GBP/USD Weekly Special Report based on 1.00 Lot Calculation:

EVENTS (UNITED KINGDOM):

- MONDAY, JUNE 30 AT 7:00 GMT+1: UK GROSS DOMESTIC PRODUCT (GDP) (Q1): The UK will release its Q1 GDP figures, with markets anticipating a modest upward revision amid resilient consumer spending and improved services activity. If growth comes in stronger than expected, it could boost confidence in the UK economy and delay expectations for Bank of England rate cuts—potentially driving the British pound higher against the U.S. dollar. (PREVIOUS: 1.5%)

- TUESDAY JULY 1, AT 14:45 GMT+1: UK MANUFACTURING PURCHASING MANAGERS INDEX (PMI) (JUNE): The UK will publish its final Manufacturing PMI reading for June, with expectations centered around a modest expansion in factory output. If the index surprises to the upside—showing stronger demand or improved supply chain activity—it could support the British pound by reinforcing optimism around the UK’s industrial rebound and delaying Bank of England rate cuts. (PREVIOUS: 46.4)

EVENTS (UNITED STATES):

- TUESDAY, JULY 1, AT 15:00 GMT+1: US ISM MANUFACTURING PURCHASING MANAGERS INDEX (PMI): A lower-than-expected reading should be taken as positive for the GBPUSD, as it will signal more interest rate cuts by the FED. This data represents monthly replies to questions by US purchasing and supply executives in over 400 companies. The result for the previous month was 48.5 which was lower than for the month before (48.7).

- THURSDAY, JULY 3, AT 13:30 GMT+1: US NON-FARM PAYROLL (NFP) AND UNEMPLOYMENT RATE (JUNE): A lower-than-expected NFP reading should be taken as positive for the GBPUSD currency pair, because a weaker US economy could exert negative pressures on the US dollar. This data measures the change in the number of people employed during the previous month, excluding the farming industry. The data for the previous month stood at 139,000 which lower than for the month before (147,000).

TECHNICAL ANALYSIS:

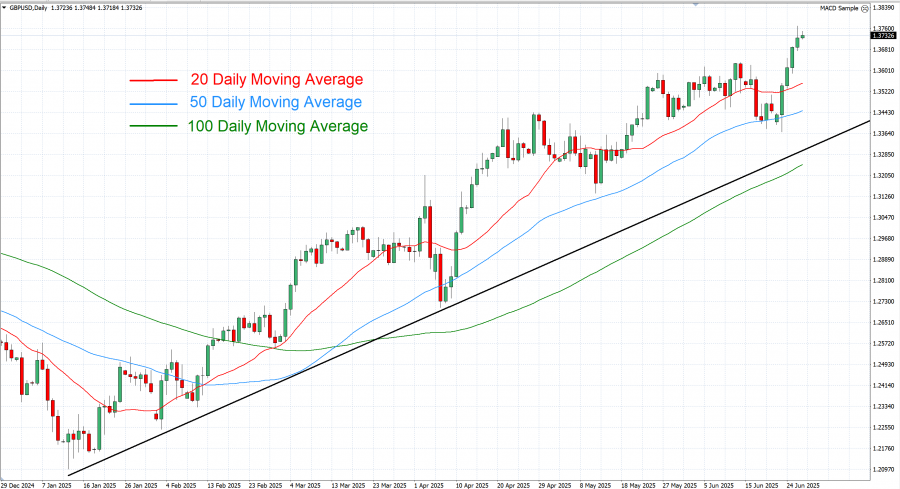

- CURRENT UPTREND (SINCE JANUARY 2025): The black trend line, describing the uptrend, is depicted on the chart below. GBP/USD currency pair has tested a level of 1.21 in January, and since then it has been moving above this uptrend line. However, there remains a risk of a potential breakout below this level if market conditions change.

- DAILY MOVING AVERAGES POINT TO UPTREND: GBP/USD currency pair has recently traded above the 20-, 50-, and 100-Daily Moving Averages, pointing to an ongoing uptrend. However, this trend can also change if prices fall below the 20-, 50-, and 100-Daily Moving Averages.

GRAPH (Daily): December 2024 – June 2025

Please note that past performance does not guarantee future results

GBPUSD, JUNE 27, 2025

Current Price: 1.37300

|

GBP/USD |

Weekly |

|

Trend direction |

|

|

1.4100 |

|

|

1.4000 |

|

|

1.3900 |

|

|

1.3590 |

|

|

1.3520 |

|

|

1.3480 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

GBP/USD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

3,700 |

2,700 |

1,700 |

-1,400 |

-2,100 |

-2,500 |

|

Profit or loss in €² |

3,160 |

2,306 |

1,452 |

-1,196 |

-1,794 |

-2,135 |

|

Profit or loss in £² |

2,693 |

1,965 |

1,237 |

-1,019 |

-1,529 |

-1,820 |

|

Profit or loss in C$² |

5,201 |

3,796 |

2,390 |

-1,968 |

-2,952 |

-3,514 |

- 1.00 lot is equivalent of 100.000 units

- Calculations for exchange rate used as of 10:40 (GMT+1) 27/6/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.