GOLD weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: RUSSIA – USA/UKRAINE CONFLICT

- BREAKING (MONDAY, JULY 28): US PRESIDENT DONALD TRUMP REDUCED RUSSIA’S DEADLINE TO REACH A CEASEFIRE DEAL WITH UKRAINE TO 10-12 DAYS. Trump gave the Russian president a new deadline of 10 to 12 days (down from the previous 50 days on July 14) to make a peace deal with Ukraine or face 100% tariffs on Russian goods, and more importantly, almost 100% secondary tariffs, suggesting trade sanctions would be imposed on countries that continue to pay for Russian oil and other commodities.

EVENTS:

- WEDNESDAY, JULY 30 AT 19:00 GMT+1: US FEDERAL RESERVE INTEREST RATE DECISION. Fed Chair Jerome Powell will hold a press conference the same day at 19:30 GMT+1. Investors will be eager to hear when the Fed will resume its cycle of interest rate cuts, and more importantly, how President Trump’s pressure on Fed Chair Jerome Powell to cut rates immediately could influence future decisions by the Fed.

- FRIDAY, AUGUST 1 AT 13:30 GMT+1: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (JULY). The US labor market data remains one of the most important indicators, used by the US Fed, that could potentially predict if and when there could be new interest rate cuts. The US unemployment rate remained above 4%, last coming in at 4.1% for June.

- FRIDAY, AUGUST 1 AT 15:00 GMT+1: US ISM MANUFACTURING PMI (JULY). The US manufacturing activity remains negatively pressured as recent figures have come in below the expansion territory of 50. In June, the data came in at 49, suggesting that the US manufacturing industry remains in the zone of economic contraction. If the trend remains in place, the Fed could then get more encouraged to act and decide to cut interest rates again soon, which in turn, could put negative pressure on the US dollar, while gold prices could see some positive support.

PRICE ACTION:

- GOLD HIT A NEW ALL-TIME HIGH OF $3,499.76 (April 22, 2025): Gold has traded around $3,303, and if a full recovery takes place, the price of Gold could rise around $200. Although the price could decline as well.

TECHNICAL ANALYSIS:

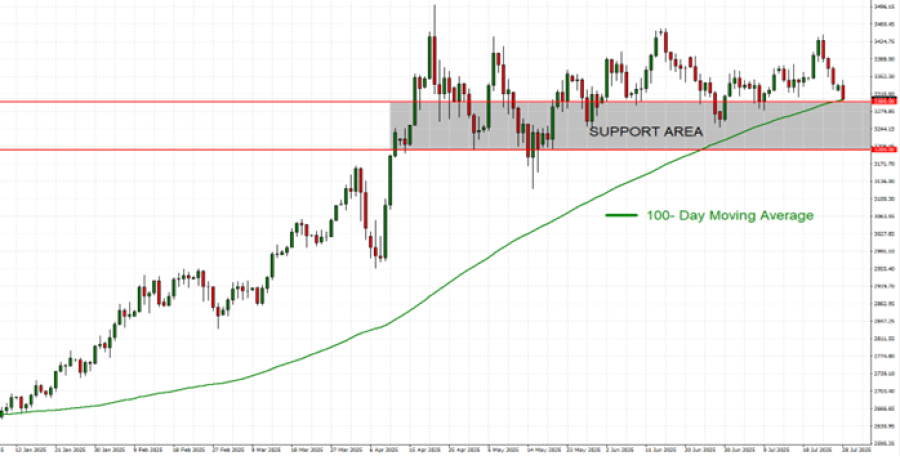

- SUPPORT AREA BETWEEN $3,300 AND $3,200: Gold prices have seen near-term support at $3,300, and an extended support level at $3,200, meaning the area between $3,300 and $3,200 altogether acts as a near-term support area.

- 100-DAY MOVING AVERAGE POINTS TO AN UPTREND: The 100-Day Moving Average points to an uptrend as long as the gold price remains above it. If, however, the gold price falls below the 100-day moving average, then its trend could change to negative.

GRAPH (Daily): January 2025 – July 2025

Please note that past performance does not guarantee future results

GOLD, JULY 28, 2025.

Current Price: 3,303

|

GOLD |

Weekly |

|

Trend direction |

|

|

3,500 |

|

|

3,400 |

|

|

3,360 |

|

|

3,250 |

|

|

3,225 |

|

|

3,200 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

19,700 |

9,700 |

5,700 |

-5,300 |

-7,800 |

-10,300 |

|

Profit or loss in €2 |

16,932 |

8,337 |

4,899 |

-4,555 |

-6,704 |

-8,853 |

|

Profit or loss in £2 |

14,686 |

7,231 |

4,249 |

-3,951 |

-5,815 |

-7,679 |

|

Profit or loss in C$2 |

27,022 |

13,305 |

7,818 |

-7,270 |

-10,699 |

-14,128 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 09:00 (GMT+1) 28/07/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.