GOLD weekly special report based on 1.00 Lot Calculation:

- SCENARIO 1: DOWN

ARGUMENTS FOR GOLD TO GO DOWN:

- ISRAEL - HAMAS REACH A CEASFIRE DEAL IN CAIRO, EGYPT. If Hamas accepts Israeli proposal for a ceasefire and hostage release, tensions in the region could go down, which in turn could push investors away from safe-haven gold. With this in mind, the price of gold, currently trading near all- time high levels, could fall in value.

- US INFLATION AT THE HIGHEST LEVEL SINCE SEPTEMBER 2023 (3.5%). US FEDERAL RESERVE TO KEEP INTEREST RATES UNCHANGED (5.50%) FOR LONGER. Most recent Inflation data showed that consumer prices in the US rose to 3.5% in March from February 3.2%, and up from January 3.1%. Having in mind that U.S. Inflation has started to go back up, the Fed is now expected to barely cut twice this year, while some analysts expect only one rate cut this year. This is compared to previous expectations for three interest rate cuts of 0.25% points in 2024. This scenario is supporting the US dollar, which in turn could have a negative impact on gold prices.

- TECHNICAL ANALYSIS: GOLD IS OVERBOUGHT. Gold has climbed over 350 dollars (or +18%) since early March 2024, with the 14- Month Relative Strength Index (RSI) entering overbought territory above the overbought threshold of 70. According to this premise, technically, Gold could be expected to experience a downward correction.

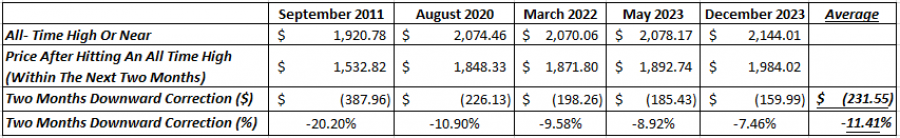

- STATISTICS: GOLD TENDS TO FALL BY MORE THAN 11.41% ON AVERAGE WITHIN THE NEXT TWO MONTHS AFTER HITTING A FRESH ALL- TIME HIGH OR LEVELS NEAR IT. The table below shows what happened to gold after hitting fresh all- time highs in 2021, 2020, 2022 and twice in 2023. The analysis shows that gold dropped in the following two months by 11.41% on average.

Table I: Gold Movement Within the Next Two Months After Hitting a Fresh All- Time High

Source: Fortrade MetaTrader 4 Platform

Please note that past performance does not guarantee future performance.

GOLD, April 12, 2024

Current Price: 2395

|

GOLD |

Weekly |

|

Trend direction |

|

|

2627 |

|

|

2550 |

|

|

2470 |

|

|

2320 |

|

|

2240 |

|

|

2163 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

-23,200 |

-15,500 |

-7,500 |

7,500 |

15,500 |

23,200 |

|

Profit or loss in €2 |

-21,792 |

-14,559 |

-7,045 |

7,045 |

14,559 |

21,792 |

|

Profit or loss in £2 |

-18,604 |

-12,429 |

-6,014 |

6,014 |

12,429 |

18,604 |

|

Profit or loss in C$2 |

-31,909 |

-21,319 |

-10,316 |

10,316 |

21,319 |

31,909 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 13:00 (GMT) 12/04/2024

- SCENARIO 2: UP

ARGUMENTS FOR GOLD TO GO UP:

- ISRAEL - HAMAS DO NOT REACH A CEASFIRE DEAL IN CAIRO, EGYPT. If Hamas rejects Israeli proposal for a ceasefire and hostage release, tensions in the region could remain high, which in turn could push more investors towards safe- haven gold. With this in mind, the price of gold, currently trading near all- time high levels, could continue to rise and reach new all- time highs.

- ISRAEL - IRAN GET INTO A DIRECT CONFLICT. Iran has threatened that they will soon conduct retaliatory strikes on Israel after earlier in April Israel attacked the Iranian embassy in Syria, killing a few Iranian military commanders. The US has said that they will protect Israel in this scenario, which could draw the world a step closer to another World War. Investors would be pushed towards the safe- haven gold as the instrument has acted as a refuge in times of distress such as war conflicts.

- US PRESIDENTIAL ELECTIONS (NOVEMBER 5, 2024). Uncertainties have also been rising over the presidential elections in the US, which could see former President Donald Trump return to the White House. This is raising much concern as Donald Trump has repeated several times that he will increase tariffs on Chinese products imported to the US, marking the beginning of another Trade War.

- CENTRAL BANKS CONTINUE BUYING GOLD. Central banks across the world have continued buying gold in a clear sign of building uncertainties ahead. China leads the way for the moment, followed by Russia, Turkey, India and Brazil.

GOLD, April 12, 2024

Current Price:2395

|

GOLD |

Weekly |

|

Trend direction |

|

|

2627 |

|

|

2550 |

|

|

2470 |

|

|

2320 |

|

|

2240 |

|

|

2163 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

23,200 |

15,500 |

7,500 |

-7,500 |

-15,500 |

-23,200 |

|

Profit or loss in €2 |

21,792 |

14,559 |

7,045 |

-7,045 |

-14,559 |

-21,792 |

|

Profit or loss in £2 |

18,604 |

12,429 |

6,014 |

-6,014 |

-12,429 |

-18,604 |

|

Profit or loss in C$2 |

31,909 |

21,319 |

10,316 |

-10,316 |

-21,319 |

-31,909 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 13:00 (GMT) 12/04/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more details.