USA500 Weekly Special Report based on 1.00 Lot Calculation:

USA500:

USA500 represents the S&P 500, which includes 500 of the largest publicly traded companies in the United States across all major sectors. It features industry leaders such as Tesla, Apple, Google, Nvidia, Meta, and Goldman Sachs.

EVENTS:

WEDNESDAY, JANUARY 28 AT 19:00 GMT: US FEDERAL RESERVE (FED) INTEREST RATE DECISION. Fed Chair Jerome Powell is scheduled to host a press conference at 19:30 GMT. The FED will be having its interest rate decision, with most analysts expecting the interest rate to remain unchanged at 3.75%. However, the FED’s forward guidance could influence the price of U.S. stocks as the markets are still uncertain about how many times the FED will cut interest rates in 2026.

Q4 2025 EARNINGS SEASON (JANUARY 12 - FEBRUARY 28)

JANUARY 12 – FEBRUARY 28, 2026. The U.S. Q4 earnings season is expected to start in mid-January with major financial institutions, while key USA100 heavyweights such as Tesla, Meta, Microsoft, Apple, Intel, NVIDIA, and AMD are to report their Q4 2025 results throughout late January and February.

- MICROSOFT: 1/28/2026, Aftermarket

- META (FACEBOOK): 1/28/2026, Aftermarket

- TESLA: 1/28/2026, Aftermarket

- APPLE: 1/29/2026, Aftermarket

- PALANTIR: 2/2/2026, Aftermarket

- AMD: 2/3/2026, Aftermarket

- ALPHABET (GOOGLE): 2/4/2026, Aftermarket

- AMAZON: 2/5/2026, Aftermarket

- NVIDIA: 2/25/2026, Aftermarket

Data Source: Bloomberg Terminal;

TECHNICAL ANALYSIS:

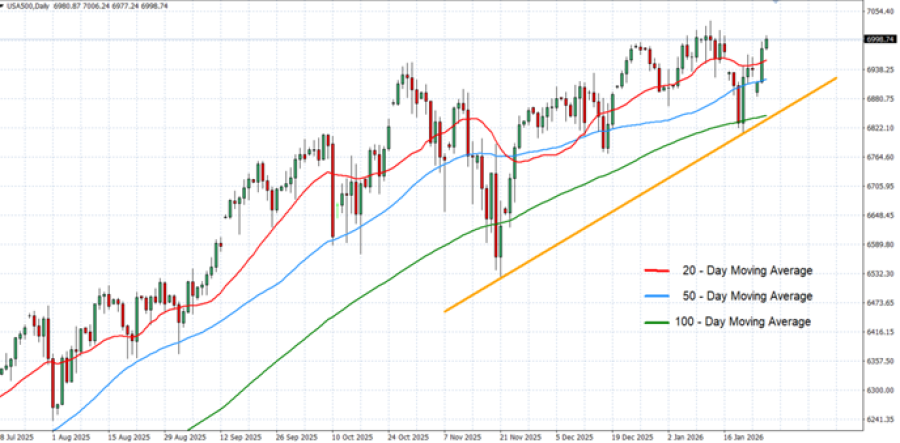

DAILY MOVING AVERAGES: USA100 has remained above the 20-, 50-, and 100-day moving averages. However, USA500 can also change its trend if prices fall below the 20-, 50-, and 100-day moving averages.

UP-TREND SINCE NOVEMBER 2025: USA500 has remained above the orange uptrend line since November 2025, confirming the positive trend.

PRICE ACTION: USA500 HIT A FRESH ALL-TIME HIGH ON JANUARY 13, 2026 (7035.74). The USA500 price rose around 16% in 2025, extending its positive trend from 2024 (+23.20%) and 2023 (+24.65%). However, it could also decline.

GRAPH (Daily): July 2025 – January 2026

Please note that past performance does not guarantee future results

#USA500, January 27, 2026

Current Price: 6,997

|

USA500 |

Weekly |

|

Trend direction |

|

|

7,500 |

|

|

7,300 |

|

|

7,150 |

|

|

6,850 |

|

|

6,830 |

|

|

6,800 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

5,030 |

3,030 |

1,530 |

-1,470 |

-1,670 |

-1,970 |

|

Profit or loss in €² |

4,232 |

2,549 |

1,287 |

-1,237 |

-1,405 |

-1,657 |

|

Profit or loss in £² |

3,671 |

2,211 |

1,117 |

-1,073 |

-1,219 |

-1,438 |

|

Profit or loss in C$² |

6,895 |

4,154 |

2,097 |

-2,015 |

-2,289 |

-2,701 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 11:10 (GMT) 27/1/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit