

-76,627 |

-89,398 |

|

Profit or loss in £2 |

137,702 |

100,485 |

63,269 |

-59,547 |

-66,990 |

-78,155 |

|

Profit or loss in C$2 |

254,634 |

185,814 |

116,994 |

-110,112 |

-123,876 |

-144,522 |

- 1.00 lot is equivalent of 5000 units

- Calculations for exchange rate used as of 13:00 (GMT) 22/12/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.