Crude Oil weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

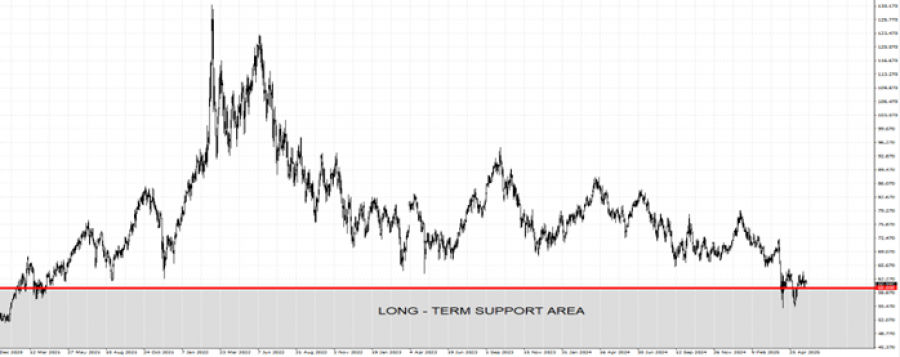

- LONG-TERM SUPPORT AREA BELOW THE PSYCHOLOGICAL MARK OF $60: Crude oil price has recently tested levels below $60, which has been acting as a support area since early 2021.

- 4-YEAR AVERAGE DAILY PRICE (MAY 2021 – MAY 2025): $79.60. The Crude Oil average price in the period between May 2021 and 2025, which includes the Russia-Ukraine war, has been $79.60. (Data Source: Meta Trader 4)

- BREAKING (MAY 5): CRUDE OIL PRICES TESTED THE LEVEL OF $55.36. After testing the mark of $55.36, Crude oil prices managed to recover and hit $64.140 on May 20 (Data Source: MetaTarder 4).

- BREAKING (APRIL 9): CRUDE OIL PRICES HIT THEIR LOWEST LEVEL SINCE FEBRUARY 2021 ($55.115): Crude oil prices fell to their lowest in more than four years to hit the level of $55.115 on April 9. After testing the mark of $55.115, Crude oil prices managed to recover and hit $64.845 on April 23. However, there remains a risk of a potential breakout below this level if market conditions change. (Data Source: MetaTarder 4).

GRAPH (Daily): February 2021 – May 2025

Please note that past performance does not guarantee future results

GEOPOLITICS:

- MIDDLE EAST TENSIONS HAVE RECENTLY RISEN AS NO CONCRETE DEALS HAVE BEEN MADE, WHILE ISRAEL COULD BE PREPARING TO ATTACK IRANIAN NUCLEAR FACILITIES. A fifth round of talks took place in Rome on Friday (May 23). The latest (fifth) round of talks between the US and Iran has ended in Rome with no concrete agreements. Iran is still insisting on continuing its uranium enrichment program, while the USA wants zero uranium enrichment from Iran. In addition, CNN reported on Tuesday (May 20) that the US has obtained intelligence suggesting that Israel is making preparations to strike Iranian nuclear facilities.

- RUSSIA-UKRAINE PEACE TALKS IN JEOPARDY. Uncertainties remain high even after President Trump- President Putin's phone call on May 19, as no breakthroughs have been announced. The phone call happened after a round of unsuccessful talks between Russia and Ukraine in Istanbul, Turkey, on May 16.

OPEC/OPEC+ EVENTS

- WEDNESDAY, MAY 28 AT 13:30 GMT+1: OPEC/OPEC+ GROUP MEETING. The meeting is planned to be held virtually with all the group’s members. The group led by Saudi Arabia and Russia (two of the three largest oil producers in the world) is responsible for over 50% of total global supply.

- SATURDAY, MAY 31: OPEC+ MEETING (EIGHT MEMBERS ONLY). According to Bloomberg, eight OPEC+ members will discuss whether or not to agree on another production increase in July at their meeting on May 31. The eight OPEC+ members consist of Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman, and they have been adding oil to the markets seen since April 2025.

EVENTS (ECONOMIC CALENDAR):

- WEDNESDAY, MAY 28 AT 21:30 GMT+1: AMERICAN PETROLEUM INSTITUTE (API) WEEKLY OIL INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the oil price could be expected. However, the price could decline.

- THURSDAY, MAY 29 AT 16:00 GMT+1: ENERGY INFORMATION ADMINISTRATION (EIA) OIL INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the oil price could be expected. However, the price could decline.

GLOBAL TRADE:

- BREAKING (MAY 5): U.S. AND CHINA ANNOUNCED A TARIFF RELIEF FOR 90 DAYS: U.S. and China have reduced tariffs, 145% to 30% (U.S.) and 125% to 10% (China). The deal could boost oil demand by easing trade and stimulating China’s economy, which is expected to drive higher usage of oil, supporting global prices.

- BREAKING (MAY 8): U.S. AND U.K. ANNOUNCED A TRADE DEAL ON THURSDAY, MAY 8. President Trump said this is the first of many to follow.

Crude Oil, May 27, 2025

Current Price: 61.00

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

75.00 |

|

|

70.00 |

|

|

65.00 |

|

|

57.50 |

|

|

56.00 |

|

|

55.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

14,000 |

9,000 |

4,000 |

-3,500 |

-5,000 |

-6,000 |

|

Profit or loss in €² |

12,322 |

7,921 |

3,521 |

-3,080 |

-4,401 |

-5,281 |

|

Profit or loss in £² |

10,325 |

6,638 |

2,950 |

-2,581 |

-3,688 |

-4,425 |

|

Profit or loss in C$² |

19,272 |

12,389 |

5,506 |

-4,818 |

-6,883 |

-8,260 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 13:53 (GMT+1) 27/05/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.