SILVER weekly special report based on 1.00 Lot Calculation:

JACKSON HOLE ECONOMIC SYMPOSIUM (2025):

- EVENT (THURSDAY-SATURDAY, AUGUST 21-AUGUST 23): JACKSON HOLE ECONOMIC SYMPOSIUM 2025. According to Investopedia, the Jackson Hole Economic Symposium is an annual symposium sponsored by the Federal Reserve Bank of Kansas City since 1978, and held in Jackson Hole, Wyoming (USA), since 1981. Every year, the symposium focuses on an important economic issue that world economies face.

THEME: The 2025 economic symposium is titled "Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy" and will be held from August 21 to August 23.

ATTENDEES: The symposium will host around 120 attendees, including central bank governors such as US Federal Reserve Chairman Jerome Powell, Bank of England Governor Andrew Bailey, and European Central Bank (ECB) President Christine Lagarde.

- EVENT (FRIDAY, AUGUST 22 AT 15:00 GMT+1): FED CHAIR JEROM POWELL SPEAKS. Since he took office in 2018, Fed Chair Jerome Powell has always delivered a speech at the Jackson Hole Symposium, sending important messages to the markets about the next Fed monetary policy steps. This time, he will speak just about a month ahead of the next, highly anticipated market interest rate cut on September 17, 2025.

LAST TIME (AUGUST 23, 2024): FED CHAIR JEROME POWELL SPOKE AT THE JACKSON HOLE ECONOMIC SYMPOSIUM. Mr. Powell said that Inflation had significantly gone down, signaling the Fed's interest rate cut cycle could begin soon. Eventually, after Jerome Powell's speech in August (2024), the Fed started its interest rate cut cycle on September 18, 2024, first lowering rates from then current 5.50% to 5.00%. By the end of 2024, interest rates fell to the current 4.5%.

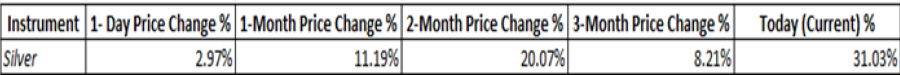

STATISTICS (2024): SILVER PRICE ROSE 2.97% THE DAY JEROME POWELL SPOKE AT THE JACKSON HOLE SYMPOSIUM (AUGUST 23, 2024). A month after that, silver prices traded up 11.19%, while two months after the speech, silver prices traded up 20.07%. In total, since Mr. Powell's speech last year at the Jackson Hole Symposium, silver prices have risen by around 31%.

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

TECHNICAL ANALYSIS:

- DAILY MOVING AVERAGES POINT TO POSITIVE SENTIMENT. Silver prices have recently returned above the 50-Day Moving Average, while trading above the 100-Day Moving Average since May 2025. Although sentiment could change if prices fall back below the 50 and 100-day Moving Averages.

- SUPPORT AREA BETWEEN $35.50 AND $36.50: Silver prices have respected the region between $35.50 and $36.50 as a stronger support area since early June 2025. However, there remains a risk of a potential breakout below this level if market conditions change.

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, Silver trades around $38.00, and if a full recovery is made, this could offer an upside potential of around 31%. However, the price could decline.

GRAPH (Daily): March 2025 – August 2025

Please note that past performance does not guarantee future results

SILVER, August 19, 2025.

Current Price: 38.00

|

SILVER |

Weekly |

|

Trend direction |

|

|

42.00 |

|

|

41.00 |

|

|

39.00 |

|

|

37.10 |

|

|

36.80 |

|

|

36.50 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

40,000 |

30,000 |

10,000 |

-9,000 |

-12,000 |

-15,000 |

|

Profit or loss in €2 |

34,247 |

25,686 |

8,562 |

-7,706 |

-10,274 |

-12,843 |

|

Profit or loss in £2 |

29,586 |

22,190 |

7,397 |

-6,657 |

-8,876 |

-11,095 |

|

Profit or loss in C$2 |

55,264 |

41,448 |

13,816 |

-12,434 |

-16,579 |

-20,724 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 11:15 (GMT+1) 19/08/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.