Natural Gas weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS

- STRONG SUPPORT AT THE LEVEL OF $3 OR NEAR: Since December 2024, Natural Gas prices have tested 4 times the level of $3 or near, and currently the price of Natural Gas is near that level.

- RECOVERY AND PRICE ACTION AFTER TESTING LEVELS NEAR $3 (December 2024 – May 2025): Natural gas prices may return to the mark of $3.5 after testing $3 since December 2024. In early March 2025, Natural Gas tested the level of $4.93, which was its highest rate since December 2022.

GRAPH (Daily): December 2024 – May 2025

Please note that past performance does not guarantee future results

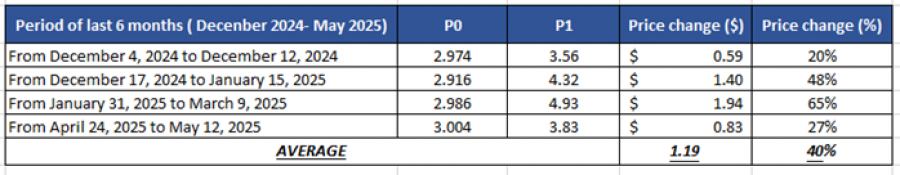

- STATISTICS: NOVEMBER 2024-MAY 2025. NATURAL GAS PRICE RECOVERED BY AROUND 40% AFTER TESTING THE MARK OF $3 OR NEAR IT. However, there is also a risk of further decline if market conditions change.

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

EUROPE EXPECTED TO SOON START BUYING BIG QUANTITIES OF NATURAL GAS

- EUROPEAN NATURAL GAS STORAGE REFILLING SEASON STARTS MARCH- APRIL AND ENDS IN NOVEMBER.

- MANDATE: EUROPEAN NATURAL GAS STORAGE MUST BE FULL AT LEAST 90% BY NOVEMBER

- CURRENT: AT AROUND 44.5%;

- EUROPE BUYS BIG QUANTITIES OF LIQUIFIED NATURAL GAS (LNG) FROM THE USA: US supplies 45% of Europe's total LNG imports.

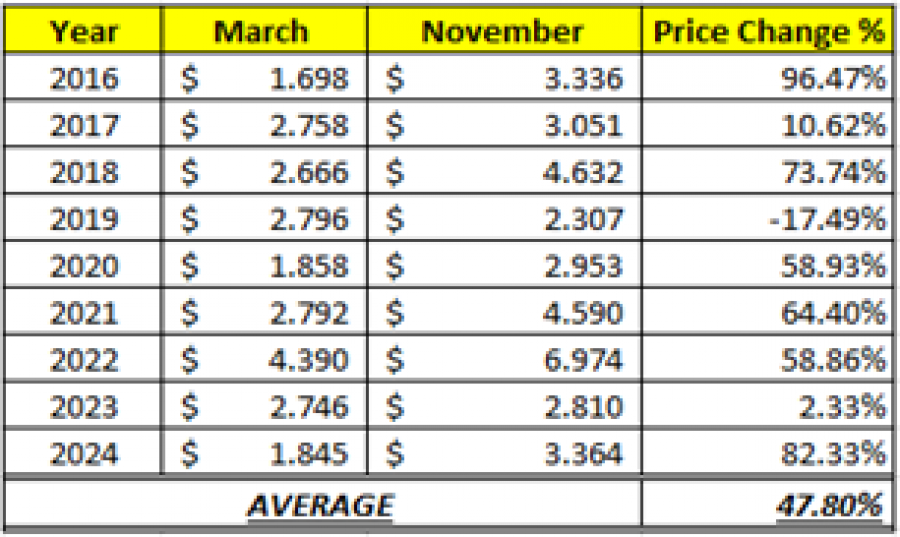

- STATISTICS (2016 - 2024): NATURAL GAS PRICES ROSE 47.80% ON AVERAGE DURING THE EUROPEAN REFILLING SEASON (MARCH – NOVEMBER)

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

NATURAL GAS: PRICE ACTION

NATURAL GAS PRICES HIT $9.972 IN AUGUST, 2022. Natural gas prices have risen due to Europe’s crisis and reduced Russian supply, boosting U.S. LNG demand. A rebound to $9.972 would represent a rise of approximately 216% from the current price of $3.16, though further declines cannot be ruled out.

Natural Gas, May 20, 2025

Current Price: 3.16

|

NATURAL GAS |

Weekly |

|

Trend direction |

|

|

4.50 |

|

|

4.00 |

|

|

3.60 |

|

|

2.80 |

|

|

2.70 |

|

|

2.60 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

NATURAL GAS |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

13,400 |

8,400 |

4,400 |

-3,600 |

-4,600 |

-5,600 |

|

Profit or loss in €² |

11,906 |

7,463 |

3,909 |

-3,199 |

-4,087 |

-4,976 |

|

Profit or loss in £² |

10,021 |

6,282 |

3,290 |

-2,692 |

-3,440 |

-4,188 |

|

Profit or loss in C$² |

18,676 |

11,707 |

6,132 |

-5,017 |

-6,411 |

-7,805 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 11:00 (GMT+1) 20/05/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.