USA100 Weekly Special Report based on 1.00 Lot Calculation:

USA100:

- USA100 represents the Nasdaq 100, which includes 100 of the largest and most innovative non-financial companies listed on the Nasdaq exchange. It features global tech and AI leaders such as Apple, Google, ARM, Nvidia, Meta, Microsoft, Amazon, and others. In essence, USA100 reflects the strength and evolution of the modern digital economy in the United States.

Q2 2025 EARNINGS SEASON: JULY 15 - AUGUST 15

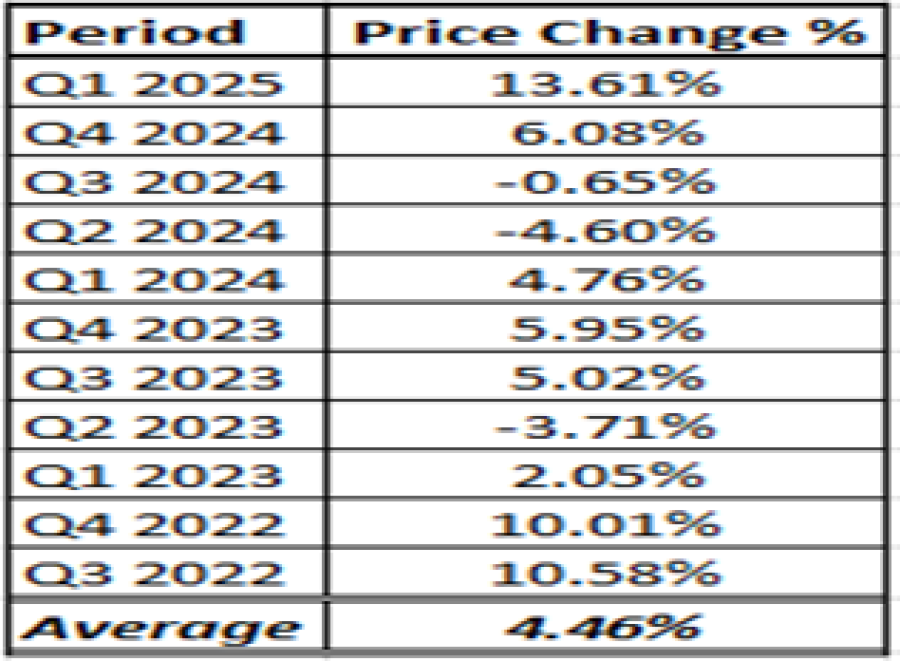

- STATISTICS (LAST 11 QUARTERS): According to the last 11 earnings seasons, since the A.I. boom began in late 2022, USA100 rose 4.46% on average during the quarterly earnings seasons.

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

US Q2 EARNINGS CALENDAR: Q2 Earnings Report dates for some of the most known tech companies in the world

- PALANTIR: MONDAY, AUGUST 4, AFTERMARKET

- AMD: TUESDAY, AUGUST 5, AFTERMARKET

- NVIDIA: WEDNESDAY, AUGUST 27, AFTERMARKET

EVENTS:

- FRIDAY, AUGUST 1 AT 13:30 GMT+1: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (JULY). The US labor market data remains one of the most important indicators, used by the US Fed, that could potentially predict if and when there could be new interest rate cuts. The NFP is expected to come in at 106,000. The unemployment rate is expected to jump to 4.2% from the previous 4.1%.

TECHNICAL ANALYSIS:

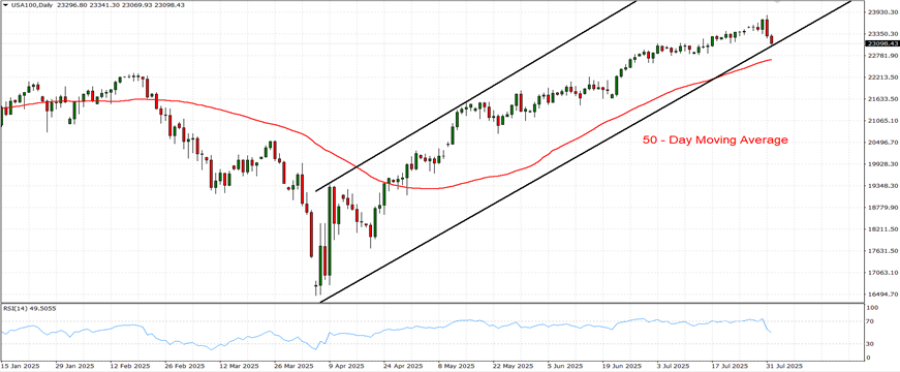

- DAILY MOVING AVERAGE: USA100 has remained above the 50-day moving average. However, USA100 can also change its trend if prices fall below the 50-day moving average.

- MID–TERM CHANNEL: As depicted by the daily chart below, USA100 has kept trading within the mid-term uptrend channel, confirming its mid-term trend is up. However, there remains a risk of a potential breakout below the lower channel boundary if market conditions change.

GRAPH (Daily): January 2025 – August 2025

Please note that past performance does not guarantee future results

USA100, August 1, 2025

Current Price: 23,070

|

USA100 |

Weekly |

|

Trend direction |

|

|

24,500 |

|

|

24,000 |

|

|

23,500 |

|

|

22,700 |

|

|

22,500 |

|

|

22,300 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

USA100 |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

14,300 |

9,300 |

4,300 |

-3,700 |

-5,700 |

-7,700 |

|

Profit or loss in €2 |

12,540 |

8,155 |

3,771 |

-3,244 |

-4,998 |

-6,752 |

|

Profit or loss in £2 |

10,875 |

7,072 |

3,270 |

-2,814 |

-4,335 |

-5,856 |

|

Profit or loss in C$2 |

19,842 |

12,904 |

5,967 |

-5,134 |

-7,909 |

-10,684 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 10:25 (GMT+1) 01/08/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.