COCOA (#COCOA) Weekly Special Report based on 1 Lot Calculation:

TECHNICAL REVIEW

- COCOA PRICES HAVE RECENTLY TESTED THEIR LOWEST LEVEL SINCE FEBRUARY 2024 ($6249).

- COCOA PRICES HAVE TESTED THE MARK OF $7000 (OR NEAR) 12 TIMES SINCE MAY 2024. This is the 13th time that the Cocoa prices are testing levels near the mark of $7000 or below. However, there remains a risk of a potential breakout below this level if market conditions change.

- STATISTICS (LAST OCTOBER TO DECEMBER 2024): DURING THE HARVEST SEASON IN WEST AFRICA. Cocoa hit a low of $6,419 in October, then it rebounded, extending recovery through $7,000 to hit a fresh all-time high of $12,911 in December (an increase of around 100%).

- ALL-TIME HIGH (DECEMBER 18, 2024): $12,911. Cocoa last traded around $6,250, and if the cocoa price tries to recover to its recent all-time high of $12,911, it can then offer an upside of around 106%. Although prices can fall, too.

GRAPH (DAILY): APRIL 2024 - OCTOBER 2025

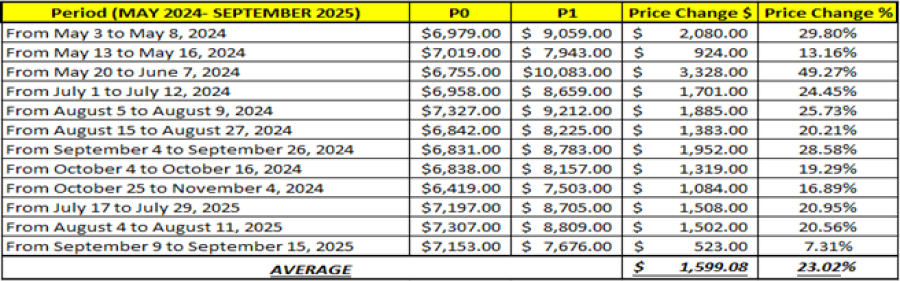

- 2024-2025 STATISTICS: COCOA TENDS TO RECOVER BY AROUND 23% ON AVERAGE AFTER TESTING THE MARK OF $7000 OR NEAR IT.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

EVENTS:

- EVENT (OCTOBER - MARCH): HARVEST SEASON IN THE IVORY COAST AND GHANA BEGINS IN OCTOBER. Both countries are responsible for around 60% of the total global cocoa supply.

SEVERE DROUGHT CONDITIONS IN AUGUST AND JULY INCREASED FEARS FOR A POOR SEASON STARTING IN OCTOBER. Poor weather conditions (severe drought) in July and August in the Ivory Coast threatened production and led the Coffee and Cocoa Council (CCC) to cut its export forecast. The CCC has set a reduced cap of 1.3 million metric tons for export contracts for the 2025/26 season, down from the usual 1.7 million tons.

SUPPLY SIDE:

- TOP PRODUCERS: The biggest producers are the Ivory Coast (40% of the world total), Ghana (20% of the world total), Nigeria, and other small countries in Africa (10% of the world total). All in all, West Africa produces around 70% of the world’s total. So, any problems that hit West Africa impact production on a massive scale.

DEMAND SIDE:

- TOP CONSUMERS: The biggest consumers of cocoa are developed countries (around 70% of the total demand for cocoa), but the demand for cocoa could increase, especially from emerging and developing countries like China and India. (China and India have cocoa consumption growth rates of around 20% and 10% respectively, which means that the market could double on average every 3,6 and 7,2 years).

COCOA (#COCOA) October 3, 2025.

Current Price: 6,250

|

Cocoa |

Weekly |

|

Trend direction |

|

|

9,000 |

|

|

8,000 |

|

|

7,000 |

|

|

5,600 |

|

|

5,500 |

|

|

5,400 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Cocoa |

||||||

|

|

||||||

|

Profit or loss in $ |

27,500 |

17,500 |

7,500 |

-6,500 |

-7,500 |

-8,500 |

|

Profit or loss in €² |

23,424 |

14,906 |

6,388 |

-5,537 |

-6,388 |

-7,240 |

|

Profit or loss in £² |

20,437 |

13,006 |

5,574 |

-4,831 |

-5,574 |

-6,317 |

|

Profit or loss in C$² |

38,390 |

24,430 |

10,470 |

-9,074 |

-10,470 |

-11,866 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 10:15 (GMT) 03/10/2025

There is a possibility to use of Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique could protect the profit.