EUR/USD Weekly Special Report based on 1.00 Lot Calculation:

JACKSON HOLE ECONOMIC SYMPOSIUM (2025):

- EVENT (FRIDAY, AUGUST 22 AT 15:00 GMT+1): FED CHAIR JEROME POWELL SPEAKS. Since he took office in 2018, Fed Chair Jerome Powell has always delivered a speech at the Jackson Hole Symposium, sending important messages to the markets about the next Fed monetary policy steps. This time, he will speak just about a month ahead of the next, highly anticipated market interest rate cut on September 17, 2025.

LAST TIME (AUGUST 23, 2024): FED CHAIR JEROME POWELL SPOKE AT THE JACKSON HOLE ECONOMIC SYMPOSIUM. Mr. Powell said that Inflation had significantly gone down, signaling the Fed's interest rate cut cycle could begin soon. Eventually, after Jerome Powell's speech in August (2024), the Fed started its interest rate cut cycle on September 18, 2024, first lowering rates from then current 5.50% to 5.00%. By the end of 2024, interest rates fell to the current 4.5%.

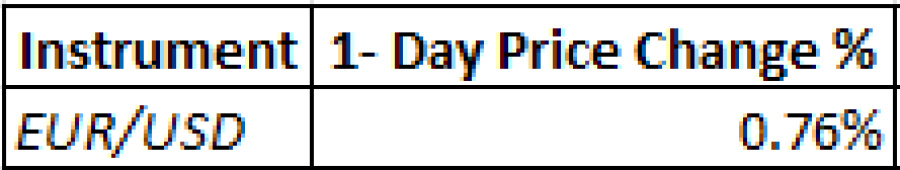

STATISTICS (2024): EUR/USD PRICE ROSE 0.76% THE DAY JEROME POWELL SPOKE AT THE JACKSON HOLE SYMPOSIUM (AUGUST 23, 2024).

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

CENTRAL BANKS:

- WEDNESDAY, SEPTEMBER 17 AT 19:00 GMT+1: US FEDERAL RESERVE INTEREST RATE DECISION. After some weaker-than-expected employment market data in July and downward revisions to June figures, markets have increased their expectations for an interest rate cut in September, expected to be followed by another in December. The benchmark interest rate currently stands at 4.5%, and according to market expectations, it is expected to decline to 4% by the end of 2025.

EVENTS:

- TUESDAY, AUGUST 26 AT 15:00 GMT+1: US CB CONSUMER CONFIDENCE (AUGUST). The July report showed an increase from 95.2 in June to 97.2. If, however, data on Tuesday came in negative and, moreover, falls short of estimates, the markets could see higher chances for interest rates by the Fed going forward, which could put negative pressure on the US dollar.

- THURSDAY, AUGUST 28 AT 13:30 GMT+1: US GDP (Q2) second reading. Data for GDP in the first (preliminary) reading showed an increase for Q1 from -0.5% to 3.00%. The second reading will be released on Thursday, and if data comes in weaker the the first reading, the US dollar could then see some negative pressure.

- THURSDAY, AUGUST 28 AT 13:30 GMT+1: US WEEKLY INITIAL JOBLESS CLAIMS. A higher-than-expected reading could prove negative for the US Dollar, because it will increase the odds of an interest rate cut by the FED. This data measures the number of individuals who filed for unemployment insurance for the first time during the past week.

TECHNICAL ANALYSIS:

- LONGER-TERM UPTREND CHANNEL: The black trend lines depicted by the chart below show that EUR/USD prices have maintained their uptrend in general since January 2025. However, the price could decline.

- 100-DAILY MOVING AVERAGE (MA): EUR/USD has recently returned above its 100-Day Moving Average, confirming that positive sentiment continues to prevail, which has been in place since January 2025. However, EUR/USD can change its trend if prices fall back below the 100-Day Moving Average.

GRAPH (Daily): November 2024 – August 2025

Please note that past performance does not guarantee future results

EURUSD, August 22, 2025

Current Price: 1.1590

|

EUR/USD |

Weekly |

|

Trend direction |

|

|

1.2000 |

|

|

1.1850 |

|

|

1.1720 |

|

|

1.1470 |

|

|

1.1430 |

|

|

1.1400 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

EUR/USD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

4,100 |

2,600 |

1,300 |

-1,200 |

-1,600 |

-1,900 |

|

Profit or loss in €² |

3,536 |

2,242 |

1,121 |

-1,035 |

-1,380 |

-1,639 |

|

Profit or loss in £² |

3,058 |

1,939 |

970 |

-895 |

-1,194 |

-1,417 |

|

Profit or loss in C$² |

5,703 |

3,617 |

1,808 |

-1,669 |

-2,226 |

-2,643 |

- 1.00 lot is equivalent of 100.000 units

- Calculations for exchange rate used as of 08:30 (GMT+1) 22/08/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.