SILVER weekly special report based on 1.00 Lot Calculation:

USA: GOVERNMENT SHUTDOWN

- BREAKING (WEDNESDAY, OCTOBER 1 AT 05:00 AM GMT+1): US GOVERNMENT SHUTDOWN BEGAN WITH NO DEAL IN SIGHT. According to Reuters, U.S. President Donald Trump and his Democratic opponents made no progress to end the government shutdown. Since Wednesday, October 1, parts of the government have remained closed due to the lack of approved funding legislation.

EVENTS:

- FRIDAY, OCTOBER 10 AT 22:00 GMT+1: US RPESIDENT DONALD TRUMP TO MAKE ANNOUNCEMENTS FROM THE OVAL OFFICE. US President Trump has been scheduled to speak on Friday, with no agenda on what he will address yet released. Possible topics could be related to Nobel Peace Prize announcements, Israel-Hamas deal, the ongoing US government shutdown or Russia – Ukraine conflict.

- WEDNESDAY, OCTOBER 15 AT 13:30 GMT+1: US INFLATION (CPI) (SEPTEMBER). Despite the ongoing US government shutdown, latest reports have said that US inflation data could be still released, with the office workers expected to work harder to get the data out. In August, US inflation rose to 2.90%, up from July’s 2.70%. This would be the last inflation report before Fed’s interest rate decision on October 29.

US FEDERAL RESERVE:

- BREAKING (SEPTEMBER 17): US FEDERAL RESERVE CUT INTEREST RATE TO 4.25% FROM 4.50%, ITS FIRST INTEREST RATE CUT SINCE DECEMBER 2024. The Federal Reserve policymakers said they expect to see 2 more rate cuts by the end of 2025, to slash current rates to 3.75%.

- NEXT FEDERAL RESERVE MEETING AND INTEREST RATE DECISION: October 29. Interest rates could be further cut to 4.00%.

- DECEMBER 10: The US Federal Reserve could finish the year 2025 by cutting the rates to 3.75% on December 10.

SILVER MARKET PROJECTIONS:

- SILVER INSTITUTE PROJECTED A GLOBAL MARKET DEFICIT IN 2025: The Silver Institute is projecting a global market deficit for the fifth year in a row in 2025, which provides additional support to silver prices from supply-side pressures.

PRICE ACTION:

- ALL-TIME HIGH PRICE: $51.339 (October 9, 2025). Currently, silver trades around $50.90, hitting fresh all-time highs on October 9 after it had recently broken through the previous all-time high set in 2011 ($49.80). However, the price could decline.

- ANALYSTS’ OPINION: CITIGROUP forecasts $55; UBS forecasts $55.

TECHNICAL ANALYSIS:

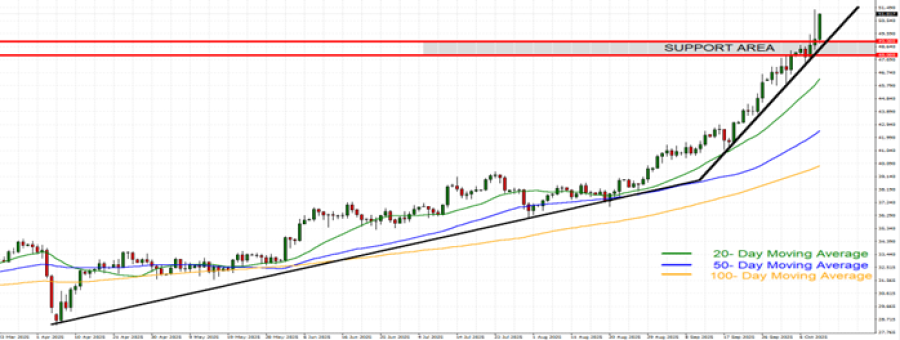

- SUPPORT AREA: $49 - $48. After hitting a fresh all-time high ($51.339), silver prices have remained above the area defined by $49 - $48, which has now become its next psychological support. Silver was last trading above $50.

- UPTREND SINCE APRIL 2025: After the March-April price pullback, silver prices have since been trading in uptrend, as depicted by the daily chart below and the solid black uptrend line on the same chart. Since the beginning of 2025, silver prices have risen by around 77%. However, the price could decline.

GRAPH (Daily): March 2025 – October 2025

Please note that past performance does not guarantee future results

Silver, October 10, 2025.

Current Price: 50.90

|

Silver |

Weekly |

|

Trend direction |

|

|

57.00 |

|

|

55.00 |

|

|

53.00 |

|

|

49.00 |

|

|

48.50 |

|

|

48.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

61,000 |

41,000 |

21,000 |

-19,000 |

-24,000 |

-29,000 |

|

Profit or loss in €2 |

52,718 |

35,434 |

18,149 |

-16,421 |

-20,742 |

-25,063 |

|

Profit or loss in £2 |

45,919 |

30,864 |

15,808 |

-14,303 |

-18,067 |

-21,830 |

|

Profit or loss in C$2 |

85,546 |

57,498 |

29,450 |

-26,646 |

-33,658 |

-40,670 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 9:35 (GMT+1) 10/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.