Silver Weekly Special Report based on 1.00 Lot Calculation:

GEOPOLITICS:

- ICC PROSECUTOR SEEKS ARREST OF ISRAELI AND HAMAS LEADERS. The chief prosecutor of the International Criminal Court (ICC) has applied for arrest warrants for Israeli Prime Minister Benjamin Netanyahu and Hamas's leader in Gaza, Yahya Sinwar, for war crimes. Israeli defense minister Yoav Gallant and Hamas's political leader Ismail Haniyeh, along with the group's military chief Mohammed Deif, are also wanted for arrest. ICC judges will now decide whether they believe the evidence is sufficient to issue arrest warrants - something which could take weeks or months.

- ISRAEL INVADES RAFAH, FURTHER ESCALATING THE SITUATION IN THE MIDDLE-EAST: Israel has invaded Rafah, in what is largely viewed as a further escalation. The risk of a wider war continues to increase, which could create further geopolitical instability and may disrupt the global economy. This could continue to drive silver demand further.

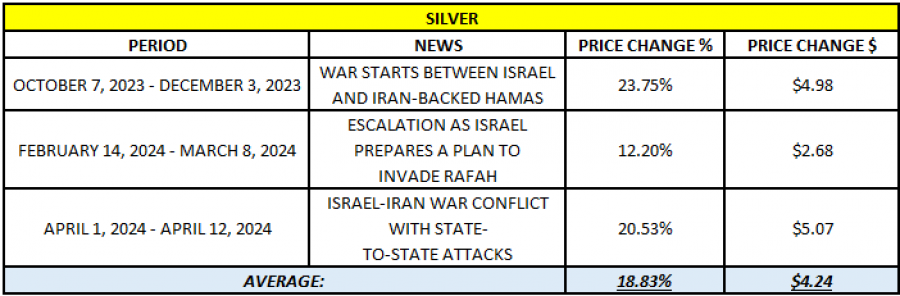

- POTENTIAL AVERAGE MARKET REACTION TO ESCALATING TENSIONS:

Source: MT4 Platform

Please note that the past performance does not guarantee future performance

EVENT:

● US Federal Reserve Interest Rate Decision (June 12 th , 2024): The Federal Reserve Bank will meet on June 12 th to set the Fed Funds rate target. According to the most recent estimates, analysts are expecting the Federal Reserve to hold interest rates at the current level of 5.50%. However, with inflation falling in April, the Federal reserve may reconsider its current rate policy, and could look to implement cuts sooner, which could drive silver prices higher.

OTHER ANALYSIS:

- SILVER DEMAND: The United States remains the most important market with 22% of global demand for silver, while China represents 15% of global demand for silver (Source: Bloomberg). China's economy could potentially grow by about 5%. A silver price was fueled by increased safe-haven demand, as geopolitical tensions in the Middle East and Ukraine intensified. Strong manufacturing data from top consumer China and projections for growing solar installations improved the metal's industrial outlook.

ANALYST EXPECTATIONS

- The Silver Institute forecasts global silver demand to hit 1.2 billion ounces in 2024, the second-highest level ever recorded. The Institute believes Gold could rise initially, followed by a rapid surge in silver prices. The report asserts that silver consistently outperforms, albeit belatedly. The Silver Institute believes that silver could potentially reach $50, but only after gold surpasses $2,200, which it already has. Therefore, a Silver wave could be possible relatively soon. Although the price could go down.

PRICE ACTION

ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, Silver trades around $30.30 and if full recovery is made this could offer an upside potential of around 64%.

Silver, May 23, 2024

Current Price: 30.30

|

SILVER |

Weekly |

|

Trend direction |

|

|

50.00 |

|

|

40.00 |

|

|

31.40 |

|

|

29.20 |

|

|

28.80 |

|

|

28.30 |

Example of calculation based on trend direction for 1.00 Lot*

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

197,000.00 |

97,000.00 |

11,000.00 |

-11,000.00 |

-15,000.00 |

-20,000.00 |

|

Profit or loss in €2 |

181,721.74 |

89,477.20 |

10,146.90 |

-10,146.90 |

-13,836.68 |

-18,448.91 |

|

Profit or loss in £2 |

154,813.36 |

76,227.90 |

8,644.40 |

-8,644.40 |

-11,787.82 |

-15,717.09 |

|

Profit or loss in C$2 |

269,452.66 |

132,674.66 |

15,045.58 |

-15,045.58 |

-20,516.70 |

-27,355.60 |

1. 1.00 lot is equivalent of 10.000 units

2. Calculations for exchange rate used as of 11:00 (GMT) 23/05/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail