GOLD weekly special report based on 1.00 Lot Calculation:

EVENTS:

- WEDNESDAY, DECEMBER 31 AT 13:30 GMT: INITIAL JOBLESS CLAIMS. A higher-than-expected reading could be positive for Gold, because it could signal a deteriorating situation in the US labor market, motivating the FED to continue its interest rate cut cycle in 2026, which could prove positive for Gold. This data measures the number of people who filed for unemployment insurance for the first time during the past week.

- MONDAY, JANUARY 5 AT 15:00 GMT: ISM MANUFACTURING PURCHASING MANAGERS INDEX (PMI) (DECEMBER). A lower-than-expected reading could prove positive for Gold, because it will signal more interest rate cuts by the FED in 2026 in order to stimulate more economic activity. The results for the previous month stand at 46.2, which is lower than the month before (48.7).

- FRIDAY, JANUARY 9 AT 13:30 GMT: NONFARM PAYROLLS AND UNEMPLOYMENT RATE (DECEMBER). A lower-than-expected reading could be positive for Gold because it will signal a deteriorating situation in the US labor market, pointing to more interest rate cuts by the FED in the near future. This data measures the change in the number of people employed during the previous month, excluding the farming industry. The results for last month came in at 64,000.

US FEDERAL RESERVE:

- BREAKING (WEDNESDAY, DECEMBER 10): US FEDERAL RESERVE CUT THEIR INTEREST RATE TO 3.75% FROM THE PREVIOUS 4.00%. This is their third consecutive rate cut, following those on September 17 and October 29, 2025. It marks the lowest rate since September 2022.

- EARLIER:

OCTOBER 29, 2025: US FEDERAL RESERVE CUT INTEREST RATE TO 4.00% FROM 4.25%.

SEPTEMBER 17, 2025: US FEDERAL RESERVE CUT INTEREST RATE TO 4.25% FROM 4.00%.

GOLD PRICE ACTION: LAST TWO TIMES TIME (SEPTEMBER AND OCTOBER): Following the last two interest rate cuts (September and October 2025) by the FED, gold rose on average 10.79% after one month.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

PRICE ACTION

- GOLD PRICE HIT A NEW ALL-TIME HIGH ON DECEMBER 24, 2025 ($4,525.46). Since the beginning of 2025, the gold price has been rising solidly, hitting a fresh all-time high in December ($4,525.46), marking an increase of around 71%. However, the price could also decline.

- ANALYSTS’ OPINION: Bank of America forecasts $5,000; Societe Generale forecasts $5,000; Goldman Sachs forecasts $4,900; J.P. Morgan forecasts $5,055; HSBC forecasts $5,000.

TECHNICAL ANALYSIS AND ANALYSTS’ OPINION:

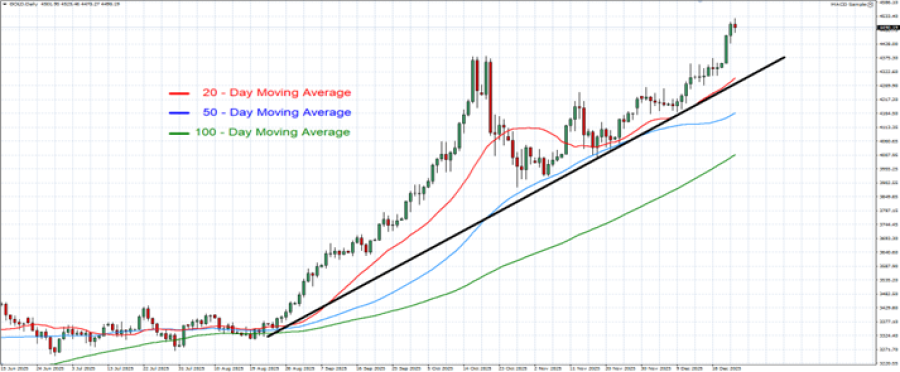

- GOLD TRADING ABOVE MOVING AVERAGES (MA). Gold has kept steady above its 20 -, 50 -, and 100-day moving averages, pointing to an uptrend. However, it could also decline.

- MID-TERM TREND IS UP. The overall trend of gold is up since the beginning of the year, with the trend accelerating since mid – August of 2025.

GRAPH (Daily): June 2025 – December 2025

Please note that past performance does not guarantee future results

GOLD, December 24, 2025.

Current Price: 4,488

|

GOLD |

Weekly |

|

Trend direction |

|

|

5,000 |

|

|

4,800 |

|

|

4,650 |

|

|

4,330 |

|

|

4,315 |

|

|

4,300 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

51,200 |

31,200 |

16,200 |

-15,800 |

-17,300 |

-18,800 |

|

Profit or loss in €2 |

43,407 |

26,451 |

13,734 |

-13,395 |

-14,667 |

-15,939 |

|

Profit or loss in £2 |

37,875 |

23,080 |

11,984 |

-11,688 |

-12,798 |

-13,907 |

|

Profit or loss in C$2 |

70,011 |

42,663 |

22,152 |

-21,605 |

-23,656 |

-25,707 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 10:00 (GMT) 24/12/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.