Nvidia (#NVDA) Weekly Special Report based on 1 Lot Calculation:

THE COMPANY:

- NVIDIA develops and produces three-dimensional graphics processors and other related software. The company also produces graphics processing units, which is a critical component when developing artificial intelligence and self-driving autonomous vehicles.

- NVIDIA’S LATEST PRODUCT PIPELINE FOR THE AI CHIP SECTOR: Nvidia’s CEO said the company plans to release a new family of AI chips yearly, accelerating its prior release schedule of roughly every two years. The current pipeline includes the Blackwell chip, set for release in 2024; The Blackwell Ultra, set for 2025; The Rubin chip, set for 2026 and the Rubin Ultra, set for 2027.

OTHER NEWS

- GOLDMAN SACHS: According to Goldman Sachs, investors will have an opportunity to “buy the dip” and take advantage of a rebound in equity prices which will see stock markets hit new highs after the U.S. elections in November.

- BANK OF AMERICA: NVIDIA IS ONE OF THE TOP “REBOUND” STOCK PICKS. Bank of America analyst Vivek Arya noted Nvidia is one of the firm's top "rebound" picks amid what he expects to be a comeback for semiconductors to end 2024.

EVENTS & ANALYSIS:

- Q2 2024 EARNINGS RESULTS. According to CNBC, NVIDIA reported a 122% increase in revenue for Q2 compared with the same period last year. The company reported a record high quarterly revenue of 30.04 billion dollars and a record high net income of 16.6 billion dollars. In addition, the company said it expects a revenue figure of 32.5 billion dollars in Q3, which would be 80% up from the same period last year.

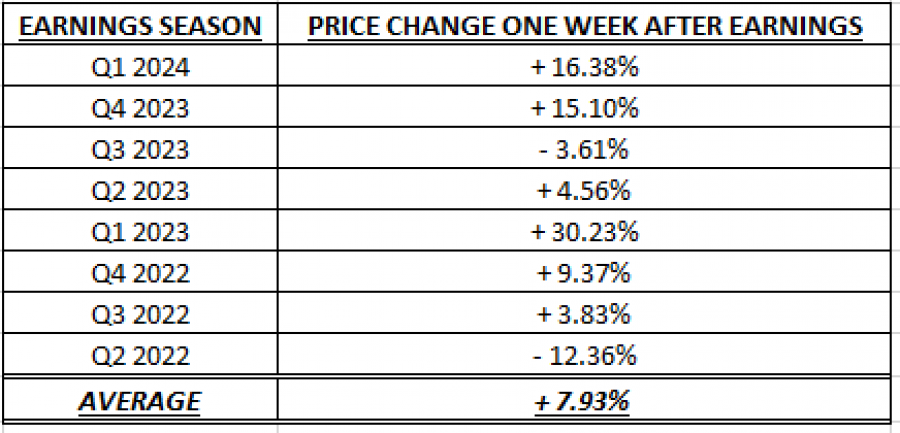

- NVIDIA STOCK PERFORMANCE ONE WEEK AFTER EARNINGS (LAST 8 QUARTERS). According the table below, the Nvidia stock tends to rise on average by around 8% a week after the quarterly earnings date.

Source: Bloomberg Terminal

Please note that past performance does not guarantee future results

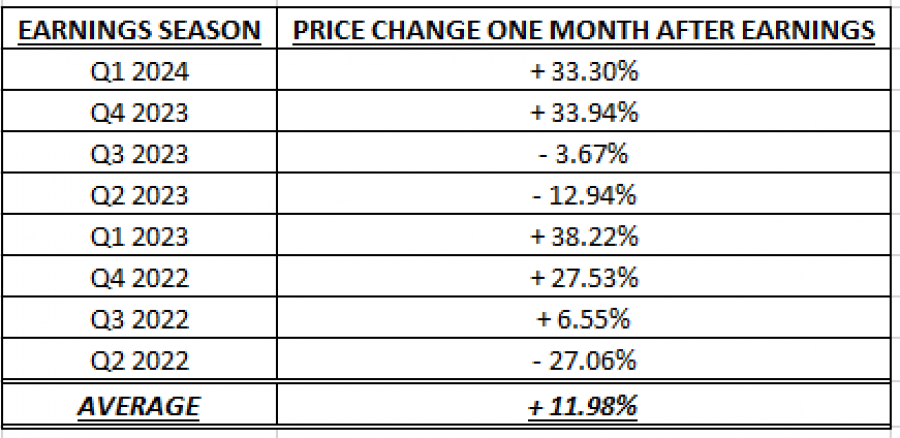

- NVIDIA STOCK PERFORMANCE ONE WEEK AFTER EARNINGS (LAST 8 QUARTERS). According the table below, the Nvidia stock tends to rise on average by around 12% a month after the quarterly earnings date.

Source: Bloomberg Terminal

Please note that past performance does not guarantee future results

NVIDIA: PRICE ACTIONS

- NVIDIA HIT AN ALL TIME HIGH OF $140.49 (June 20, 2024). The price of stock trades currently around $120 and if it follows a full recovery to its most recent all-time high of $140.49, this could provide an upside potential of around 17%. However, the stock price could further decline.

- ANALYST OPINION: Wells Fargo forecasts $165, Morgan Stanley forecasts $150, Citigroup forecasts $150, Rosenblatt forecasts $200, JPMorgan forecasts $155.

Nvidia, August 29, 2024

Current Price: 120

|

NVIDIA |

Weekly |

|

Trend direction |

|

|

200 |

|

|

170 |

|

|

140 |

|

|

105 |

|

|

100 |

|

|

95 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Profit or loss in $ |

80,000 |

50,000 |

20,000 |

-15,000 |

-20,000 |

-25,000 |

|

Profit or loss in €² |

71,674 |

44,796 |

17,918 |

-13,439 |

-17,918 |

-22,398 |

|

Profit or loss in £² |

60,524 |

37,827 |

15,131 |

-11,348 |

-15,131 |

-18,914 |

|

Profit or loss in C$² |

107,744 |

67,340 |

26,936 |

-20,202 |

-26,936 |

-33,670 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 10:30 (GMT+1) 29/08/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.